Disclaimers

*QuickBooks Live Tax, powered by TurboTax, is an integrated service available with a QuickBooks Online subscription. Additional terms, conditions and limitations apply. Pay when you file.

**QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a Live Bookkeeper. Available to new QuickBooks Online Simple Start, Essentials, Plus, or Advanced subscribers who are within their first 30 days of their subscription. The QuickBooks Live Setup service includes instructions on how to set up your chart of accounts, customize invoices, set up reminders, and connect bank accounts and credit cards. QuickBooks Live Setup does not include Payroll setup or services. Your bookkeeper will only guide you through the setup of your QuickBooks Online account, and cannot set it up on your behalf.

Terms and conditions, features, support, pricing, and service options subject to change without notice.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

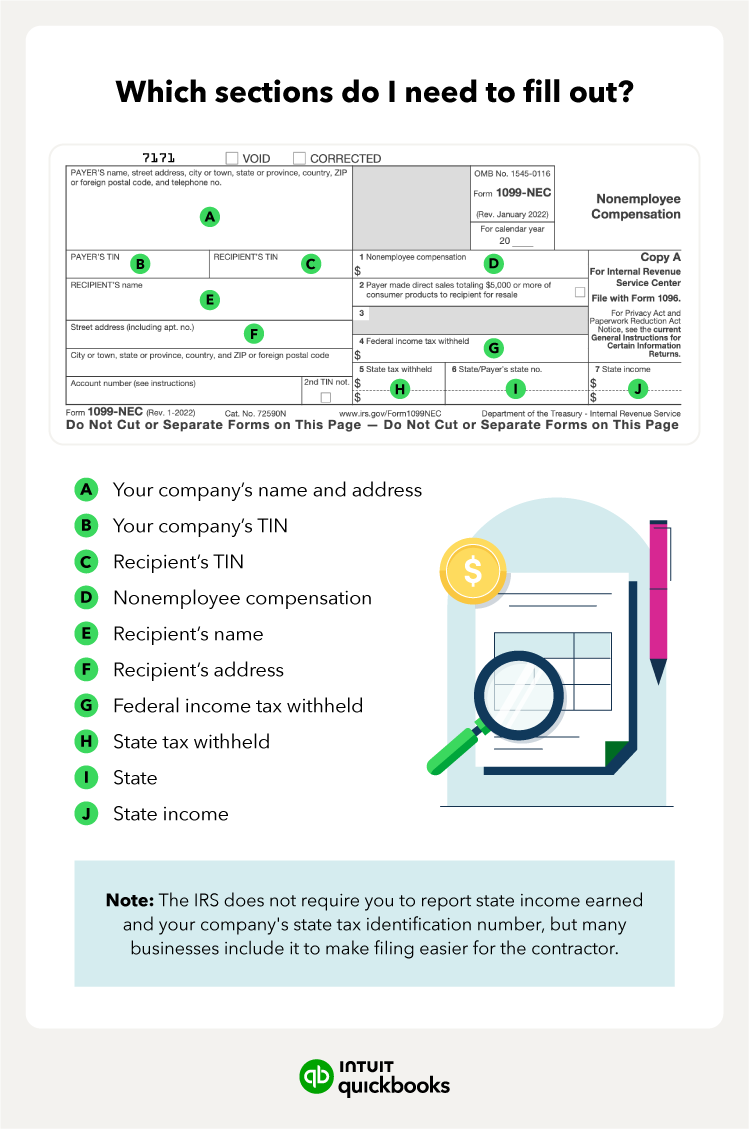

To avoid any issues with the IRS, make sure the information you enter matches exactly what's on the contractor's W-9 form.

To avoid any issues with the IRS, make sure the information you enter matches exactly what's on the contractor's W-9 form.