Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowNot sure when this happened but a few issues appeared simultaneously. Several bank accounts show the same, incorrect, account balance in the bank feeds area. When I go in to edit the bank feed settings, I see that the bank user ID now has dashes in it. It will not let me change the bank user ID. When I select "deactivate all online services" I get an error that says "your federal employer identification number (ein) is not valid. Please use format ##-#######" I select ok, and then the error "Invalid Customer ID. Customer ID can only contain alpha numeric characters."

So somehow my bank accounts are corrupt. What is the best way to restore them? Thanks!

Thanks for posting to the Community, @sthiede1.

Let me share insights before setting up Bank Feeds in QuickBooks. Make sure that you have entered a valid EIN under the Company settings.

Also, if you're changing the EIN, make sure to contact us so we can update your EIN in our records. This way, the information is restored in QuickBooks.

Additionally, when setting up Bank Feed, ensure to select the correct account to connect. You can follow the steps given through this article: Set up or edit bank accounts for Bank Feeds in QuickBooks Desktop.

Let me know if you have more questions about Bank Feeds. I'll be around to help. Stay safe and well!

Thanks for responding. I did not change the EIN and it is still the same and correct in company settings. But for some reason when trying to setup bank feeds it gives an error saying it is not valid. It also won't allow me change the user ID in bank feeds.

I appreciate your time and effort in performing the steps to resolve this issue, @sthiede1.

It's possible that the original file might be damaged. In this case, I recommend running the verify rebuild diagnostic tool. This helps identify data damage and then self repair it.

Let me show you how:

You can also use the QuickBooks File Doctor to fix your company file just in case you can still see them.

Keep us posted or please reply to this thread if you still have the same result. We'll look for other options that can get this resolved.

I have the same problem, I did the rebuild data and it did not work, please could you help me

I ran the verify data function and it said there were no errors in the data

Hi sthiede1.

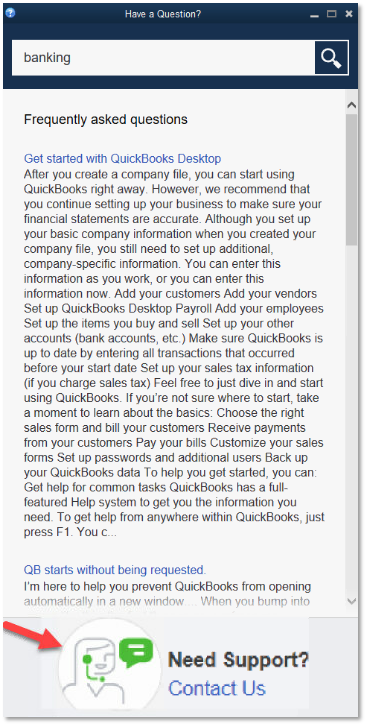

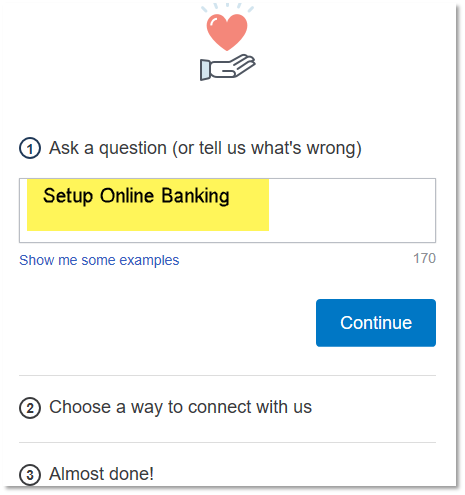

If you ran the verify data function and you still are experiencing issues, my recommendation would be to reach out to our support team, because this is a public forum setting, we don't have the tools to dive into your account and properly diagnose exactly whats causing the issue like our support team would. They will be able to guide you click-by-click as they screen share with you through the process. Follow these steps to reach out to them.

Check our support hours and contact us.

If you need any further assistance or guidance, feel free to post here anytime. Thank you and have a nice afternoon.

Did you ever figure out the solution to the problem? I've spent hours on chat and remote with QB "support" and they haven't been able to fix the problem.

I'm here to share information on how to resolve the error, @Chris Cap.

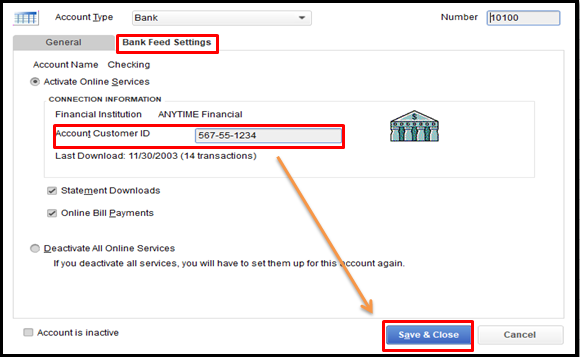

An invalid Customer ID for an account set up with online services (Bank Feeds) is causing this error. Let's go to your chart of accounts to correct it.

Here's how:

After correcting the ID, run the same data utility to sync the changes, and complete the process. Check out this link for more information and the recommended solution if the above steps don't work.

Please let me know if you need more help with QuickBooks Online. I'm always here to assist. Take care and stay safe.

Hi Chris, I also called support and talked with several support people and they were not able to fix it.

Hi Chris, I also called tech support and with several support people and they were not able to fix the issue. They blamed it on the bank. So now I'm manually entering in bank transactions.

This does not work. Quickbooks changes the ID back to something with dashes in it.

Quickbooks will not let me change the customer ID. When I click on the box to change it, it gives me the same error even though it does not allow me to change it.

I'm here to share with you the steps so you can change the customer ID, @sthiede1.

Let's re-brand or reset the account connected to QuickBooks Bank Feeds in order to fix the error message you encountered. Before performing the troubleshooting steps below, make sure to create a backup copy of your company file.

The first solution is to re-brand your online banking files. To do so, you'll have to update the Financial Institutions Directory in QuickBooks Desktop. This will ensure that you have the latest information from your financial institution.

Another step is to reset your account for online access to check for possible account issues. Here's how:

You can also create a dummy company file to test online transaction downloads. For the detailed process, please proceed to Solution 3 of this article: Re-brand or reset accounts for Bank Feeds access.

Also, if you need further guidance in performing the steps above, I recommend contacting our technical support team to assist you.

To learn more about connecting bank account to Bank Feeds in QuickBooks Desktop, please visit this link: Set up bank accounts for Bank Feeds.

Let me know how this goes, @sthiede1. I'm always here if you have bank feeds concerns. Feel free to visit us again have a good one.

Hello, I updated the financial institution directory as you said. In the next step I can't deactivate bank feeds for this account. As soon as I click "deactivate all online services", it comes up with the same error "Your employer identification number (EIN) is not valid. Please use format ##-#######." I click OK, and it gives another error "Invalid Customer ID. Customer ID can only contain alpha numeric values." I click ok and I am back to where I started.

I can share a couple of solutions to ensure you can deactivate your bank account's online services, @sthiede1.

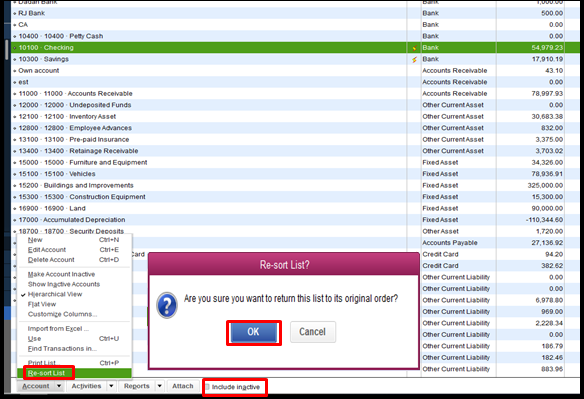

First, you'll need to re-sort your lists so they go back to their default order. This way, you can undo the changes made to them. Here's how:

If you got the same result, please proceed to Steps 2 and 3 outlined in this article: Fix issues when deactivating bank feeds. Once done, perform the steps given by my peer @DivinaMercy_N again.

Also, with regards to the "Invalid Customer ID. Customer ID can only contain alphanumeric values" error, you can correct the customer ID's on accounts set up for online services in your Chart of Accounts. Let me guide you how:

If the same thing happens, please see Step 2 in this article: Verify Online Account for Bank Feeds.

Lastly, you may contact our support team if the issue persists. This way, they can check this further and open an investigation if needed. You can follow the steps provided by my colleague @Nick_M. Please review our support hours guide to ensure your issue gets taken care of right away.

Once everything's fine, you'll want to add and categorize your transactions to make sure they're accounted for correctly and prevent any duplicates. Then, you can reconcile your account to ensure the accuracy of your books.

I'm always around to lend a hand if you have more questions about managing your banking feeds in QuickBooks Desktop. Take care and have a good one, @sthiede1.

Hello,

When I go into change the account customer ID, for example "bankCID7", it give the warning "You have just disabled one or more online services...." I click ok. I then get the warning "Your federal identification number (EIN) is not valid. Please use the format ##-######". I click ok and it gives the warning "Invalid Customer ID. Customer ID can only contain alpha numeric values.". QB then changes the Account Customer ID from "bankCID7" to "ban-kCD-D7". So somehow QB is putting dashes in my customer account ID, and then it doesn't like it because it can't have dashes in it. It's almost as if QB is confused between customer ID, and federal identification number (EIN)

Hello there, @sthiede1.

Thank you for keeping in touch and keeping us updated.

I know that you've already contacted us several times. However, the Community is a public forum, and all the necessary troubleshooting steps are already provided by my colleagues.

I want to be the one to check this for you, but the security of your account is my top priority. Our Support Team has access and tools unavailable to me so that your information is kept secure and private.

I'd advise you to contact us again to troubleshoot the issue further and help you with making sure your information is safe and in place. If you have a case number, you can proactively provide it to streamline the process.

Your case number has the previous representative's notes according to what happened to your issue. This way, you won't be explaining all over again.

I've also attached an article you can use to learn more about setting up a bank account and linking to bank feeds: Set up bank accounts for Bank Feeds in QuickBooks Desktop.

Let us know if you have any other concerns. We're here to help.

I'm curious, we are the customer and it's your program. Why are we having to jump through all these hoops in order to set up online payment with you. Should't this be seamless? I've not jumped through all the byzantine steps above because I have a business to run. Are you sure you're "quickbooks" because I'm not seeing it. I put the EIN in the correct field and it should accept it. Is that too much to ask??????

This seems to be a common enough problem for a public fix to be available.

I use QB 2019 Pro desktop, having the same issues. Tried to fix the COA via the IIF Export / Import, but fails on import with errors "; [ERROR] The record at (or starting at) this line could not be imported. There was an error when modifying a Accounts list, element "XXX (xxx edited for public post) Bank Checking". QuickBooks error message: Unknown Error [3170]" "; [ERROR] It's a list or transaction that is not supported by the IIF import process." when changing the the Y to N in the appropriate QB ONLINE section of IIF.

Cannot deactivate account, change user name (QB Added "-" in middle), cannot perform any update to account under "Edit Account". Ran Verify (no errors), did a rebuild just in case (no errors), ran QB Doctor (no errors).

Hello there, FEL Acctg.

I see you've tried a few things to resolve the error. Let me route you to our support team, who can help and check further this error in QuickBooks Desktop. The ability to look into your specific account in detail, see what's going on, and even screen share with you if necessary.

Here's how to connect with them:

Let me know if you have other questions. I'll be here to help in any way that I can.

I know this is a community support forum, but sometimes it seems that the people trying to answer the question haven't actually read the previous comments. I am having this exact same problem. It's obviously a bug in the software. So why the rigmarole instead of a fix. The software has a crossed wire and is giving out an erroneous error message because it is checking the wrong data field. Why this is happening and an easy fix would be helpful. I've wasted so much time dealing with this data feed issue that I am not actually getting any book keeping done and I have to get 1099's out soon and ready my QB for tax reports.

I can't even get the data into QB because I have run into so many problems with this bug ridden software.

Please help. There must be an easy fix for this problem by now. Thanks

Hello there, LymanDesignLLC.

Let's keep QuickBooks Desktop up-to-date to always have the latest features and fixes. Once done, you can run the Verify and Rebuild Data to identify and fix common data issues such as the Your Federal Employer Identification Number (EIN) is not valid error. Set up your bank feeds again by following the steps on this link: Get started with Bank Feeds for QuickBooks Desktop.

If the error persists, I'd suggest create a new account and merge them afterward. Our Phone Support Team can also open a case for the issue you're currently experiencing when setting up bank feeds. This way, our engineers will look into the root cause of why it's not allowing you to continue the process.

Let me know how this works. I'll be around the corner to keep an eye on your reply. Take care!

Finally solved this. It was an issue with the bank. Not sure why it caused the EIN error, but once the bank updated their QB stuff and I imported new transactions the problem went away. If you are having this issue, call your bank and ask if they need to do a QB update.

I have had the same exact issue and am glad to have found this post. Like most of you I have tried all the steps mentioned with no success. I did contact tech support, but there was an additional fee of $299 to have someone from QuickBooks fix this issue, which I did not want to pay.

I believe at one time I had Bank Feeds enabled, but have since disabled it. I prefer to manually input my transactions as I don't have a lot of them. Now, I cannot remove it without the same symptoms as others have reported. The manual import fails as well. I am stuck in a loop of Error -> Cannot do what is says to do to fix error -> Error.

I tried to sign in with my bank information hoping that would sync up any discrepancies, but that errored out with Bank Not Supported. At one time, Wells Fargo was supported for me.

Any other recourse for me, other than paying $299 for QuickBooks tech support?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here