Small business owners face numerous challenges when it comes to data security, but implementing strong fraud prevention measures can go a long way toward providing peace of mind.

To facilitate unlawful transactions, scammers and bad actors may steal credit card information, PINs, and security codes. And a data breach at your small business can also lead to personal identity theft, data mining, and even a loss of control over your accounts. These threats cause large-scale harm to even the smallest enterprises and business owners.

Some might believe larger organizations are the only ones at risk for a data breach, but it also affects small businesses. In fact, according to the Association of Certified Fraud Examiners (ACFE), small businesses had the highest median loss of $150,000, compared to larger organizations.

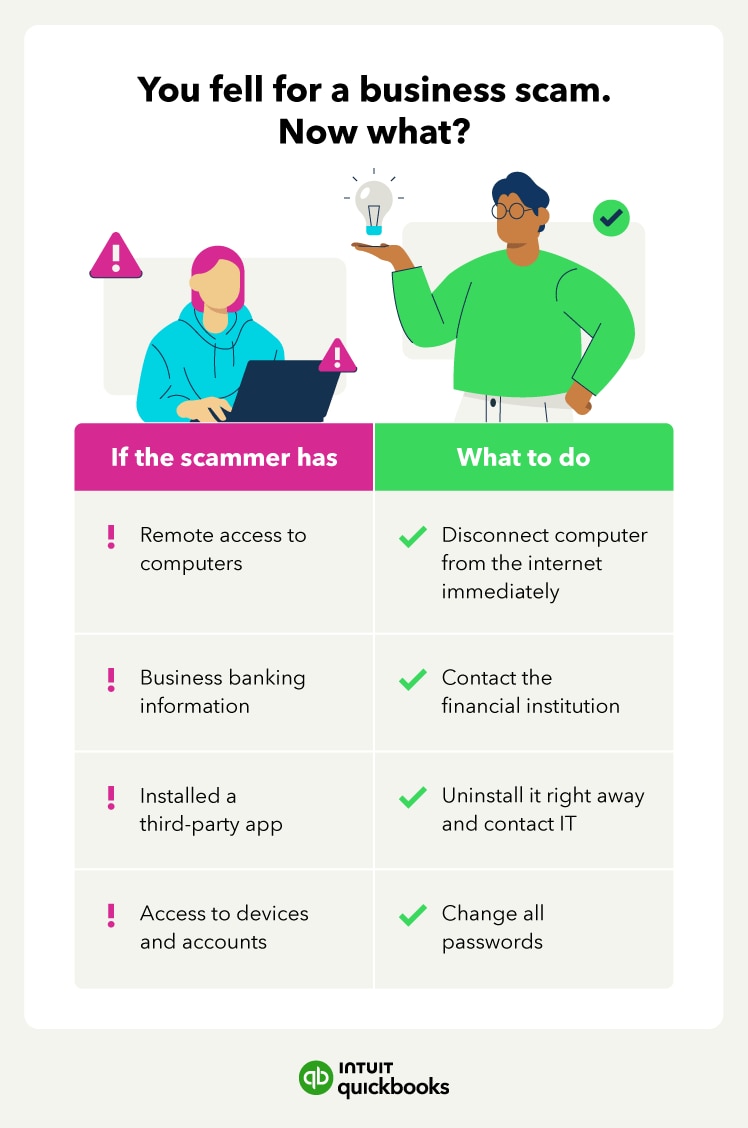

In this article, learn how to protect your business from business fraud and what to do in the case of a security breach.

Jump to:

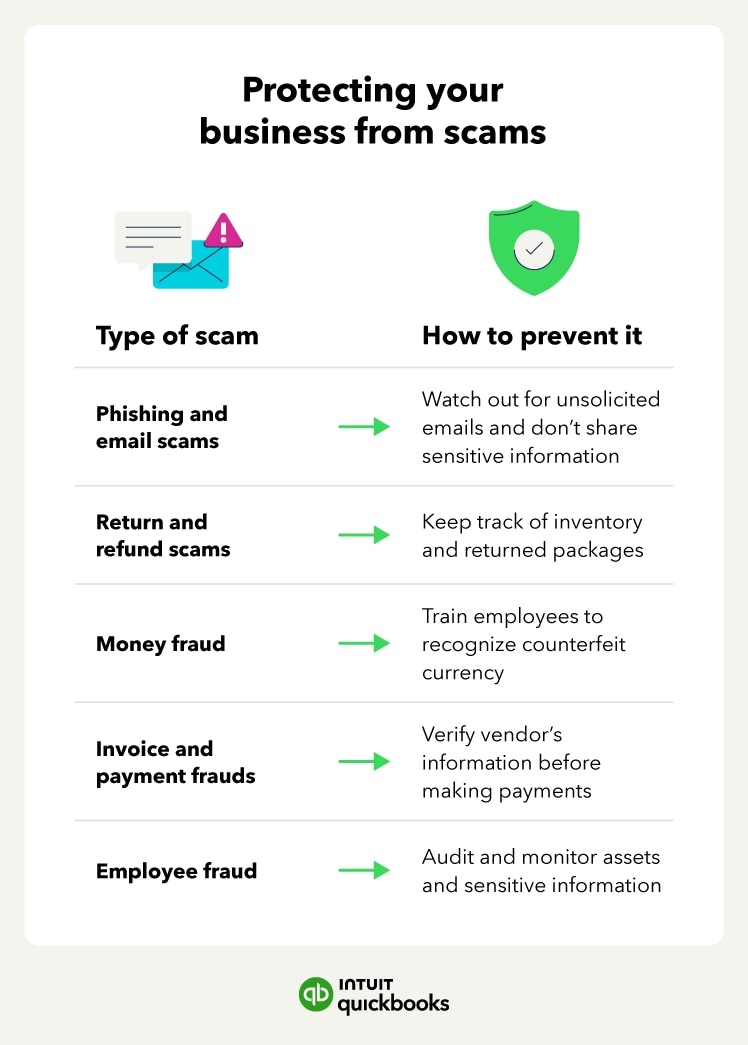

- Phishing and email scams

- Return and refund scams

- Money fraud

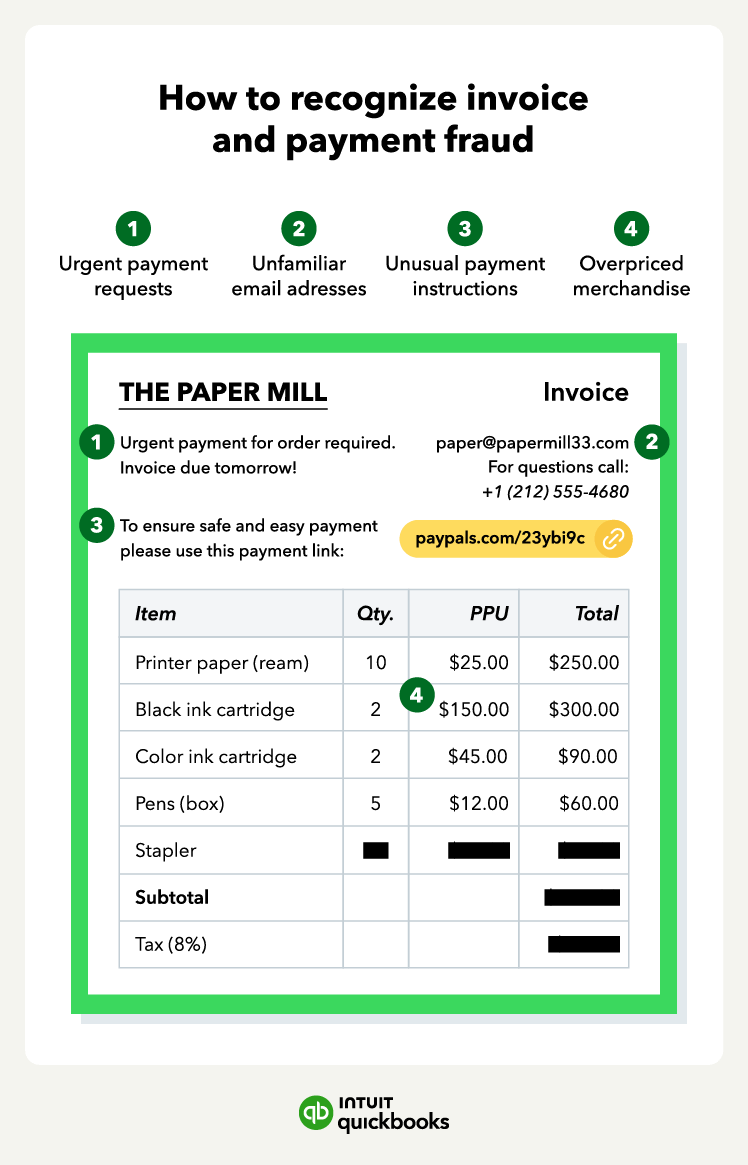

- Invoice and payment fraud

- Employee fraud

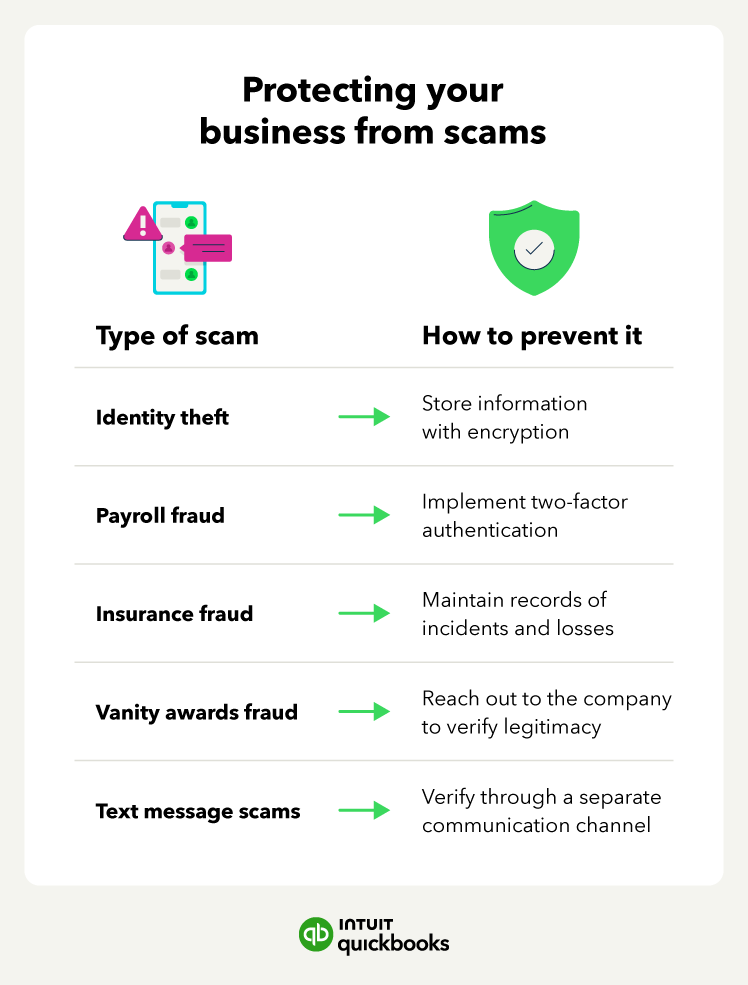

- Identity theft

- Payroll fraud

- Insurance fraud

- Vanity awards scams

- Fake text message scams

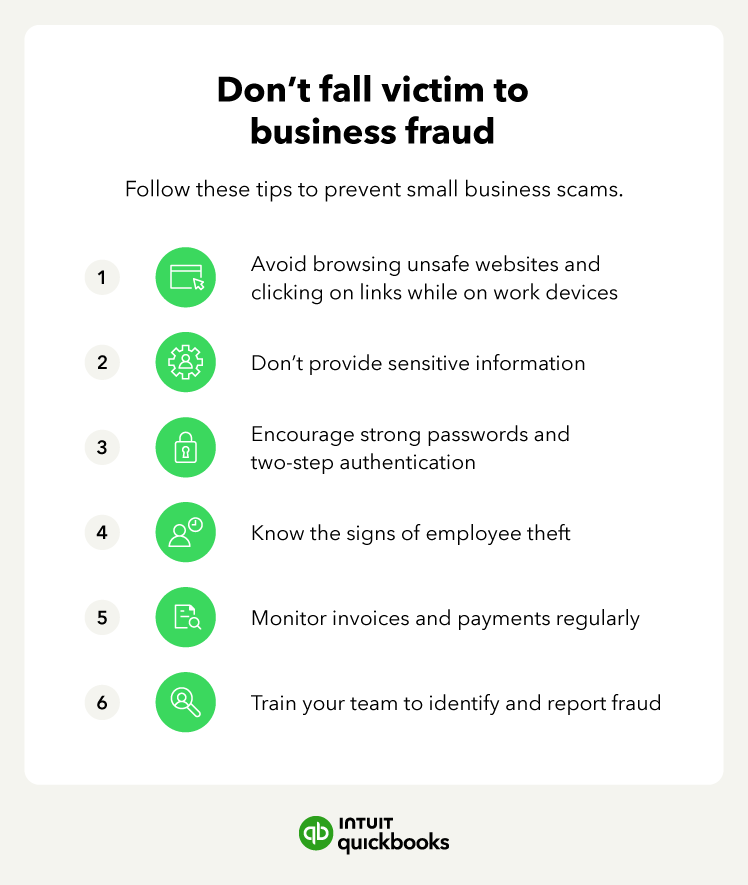

How to prevent small business fraud