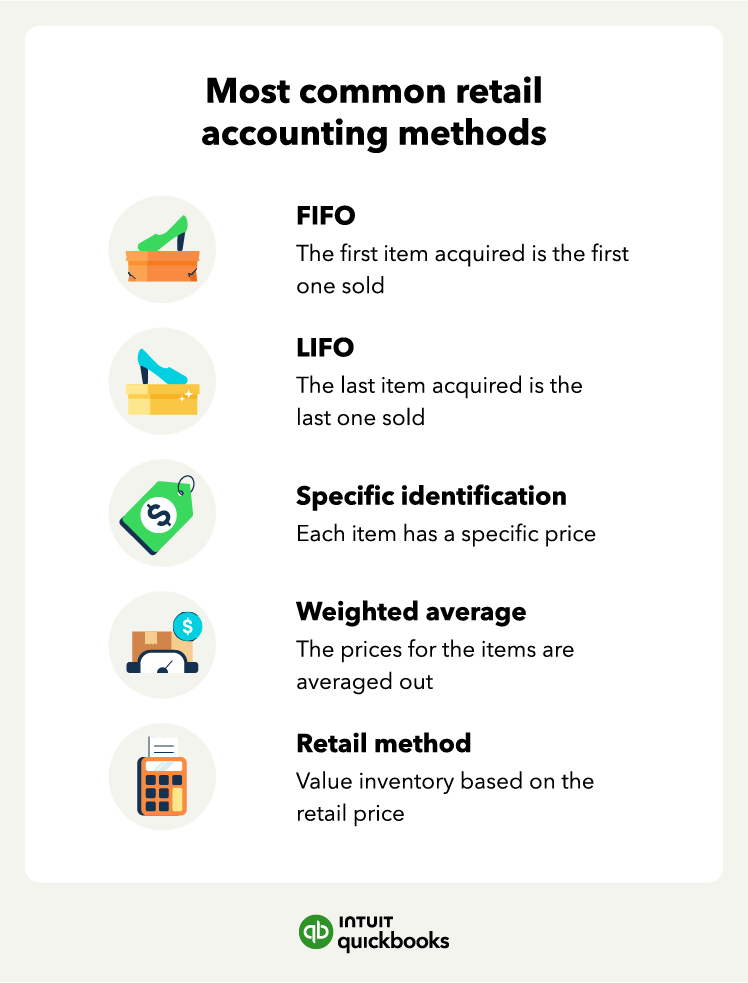

First in, first out (FIFO)

The first in, first out (FIFO) is an inventory costing method that calculates inventory value, considering that the goods you acquired first are the first ones you sell. This method is commonly used by businesses that sell inventory with an expiration date, like food and drinks.

For example, your business purchased 50 bags of chips for $1 each, then at a later date, decided to buy 30 more, but the price rose to $2 each. By the end of the month, you sold 40 bags of chips.

With the FIFO method, the cost of goods sold would be $40 because this was the price you purchased the first bags of chips. Your inventory value would be $70 since there were 10 bags left that you bought for $1 and 30 left that you bought for $2.

Last in, first out (LIFO)

The last in, first out (LIFO) is the opposite of the FIFO method. In this inventory costing method, you’ll calculate inventory value, considering that the goods you acquired last are the first ones you sell.

For example, your business purchased 30 basketballs for $5 each, then at a later date, you purchased 20 more basketballs, but for $6 each. By the end of the month, you sold 15 basketballs.

With the LIFO method, the cost of goods sold would be $90 since the last 20 basketballs you purchased cost $6 dollars each. Your inventory value would then be $180 since you have five basketballs left purchased for $6 each and 30 left for $5 each.

Specific identification

The specific identification is another inventory costing method that tracks the cost of each item you have in stock by assigning a different price to each item, usually with SKUs. This method helps businesses keep track of every item in their inventory without grouping them.

It’s most common in businesses that sell high-ticket items or have a smaller stock quantity. For example, if your business sells jewelry, you’ll assign a price to each item based on its material and details.

Weighted average

The weighted average is an inventory costing method that averages the cost of your items. This method is the most useful when dealing with goods you rotate or mix up, like smaller identical items in large quantities.

For example, let’s say your business has a bin of 200 hair ties, each of which you and you purchased at different prices for a total of $40. Using the weighted average, you’ll divide the total cost of the hair ties by the number you purchased, which is 20 cents each. If you sold 120 of them, the cost of goods sold was $24, and you have $16 for the ending inventory.

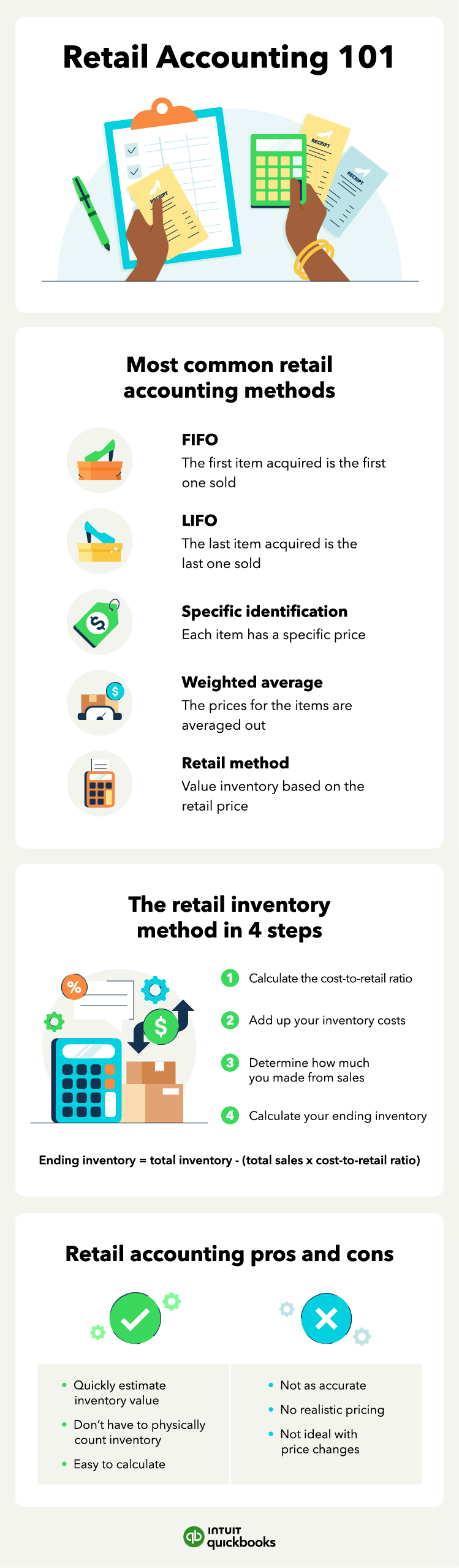

Retail method

The retail method is different from the other costing methods since it values the inventory based on the retail price instead of the cost to acquire them. This method helps you get an approximate value for your inventory without having to count the inventory often. The retail method works for businesses that mark up their inventory consistently and at the same percentage.

You’ll first have to find the cost-to-retail percentage by dividing the cost of your product by the sale price. Then to find the ending inventory, you’ll multiply your sales by the cost-to-retail percentage, then subtract it from your beginning inventory.

How to use the retail method (with examples)

If your business usually marks up prices consistently across all inventory goods and you want to use the retail inventory method, here’s how it works: