Managing accounts receivable

Accounts receivable transactions are posted when you sell goods to customers on credit and you need to monitor the receivable balance. The accounts receivable turnover ratio compares sales to accounts receivable, and your goal is to maximize credit sales while controlling the growth of accounts receivable.

You can also monitor accounts receivable using days sales outstanding (DSO). The metric calculates the average number of days it takes to collect a payment after a credit sale. A lower DSO means that you’re collecting balances faster.

Finally, offer a discount to customers who pay within 10 days, or some other time period you select. For example, offer a 2% discount for orders paid within 5 days. You’ll receive slightly less cash, but you’ll collect cash faster, which reduces the need to borrow money to fund operations.

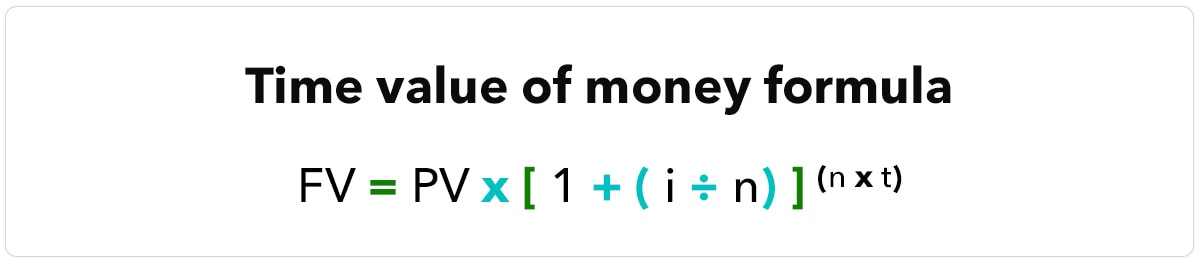

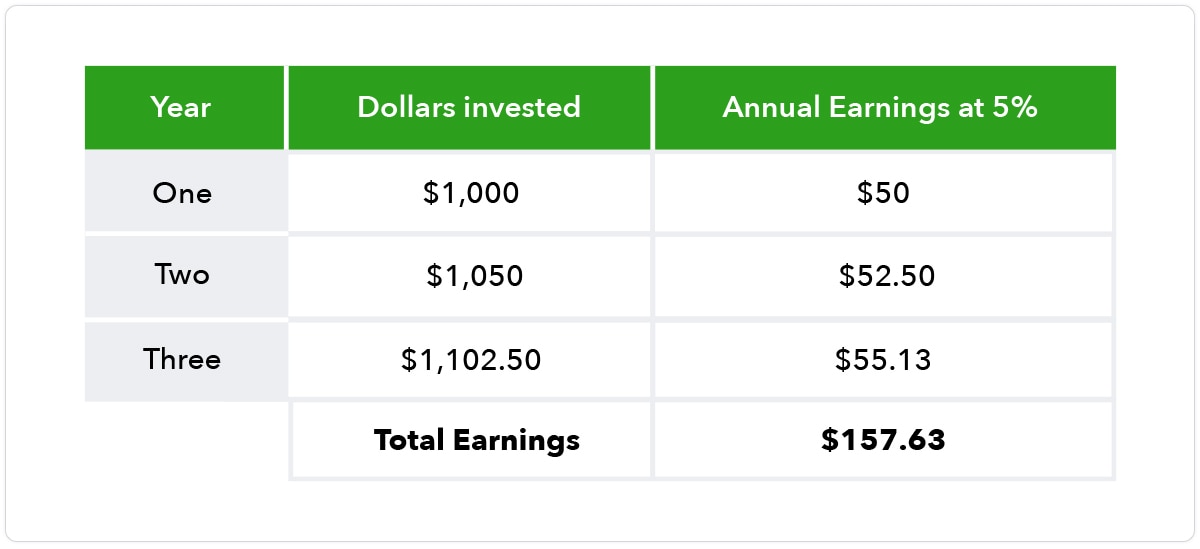

Accounting for the time value of money involves your cash and accounts receivable balances.