Scale up seamlessly with tools and services that are right for you at every stage of your business. Find what you need to streamline payday, track time, manage HR, and offer team benefits—all with the #1 payroll provider.¹

Have QuickBooks Desktop? Explore your options.

Peace of mind beyond payday

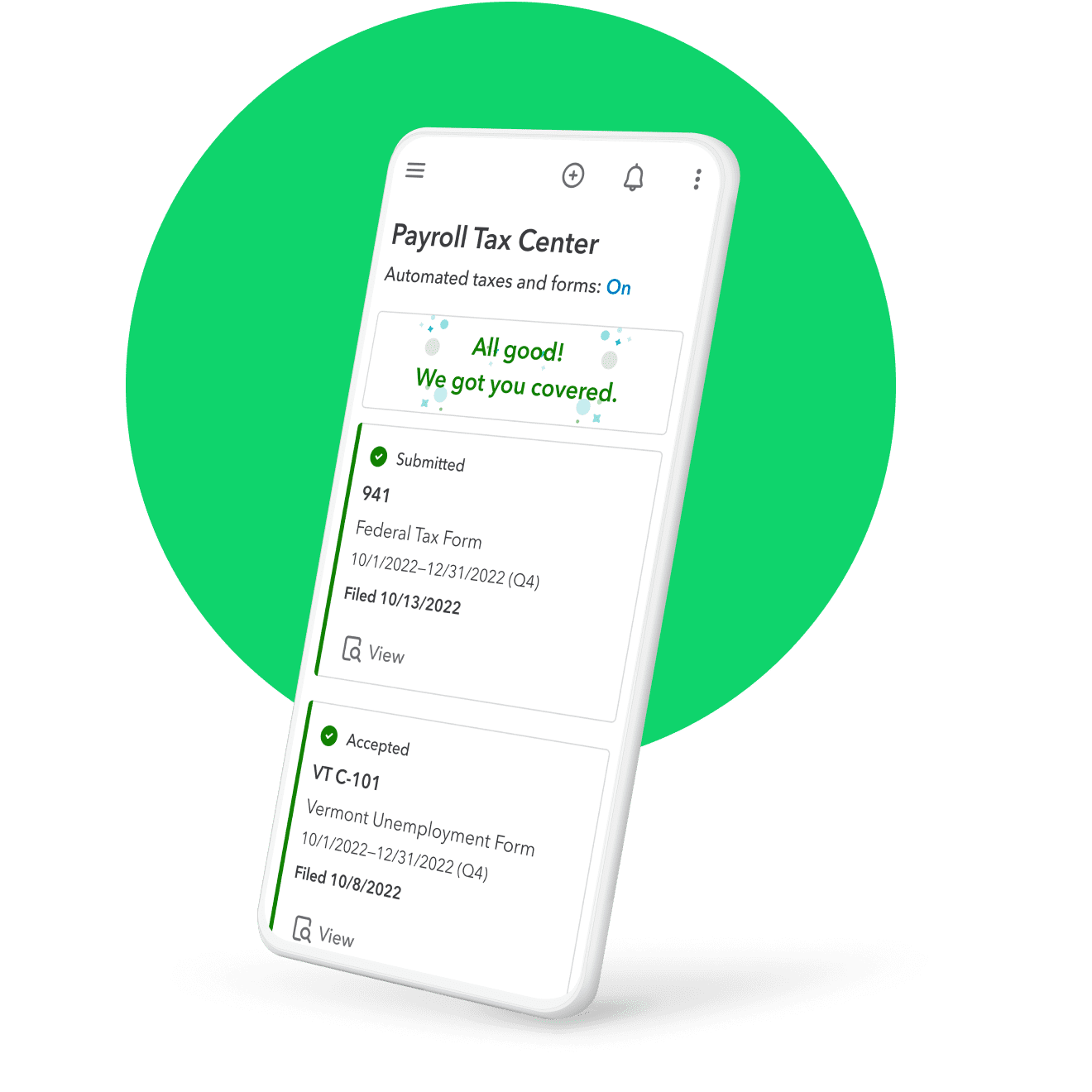

Stay covered at tax time

With tax penalty protection, we'll pay up to $25,000 if you receive a penalty for any reason.**

Pay your team fast

Hold onto cash longer and pay your team on your schedule with same-day direct deposit.**

Taxes done for you

We’ll calculate, file, and pay your payroll taxes, with an accuracy guarantee.**

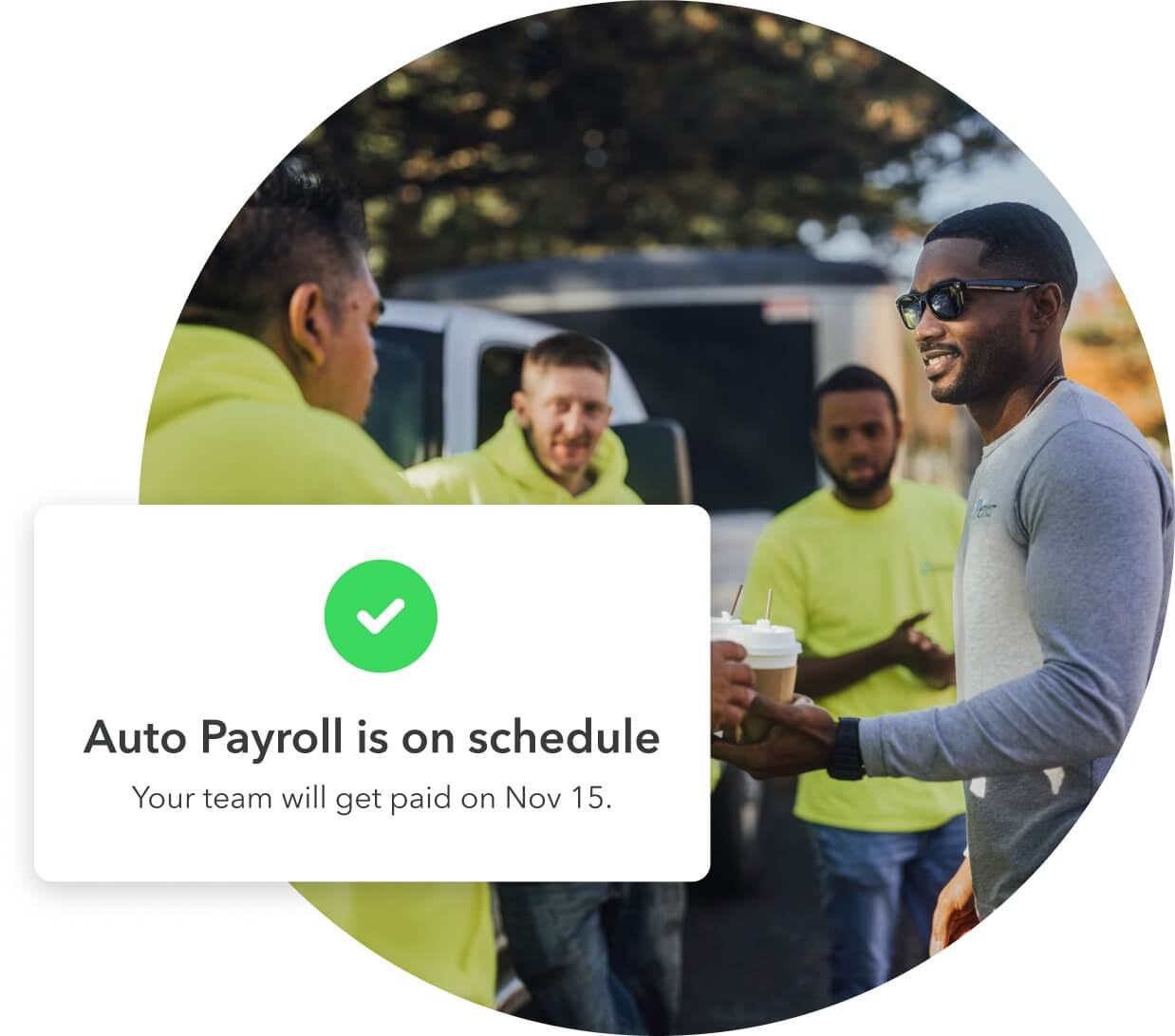

Automatic payroll

Reduce manual entries and free up your time when you set payroll to run on its own.**

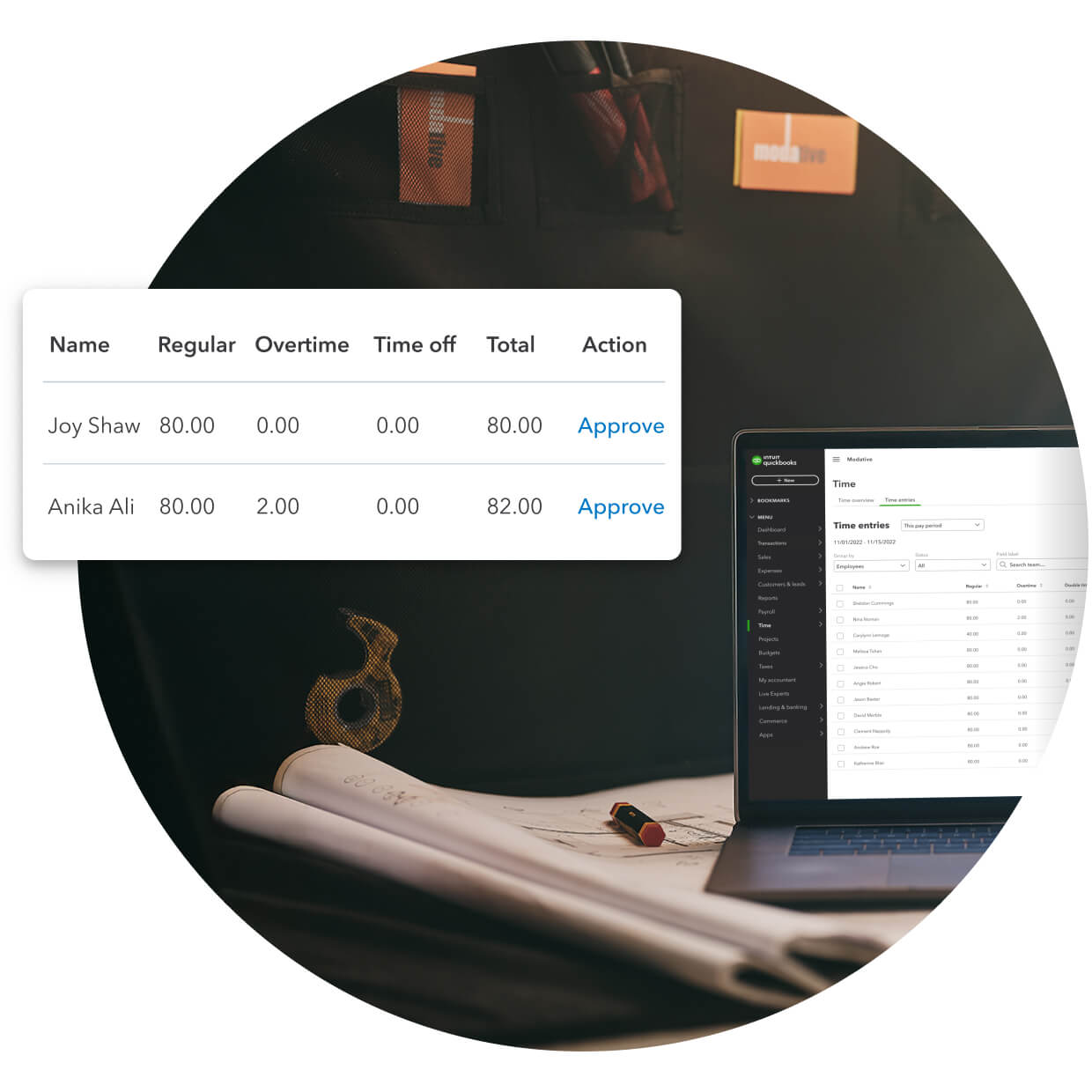

Manage time tracking

Improve accuracy, approve timesheets, and save over 2 hours every time you run payroll.2

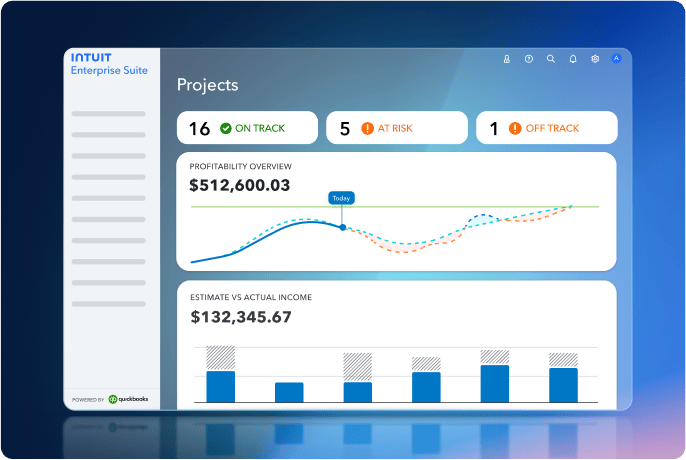

Seamless integration

Payroll, time tracking, and accounting data connect, so you can save nearly 4 hours a week.3

Offer team benefits

Attract skilled applicants, retain your best employees, and help them grow with you.

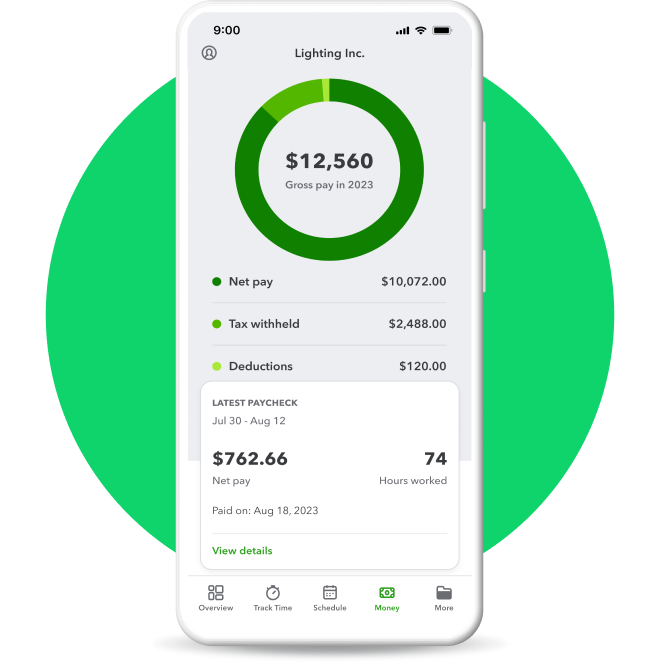

Workforce app

Your team can view pay info and W-2s, plus track hours with the QuickBooks Workforce app.**

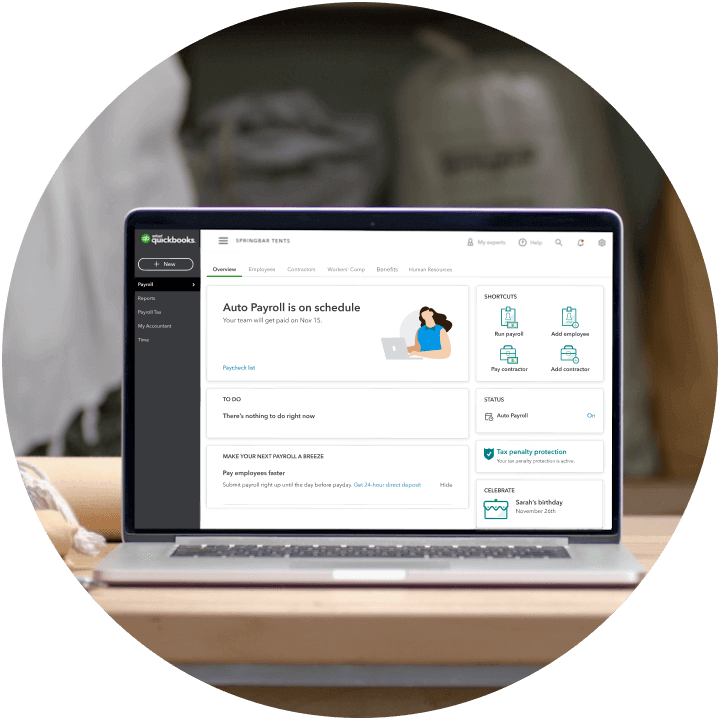

Manage and pay your team with confidence

Automate tedious tasks and get back to business. Set payroll to a schedule, so your team gets paid on time, every time.

Reduce manual entry, increase accuracy, and manage timesheets with QuickBooks Time.** Payroll and time tracking data seamlessly connect, cutting payroll costs by over 4%.5

Your team can access their pay stubs, W-2s, and other important pay details online or in the app.** Plus, if you manage time tracking, they can clock in and out with a tap.

We’ll calculate, file, and pay your federal and state payroll taxes for you—100% accurate tax calculations guaranteed.**

Benefits for every budget

Find everything you need from employee benefits to hiring and management tools.

Healthcare packages

Prioritize your team’s well-being with affordable packages that include medical, dental, and vision insurance by Allstate.**

401(k) plans

Retain top talent with an affordable plan by Guideline, match contributions, and help employees save for their future.**

Workers’ comp

Stay compliant by connecting a policy by Next.** Pay as you go, simplify annual audits, and get automatic calculations.**

HR advisor

Talk to a certified HR advisor by Mineral to stay compliant, hire and onboard your team quickly, and scale with confidence.**

How QuickBooks Payroll works

Learn how to get set up, pay your team, find HR support and benefits, and sync with accounting so you can manage everything in one place.

Simplify employee management

QuickBooks Payroll now includes team management tools so you can streamline your HR tasks and save precious time. From uploading and sharing documents to requesting e-signature and automating l-9 compliance, do it all from one easy-to-use platform.