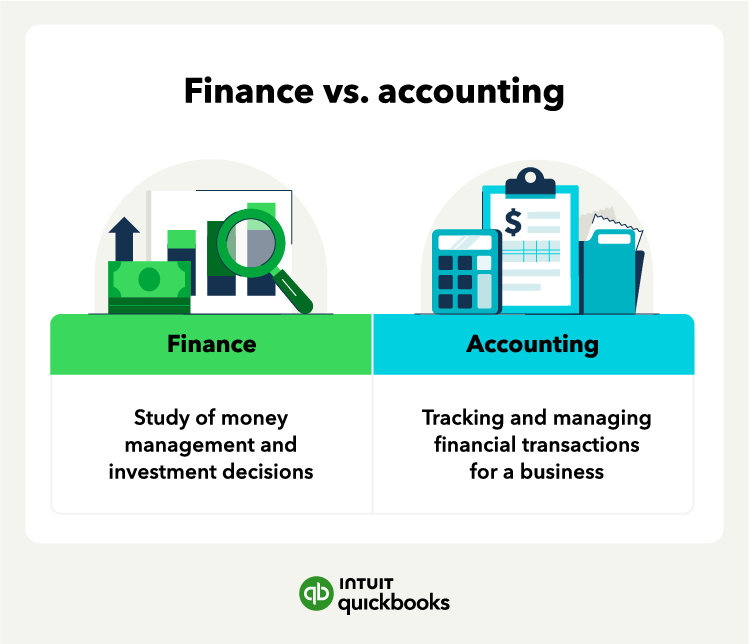

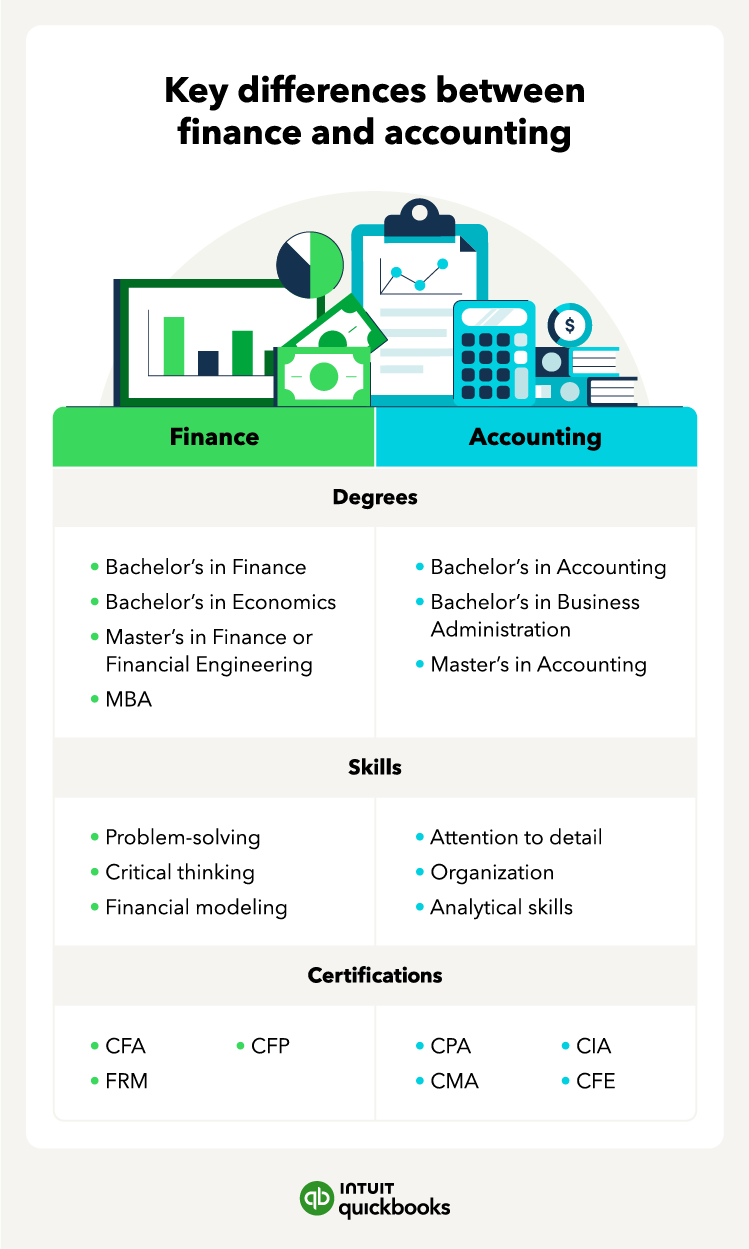

The key difference between finance and accounting is the focus of each discipline. Accounting involves recording past financial transactions and creating financial statements to help inform decision-making. Conversely, finance forecasts the cash flow types and allocates resources to get the maximum return on investment.

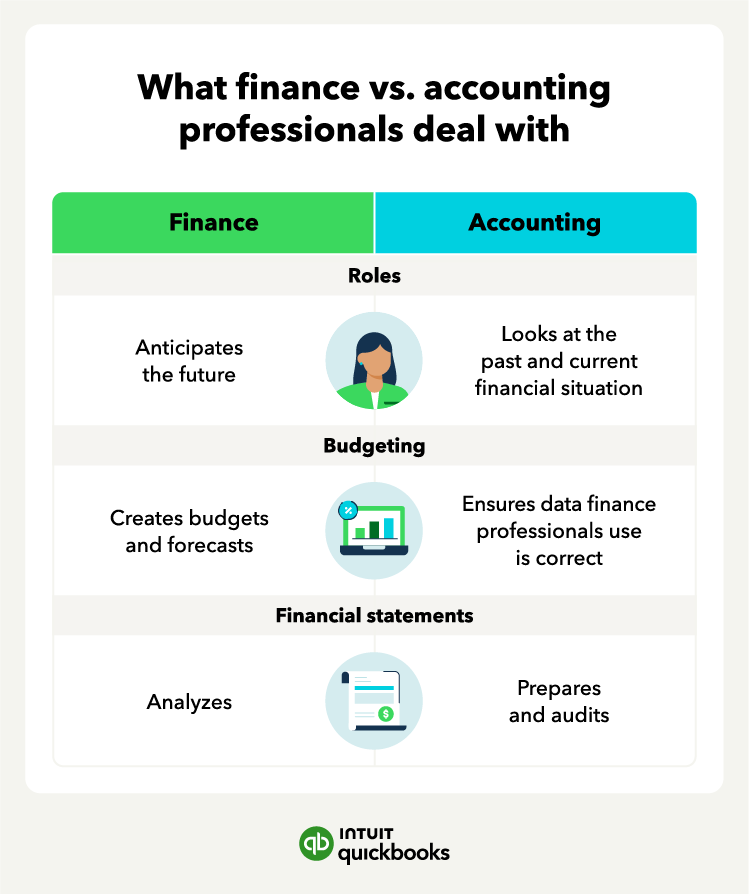

Another key difference lies in the roles they play within an organization. Accountants are typically responsible for preparing and presenting financial reports, while finance professionals are often involved in strategic planning, budgeting, risk management, and investment decisions.

When it comes to compliance with regulations and laws, accounting focuses on accounting standards like Generally Accepted Accounting Principles (GAAP). Finance professionals deal with financial regulators like the Securities and Exchange Commission (SEC).

Roles in your business

Accounting ensures the data financial professionals use is timely and accurate. Accounting also handles paying taxes. Finance primarily focuses on managing money, investments, and risk.

Financial professionals work to optimize an organization's financial performance. They decide on capital allocation (how to invest money), risk management, and raising money from investors. They also assess various investment opportunities and manage financial resources to achieve the organization's goals.

On the other hand, accounting focuses on the accurate recording, reporting, and analysis of financial transactions. They're generally the main users of accounting software, where they can enter data and manage bills.

Accountants ensure that an organization's financial records comply with accounting standards and regulatory requirements. They also prepare financial statements and tax filings and provide critical financial information for decision-making within the organization.

However, the rise of artificial intelligence (AI) may transform how certain finance and accounting processes are carried out. AI-powered tools like Intuit Assist are leading the charge in automating routine tasks and allowing businesses to focus on growth.

For example, with Intuit Assist in Quickbooks, professionals can snap photos of notes or documents after a client meeting, and Intuit Assist will generate them into an estimate or invoice in minutes. It can also detect potential cash flow shortages and suggest payment methods that are most likely to expedite payments, as well as provide lending services when a financial boost is needed.

Ultimately, AI can be a powerful tool for accounting and finance professionals that allows them to be more efficient and focus on what really matters — big-picture planning, building stronger client relationships, and driving growth.

Budgeting and planning

When it comes to budgeting and planning, finance professionals develop financial strategies and allocate resources to achieve the organization's objectives. They forecast future financial performance by analyzing historical financial data, market trends, and economic indicators.

Finance experts create budgets, assess financial risks, and develop contingency plans to navigate potential challenges. They also create pro forma financial statements.

Accountants and accounting professionals provide the necessary data and financial records to inform budgeting and planning decisions. They compile accurate financial information and ensure all transactions are properly recorded and categorized.

Accountants also monitor the organization's financial performance against the budget, identify variances, and help adjust plans to maintain financial stability.

Financial statements

There is a major difference in the role of finance vs. accounting when it comes to financial statements. Financial statements include the income statement, balance sheet, and cash flow statement.

Accounting involves putting these documents together, while finance analyzes them. Accounting primarily focuses on balancing the following equation:

Assets = Liabilities + shareholders’ equity

The accounting department and accountants ensure that all transactions are accurately recorded and adhere to accounting standards and regulatory requirements. Accountants also verify and reconcile financial data, maintain audit trails, and address any discrepancies to ensure the integrity of financial statements.

Financial professionals focus on cash and the company’s ability to generate and use it. In particular, they look at free cash flow—the amount of money a company has available to reinvest after paying expenses.

Finance professionals analyze financial statements to evaluate a company's financial health, identify trends, and make recommendations for strategic decision-making. They use the information provided in financial statements to assess profitability.