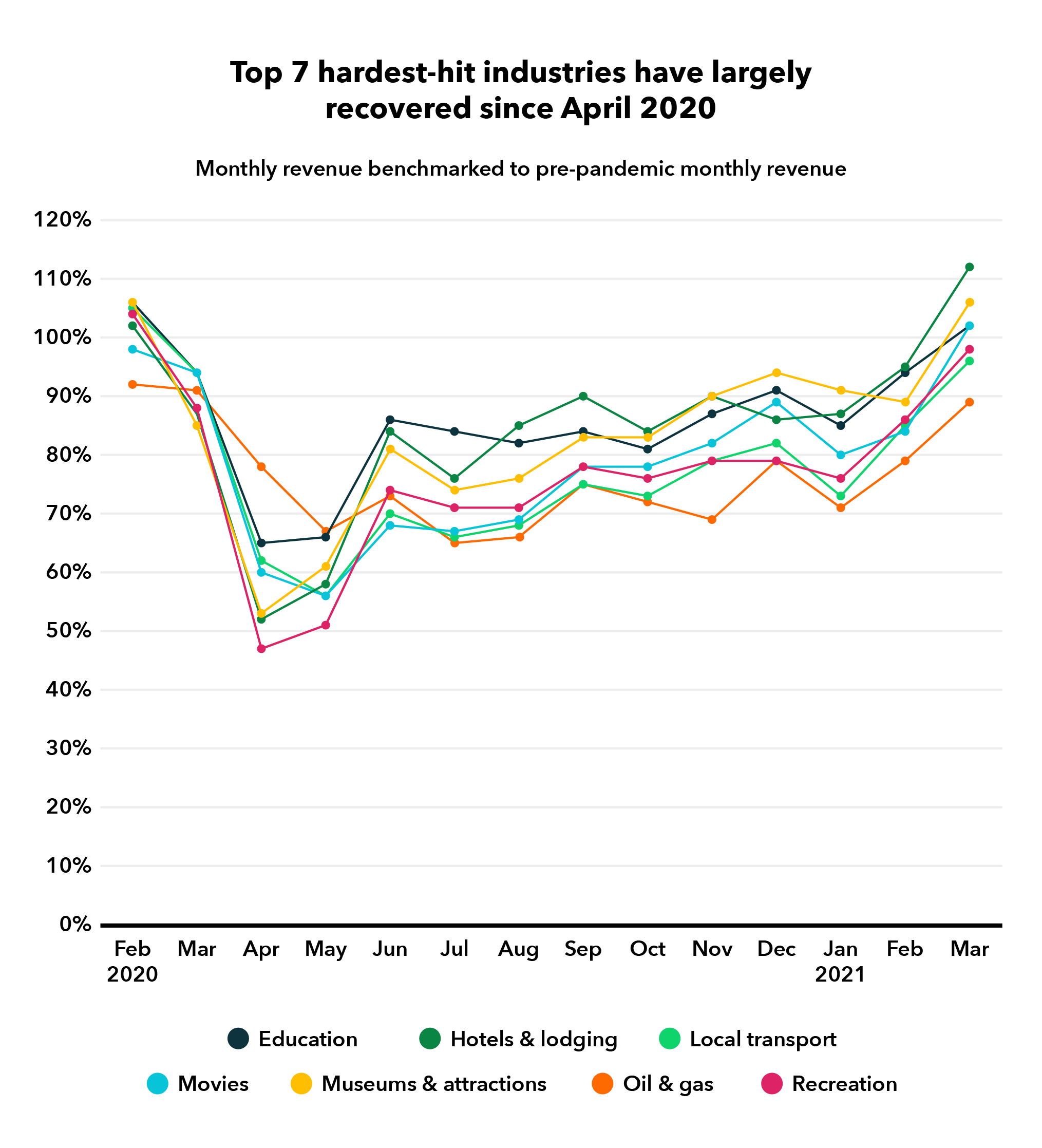

Stronger, more consistent recovery since January 2021

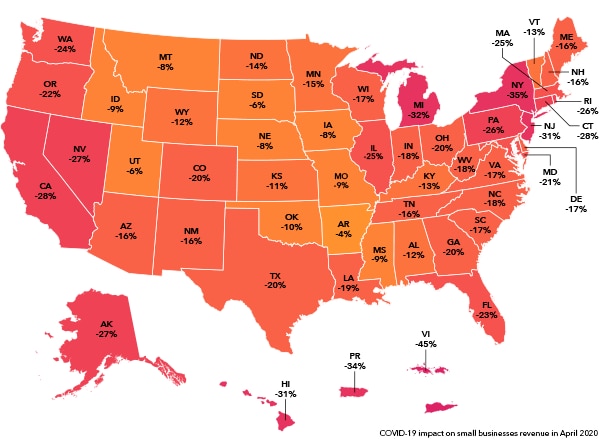

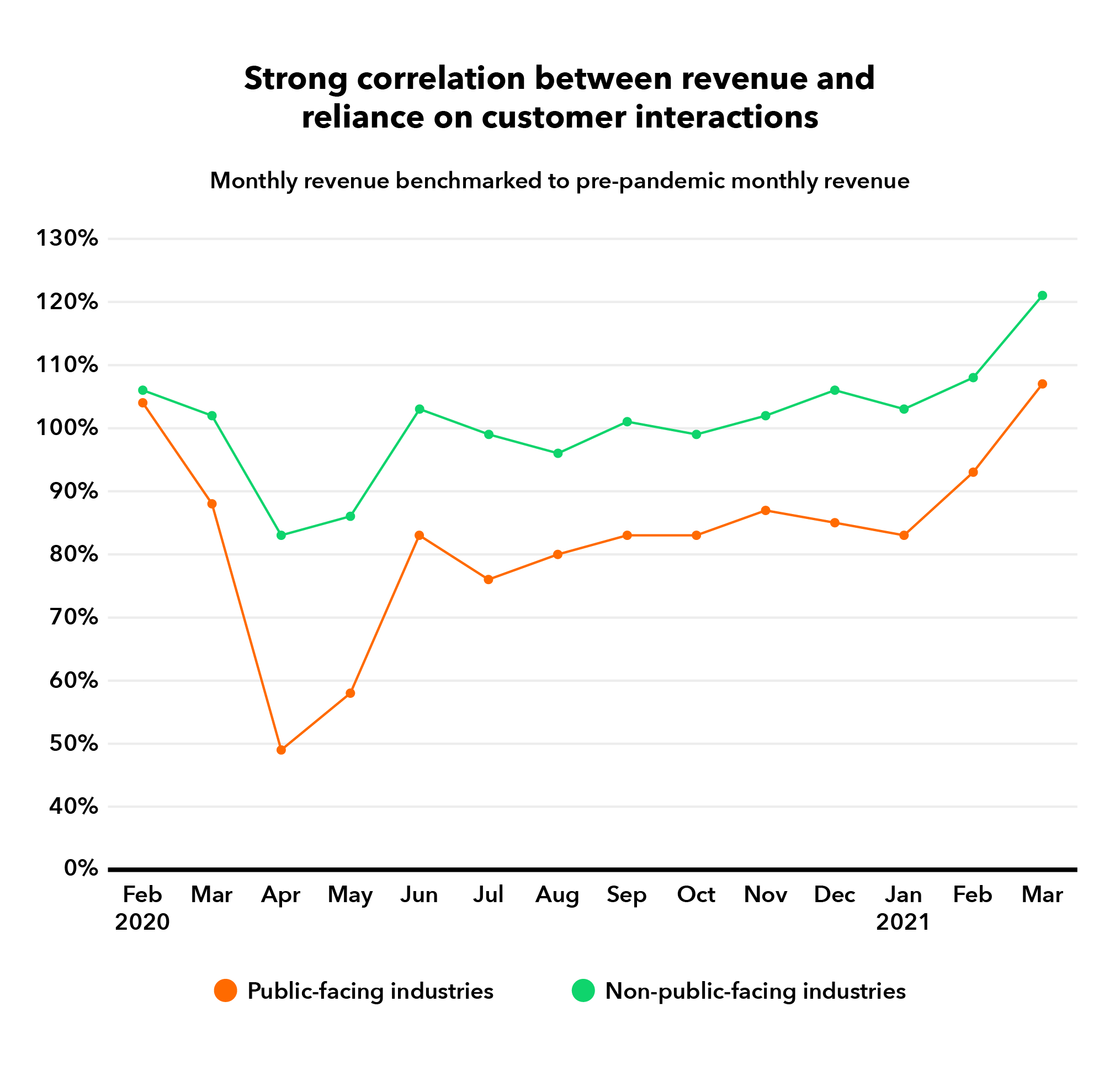

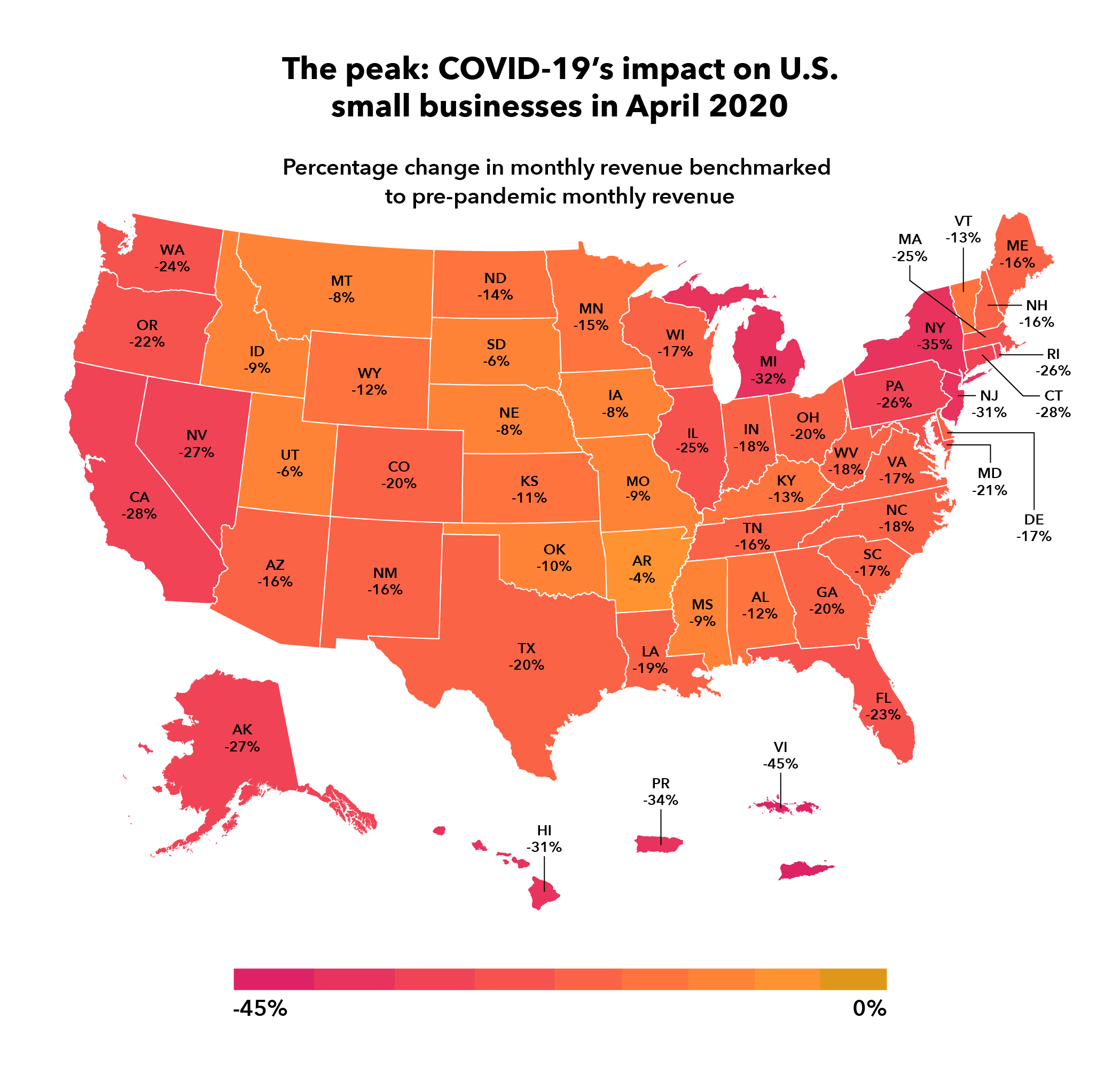

As we’ve seen — and is evident here in the timeline above — the summer of 2020 marked the beginning of a gradual recovery that largely continued until December 2020, when some businesses were again affected by renewed safety regulations. The impact of the winter lockdowns was uneven. Public-facing businesses that are most reliant on face-to-face interactions — such as restaurants, bars, hotels, and recreation businesses — were hit harder. This was especially true on the east and west coasts where population densities are higher.

To quantify this impact, for almost 33% of these businesses, revenue in December 2020 was 50% lower than in December 2019. In contrast, only 14% of these businesses experienced a similar revenue drop the year prior. In other words, during the pandemic, the proportion of public-facing businesses in financial distress more than doubled in December 2020.

In comparison, businesses that are less reliant on face-to-face interactions show mostly similar results in December 2020 compared to December 2019.

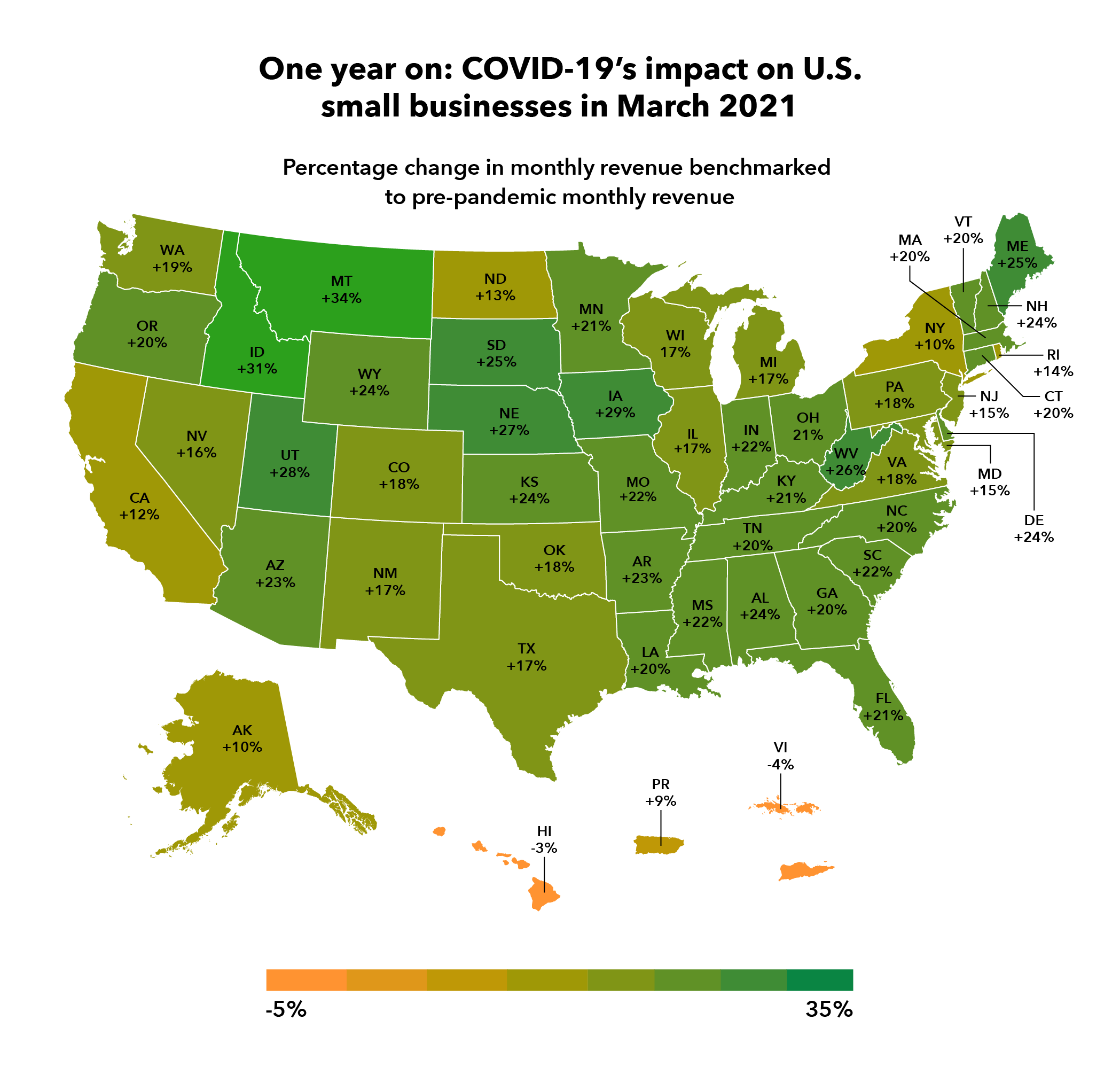

In January 2021 the recovery picked up speed more broadly again. And by February, even businesses that rely on face-to-face interactions hit 93% of the benchmark they set before the pandemic. By the end of March, they were at 107%.

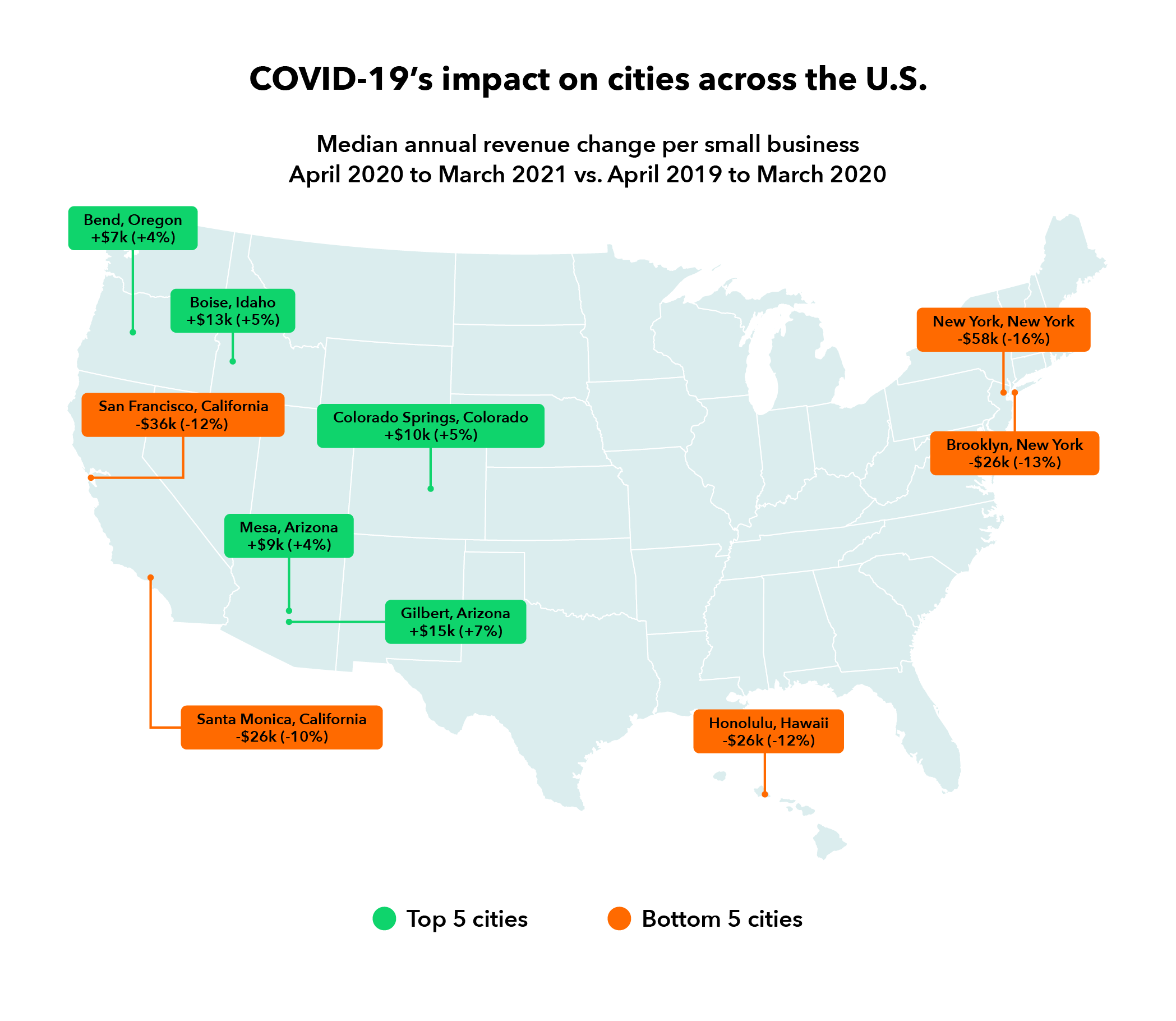

Up next: COVID-19’s impact on cities and states