Explore our features and choose the plan that’s right for you.

Powerful payroll features

Tax penalty protection

With tax penalty protection, we’ll resolve filing errors and pay penalties up to $25,000. We work directly with the IRS so that you don’t have to.

Same-day direct deposit

Keep employees happy with direct deposit. Submit payroll by 7 AM PT on payday morning to have funds withdrawn the same day.**

Trusted time tracking

Schedule employees by shift or job, and update hours in real time. Approve timesheets and run payroll from your mobile phone.**

Personal HR advisor

We’ve got your back with professional guidance on critical HR issues like hiring, compliance, and performance, powered by Mineral, Inc.**

Customized payroll setup

Complete payroll with confidence. Save time and get your payroll up and running with white-glove setup and support from a QuickBooks Payroll expert.**

24/7 expert product support

Get answers to your payroll questions whenever they come up—day or night. Figure out features with step-by-step help via phone or chat.**

Tax penalty protection

With tax penalty protection, we’ll resolve filing errors and pay penalties up to $25,000. We work directly with the IRS so that you don’t have to.

Same-day direct deposit

Keep employees happy with direct deposit. Submit payroll by 7 AM PT on payday morning to have funds withdrawn the same day.**

Trusted time tracking

Schedule employees by shift or job, and update hours in real time. Approve timesheets and run payroll from your mobile phone.**

Personal HR advisor

We’ve got your back with professional guidance on critical HR issues like hiring, compliance, and performance, powered by Mineral, Inc.**

Customized payroll setup

Complete payroll with confidence. Save time and get your payroll up and running with white-glove setup and support from a QuickBooks Payroll expert.**

24/7 expert product support

Get answers to your payroll questions whenever they come up—day or night. Figure out features with step-by-step help via phone or chat.**

Payroll reporting

- Stay on top of your clients’ tax liabilities with quarterly or annual payroll reports.

- Avoid surprises and run and export reports to track bank transactions, contractor payments, paid time off, and more.

- Allow access to reports or hours while maintaining full control by customizing team and client permissions.

Payroll services for your clients

From basic to advanced features, it’s easy to find a payroll system that works for your clients. All plans come with full-service payroll, including automated taxes and forms.**

- Payroll Core has you covered. Pay your team, enroll in health benefits from Allstate Health Solutions, and get expert product support.**

- Payroll Premium adds powerful tools, including same-day direct deposit, employee time tracking, and help with HR compliance.**

- Payroll Elite is there for every step with white-glove customized setup, tax penalty protection, a personal HR advisor, and 24/7 product support.**

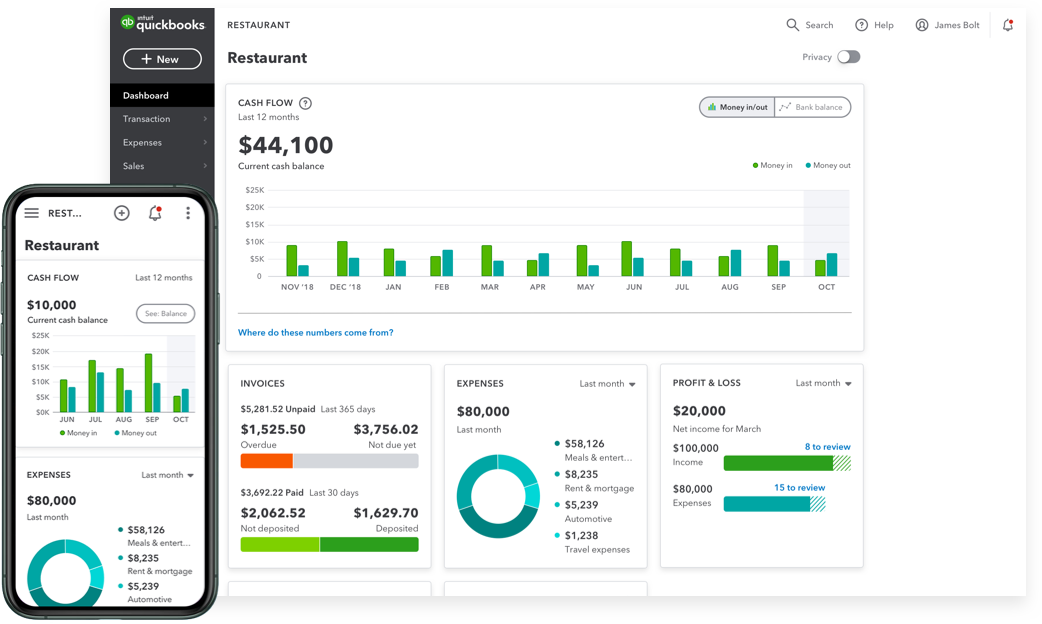

Mobile app

- Pay employees on the go with our payroll app—free with your subscription.**

- Never forget a deadline, and get automated alerts when taxes or payroll are due.

- File tax forms in all 50 states, right from the app.

Why trust QuickBooks for payroll?

Grow your accounting practice with confidence—get services backed by a personal HR advisor and expert support. It’s no wonder more than a million customers made QuickBooks Payroll the No. 1 payroll provider for small businesses.1

Core

Cover the basics—easily pay your team and have your payroll taxes done for you.

$ 50

$ 2500 /mo

Save 50% for 3 months*

+$6.50/employee per month

Premium

Manage your team and perfect payday with powerful tools and services.

$ 88

$ 4400 /mo

Save 50% for 3 months*

+$10/employee per month

Elite

Access on-demand experts to simplify payday and protect what matters most.

$ 134

$ 6700 /mo

Save 50% for 3 months*

+$12/employee per month