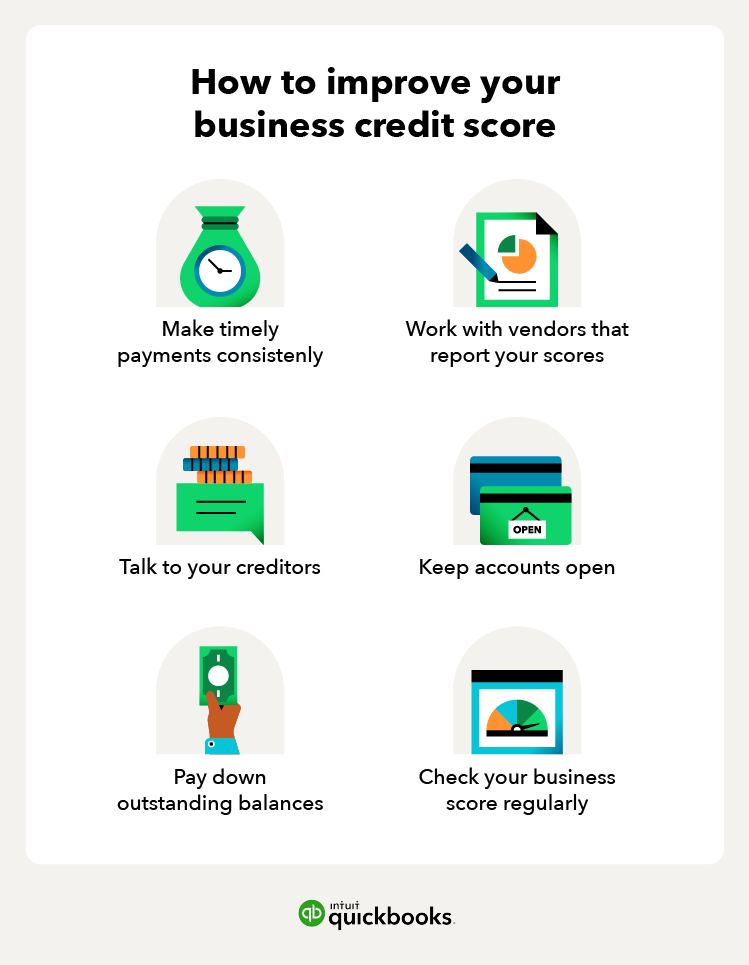

Understanding a good credit score is one major key to overall business success. After all, having a good business credit score can lead to lower interest rates, access to the necessary financial resources needed to grow your business, and better trade credit.

Good (or high) business credit scores are considered a low risk for lenders and creditors, while low credit scores are considered risky for lenders. Therefore, it’s critical that you not only nurture your business credit score but also understand the ins and outs of what constitutes a good credit score.

Below we’ve listed the four main business credit scoring systems, along with the business credit score ranges that are considered favorable:

It’s important to note that your FICO Small Business Scoring Service (SBSS) also incorporates your personal credit score, creating a hybrid score. Since the small business owner and their business are often intertwined, this score has become a key factor in assessing and establishing the business credit validity of small businesses.