Understanding your business’s core performance can feel like a guessing game. You deal with sales, expenses, and maybe even debt—but how can you truly know if your operations are profitable? This is where earnings before interest and taxes (EBIT) come in.

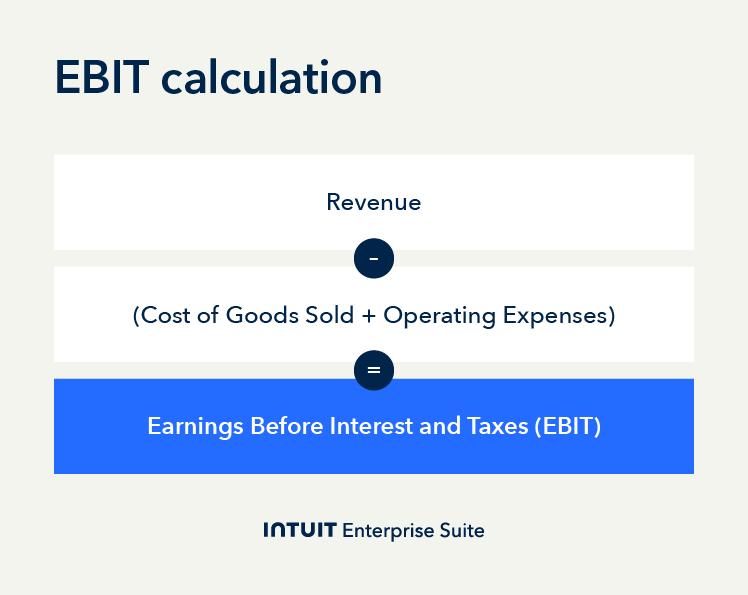

By focusing only on revenue and operating costs, EBIT gives you a clearer picture of your company’s operational strength, helping you make better decisions without the noise of financing or tax details.

Learn what EBIT means and how to calculate it. We’ll also discuss why EBIT matters for assessing core profitability and how it can guide smart, growth-oriented choices.

EBIT is ideal for evaluating operational performance across companies, while EBITDA is best for comparing cash flow potential, especially in asset-heavy industries.

EBIT is ideal for evaluating operational performance across companies, while EBITDA is best for comparing cash flow potential, especially in asset-heavy industries.