Credit cards: Flexible but limited

Business credit cards give you access to revolving credit. In other words, you can borrow up to a set limit, repay, and borrow again as needed. This makes them ideal for everyday expenses like office supplies, travel, or short-term cash gaps.

However, credit cards typically come with higher interest rates than loans, especially if you carry a balance. They may also have lower credit limits, which might not be enough to cover larger investments.

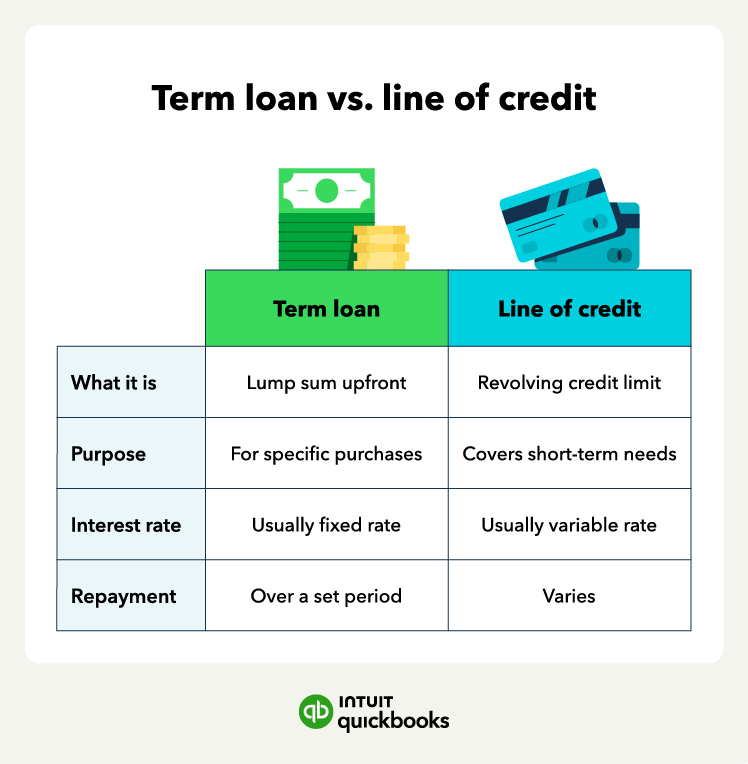

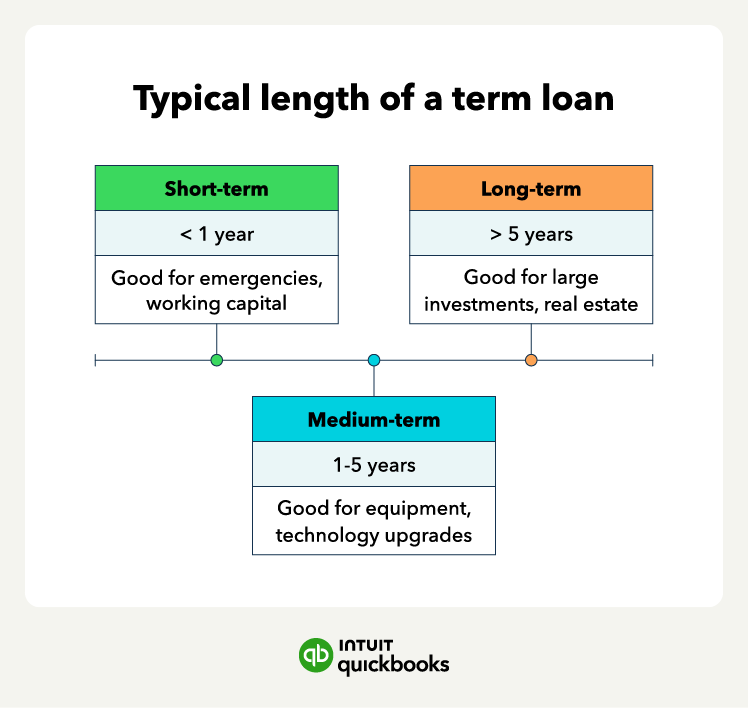

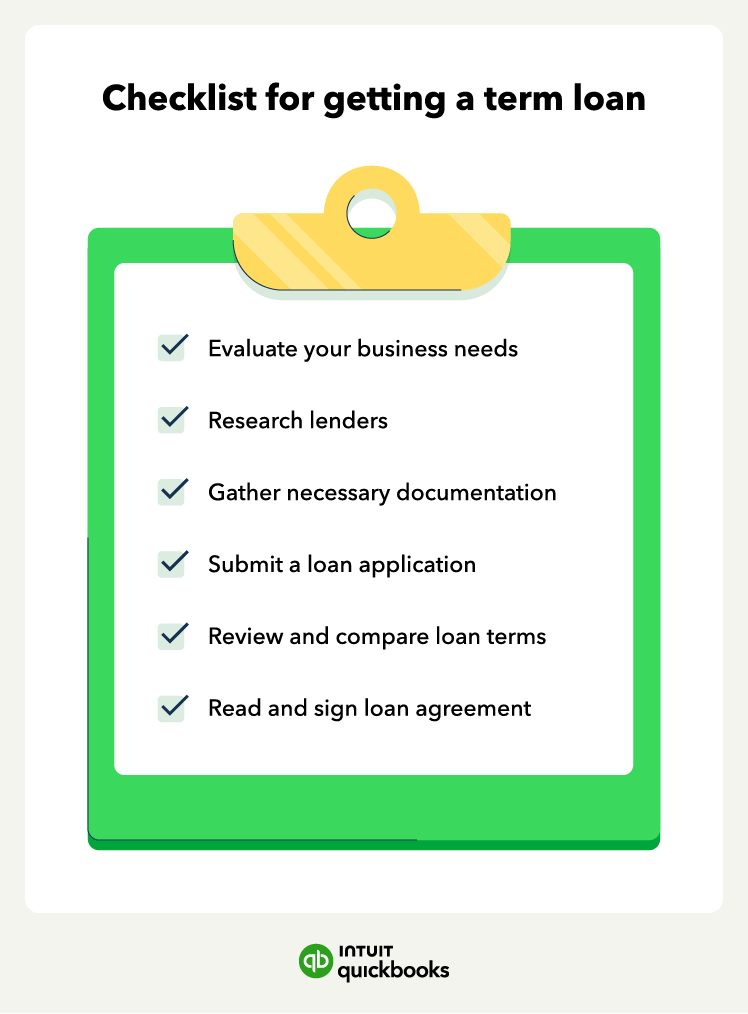

Term loans: Structured and scalable

Term loans provide a lump sum of money upfront with a fixed repayment schedule. They’re best for bigger expenses, such as purchasing equipment, expanding operations, or consolidating debt. Because of their structured terms, they often come with lower interest rates than credit cards.

The trade-off is that term loans can require more paperwork, stricter qualifications, and collateral for larger amounts.

Lines of credit: Flexible and reusable

A business line of credit works like a hybrid between a loan and a credit card. You can borrow funds up to a set limit, repay, and then borrow again as needed. This flexibility makes them useful for covering cash flow gaps, unexpected expenses, or seasonal fluctuations.

Lines of credit usually have lower interest rates than credit cards, but they may come with annual fees or require collateral for higher limits.