After reviewing the different services that bank lenders offer, it’s time to choose a bank account for your small business. You can start most U.S. bank accounts with an Employer Identification Number (EIN) or Social Security number if you operate as a sole proprietorship.

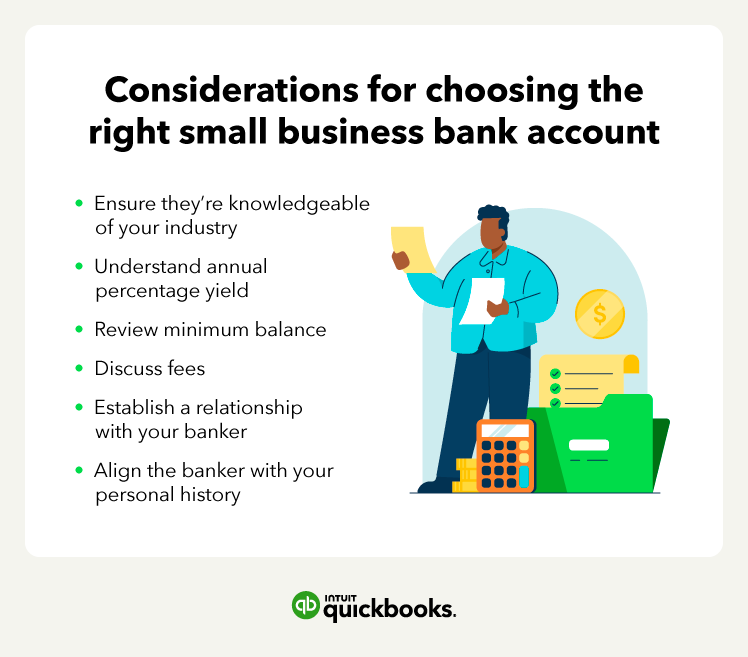

Here are some factors and account features to consider as you choose a bank account:

- Ensure they’re knowledgeable about your industry

- Understand annual percentage yield

- Review minimum balance

- Discuss fees

- Establish a relationship with your banker

- Align the banker with your personal history

Ensure they’re knowledgeable of your industry

The banker must understand how businesses in your industry operate. They must understand several factors, including:

- Profit margins

- Sales cycle

- Customer acquisition cost

- Monthly recurring revenue

Partnering with a bank that is knowledgeable of your industry will help with your overall success in the long term.

Understand annual percentage yield

To assess your bank account options, you need to understand the competitive annual percentage yield (APY).

APY is the rate of return (interest) you earn on business savings accounts, business checking accounts, and certificates of deposit (CDs). The APY rate assumes that your interest is reinvested in the account, which means that interest compounds.

It’s important to understand APY so that you can compare the interest rates offered on bank products. For example, QuickBooks Checking offers a competitive APY on Envelope balances.

Review minimum balance

If you are required to keep a minimum account balance to avoid fees, cash management can be more difficult. The minimum balance reduces the flexibility of the cash available in your account, so you'll have to plan cash flow more carefully.

The requirement may be stated as a minimum daily balance or a minimum balance requirement. If you see any language regarding a minimum balance, ask the bank to explain how they calculate the required balance.

Be sure to also check if there’s a minimum account opening deposit.

Discuss fees

It’s also important to discuss fees that may be included. Typical bank costs include fees for:

- ATM usage

- Check writing

- Paper statements

- Wire transfers and incoming wires

- Monthly maintenance fees

- Transaction fees

- Withdrawals

- Overdrafts

- Service fees

- Cash deposits

As you look for a bank to meet your long-term needs, you can also review the type of business accounts they offer. The type of small business checking account you choose will vary depending on your needs and creditworthiness.

Establish a relationship with your banker

When considering a business banking relationship, start with the end in mind. Your banker needs to understand the unique challenges of your industry to serve your banking needs as your small business expands. Over time, you may need a line of credit for operations or a long-term small business loan to purchase assets.

To help establish a relationship with your banker, be sure to:

- Communicate regularly

- Speak about your business’s goals

- Share as much detail as possible

- Stay honest

Small business owners must build trust with a banker so that the bank is willing to add services and lend money. Loan approval requires more than a set of financial statements. Ultimately, a loan officer must know you and trust that you’ll repay the loan on time.

If you need a small business loan, utilize QuickBooks Capital for additional funding help.

Align the banker with your personal history

A business owner with prior success in an industry is more likely to succeed, and bankers value experience. Be sure to:

- Talk with the bank’s loan officer.

- Determine if they understand how you operate.

- Think carefully about the services you need from your bank.

- Think of how your needs may change due to company growth.

Personal creditworthiness may also be a factor, particularly if you need a business loan down the road. How you handle personal finances is important to a loan officer. If you’re willing to move personal investment assets to the bank, you can build a stronger relationship.