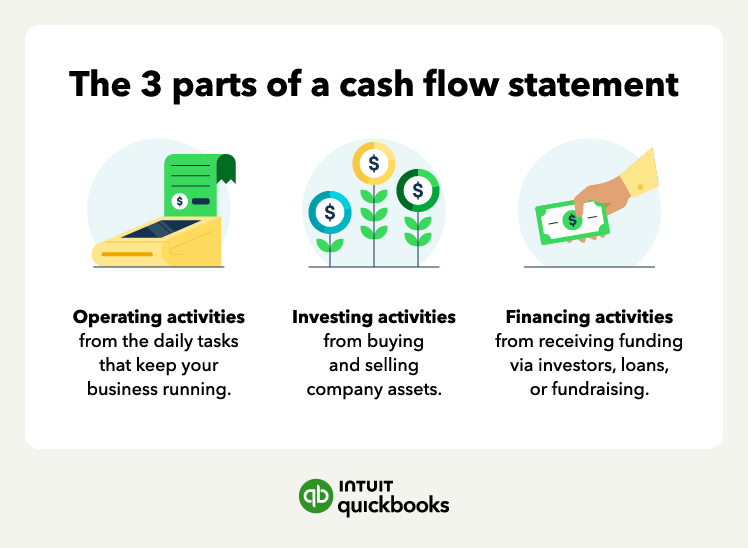

There are three core parts to a cash flow statement. To create a cash flow statement, review each cash transaction on record, and assign the dollar amount to one of three categories.

Operating activities

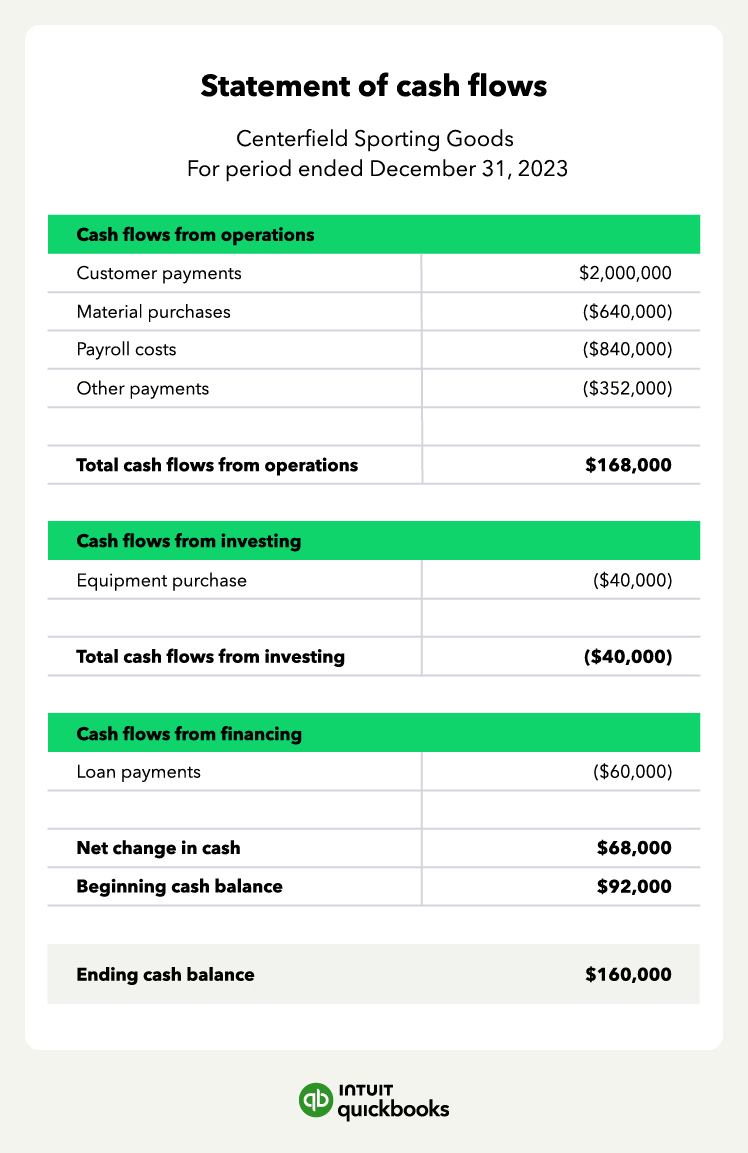

Statement of cash flows operating activities refers to day-to-day business management activities. The majority of your cash will be from operating cash flows. Buying materials, managing payroll, and collecting customer payments are all examples.

Investing activities

Investing activities in a cash flow statement refer to the inflow and outflow of investment capital for your small business. If your business purchases or sells an asset for cash, you'll post the impact here.

Financing activities

Financing activities in a cash flow statement refer to transactions that create funding for your small business. When a company raises money from investors, borrows funds, or pays down a loan, those cash transactions are classified as financing activities.

How to calculate cash flow

Calculating cash flow might be easier than you think. You can begin preparing a statement of cash flow in five simple steps:

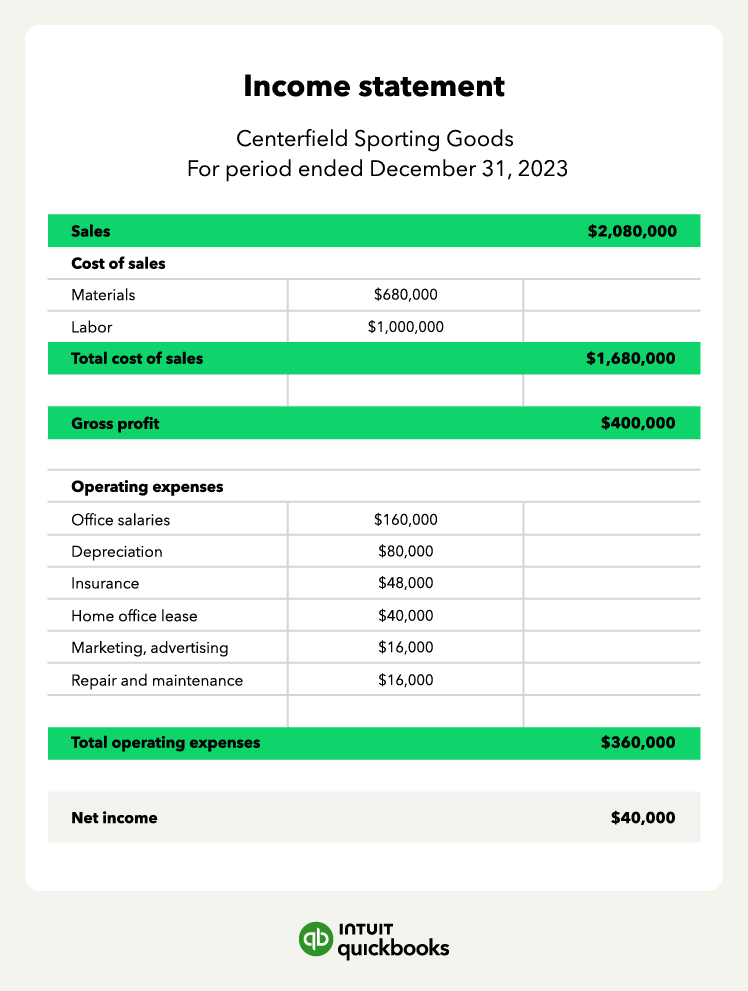

1. Find the starting balance: You’ll need your starting balance from your latest income statement if you are using the indirect method to calculate cash flow.

2. Calculate operating activities: Subtract all your operating expenses from any earnings gained through business operations.

3. Calculate investing activities: Report any earnings or losses from company assets here. This includes land, vehicles, and equipment.

4. Calculate financing activities: Share any funding or financing you receive here. This includes debt payments, equity, and fundraising.

5. Share the ending balance: Combine the totals from your operating activities, investing activities, and financing activities calculations to achieve your end balance for this reporting period.

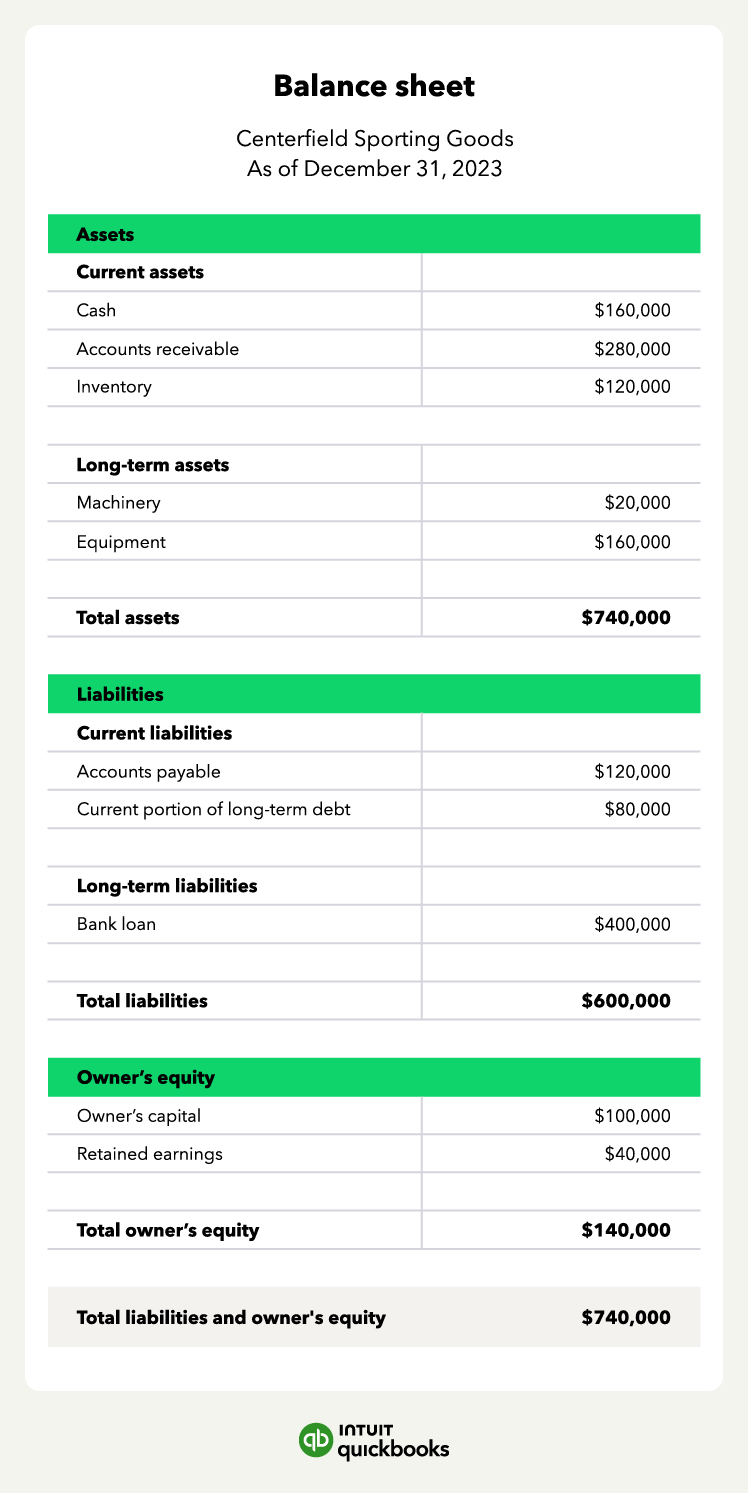

A cash flow statement lists the cash inflows and outflows of cash for a period of time, and the ending cash balance is the same dollar amount reported on the balance sheet.

You can calculate operating cash flow using the direct or indirect method:

- The direct method refers to assigning cash inflows and outflows to the operations section by reviewing the firm’s cash account and line items of major transactions.

- The indirect method for cash flow from operations begins with net income. The report then makes adjustments to reconcile net income to net cash flow from operations.

Here are the main differences between the two methods: