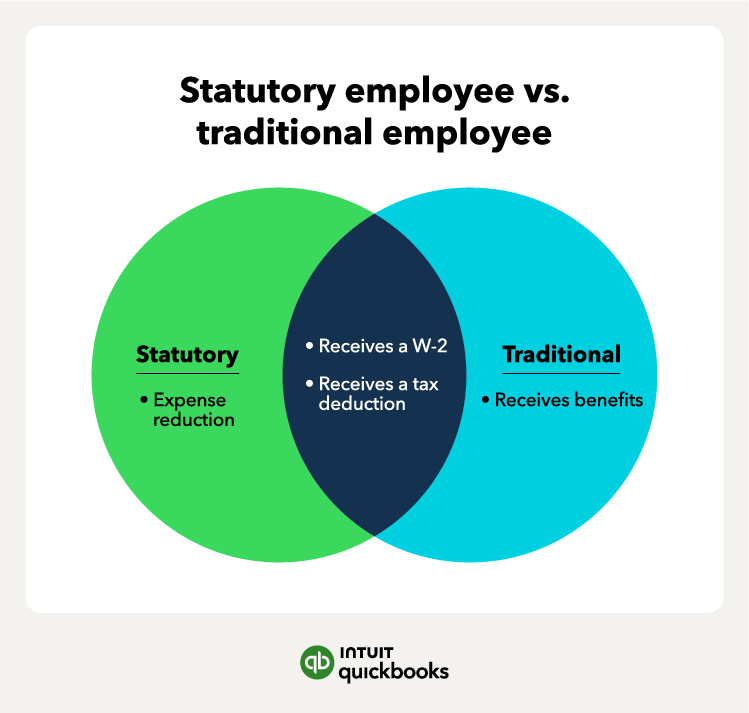

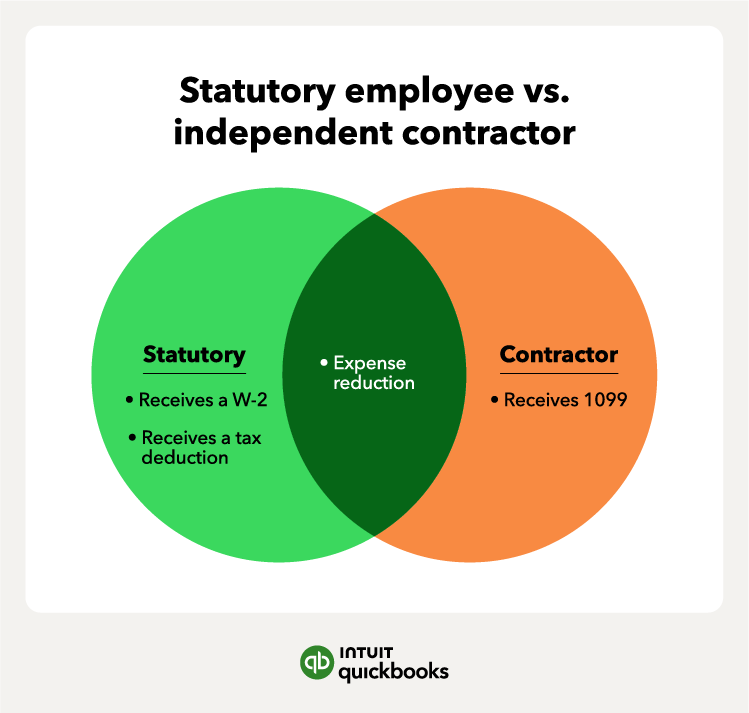

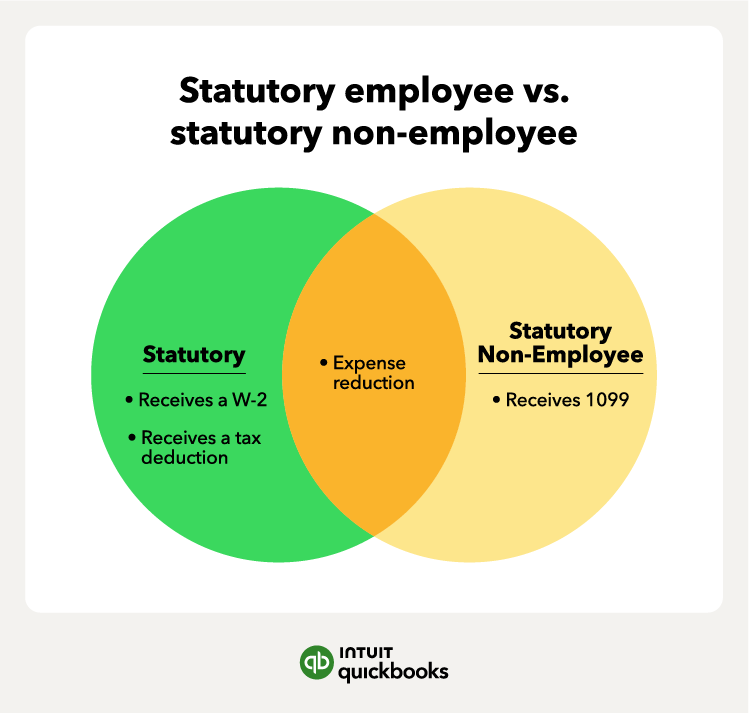

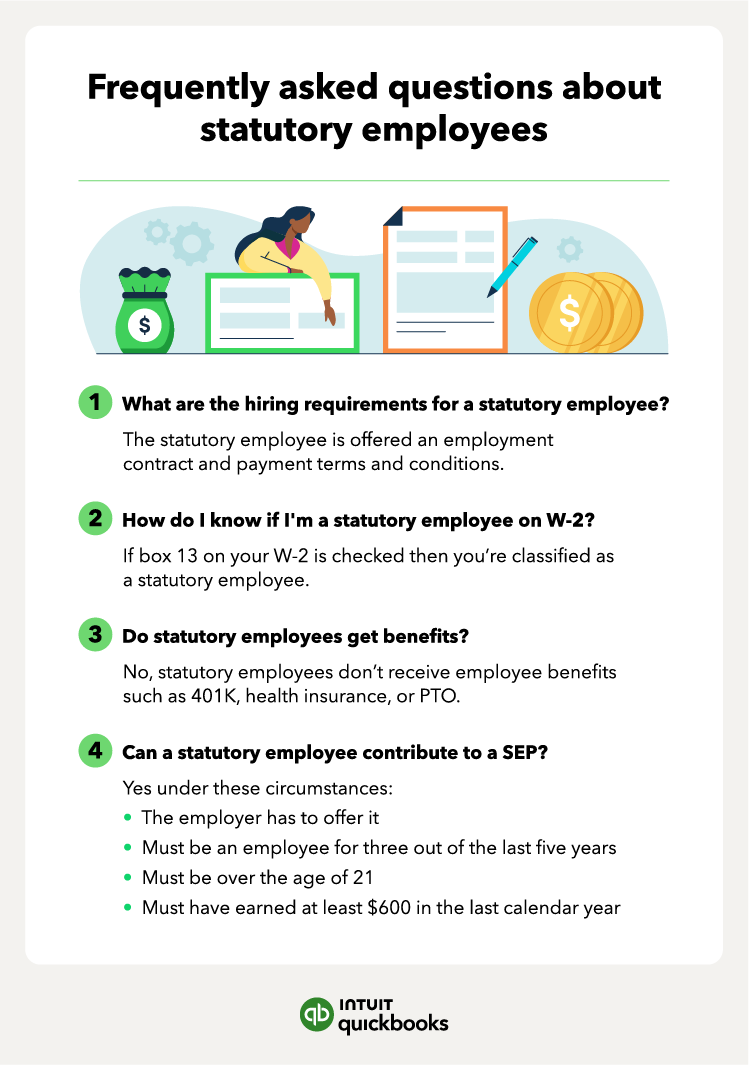

Business owners commonly interact with multiple types of employees over the lifespan of their company. Both traditional employees and independent contractors are fairly straightforward to work with, but what happens when you start mixing the two? A statutory employee is a hybrid between both, and a worker must meet specific criteria in order to become one.

So what is a statutory employee? Below we’ll discuss the definition, criteria, and tax implications of having a statutory employee on your payroll.