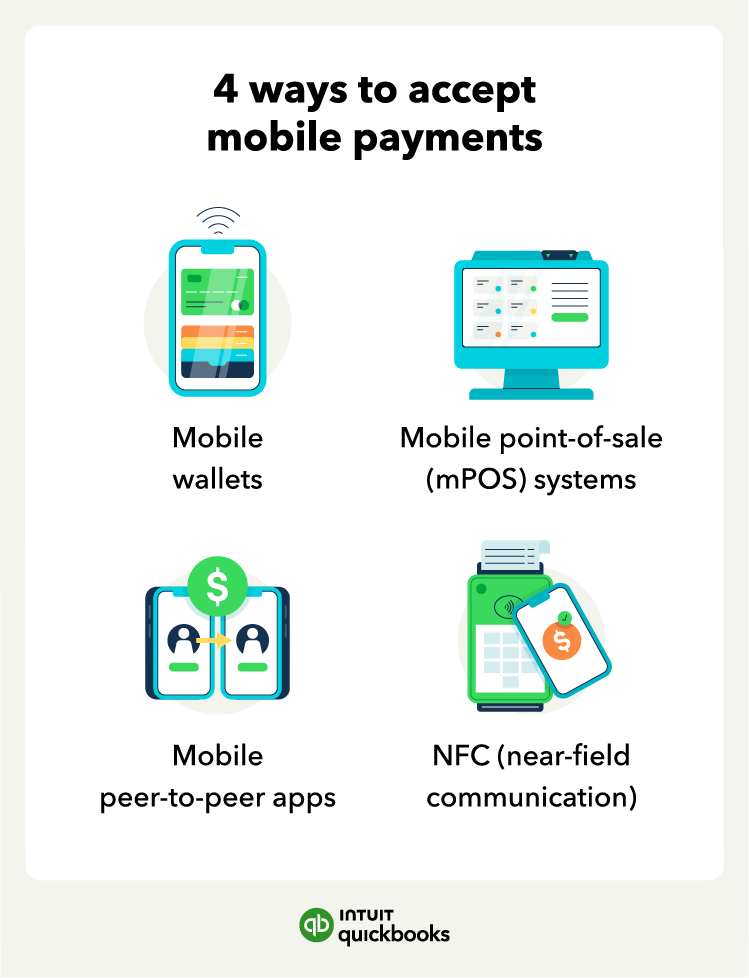

Mobile point-of-sale systems (mPOS)

An mPOS (mobile point-of-sale system) is similar to a traditional point-of-sale system in that it consists of software and portable hardware. You can install the software onto an existing tablet or phone, or it can be a part of a specialized package with proprietary hardware. With an mPOS, a business can accept payments in multiple places.

Several companies offer mPOS setups for a variety of business types. Using the QuickBooks Card Reader and GoPayment app, you can take payments nearly anywhere from customers with credit cards and popular mobile wallets like Apple Pay.

To start accepting payments with a mobile point-of-sale system, you’ll need to find a payment service provider that offers them and then integrate them with your existing systems.

Mobile peer-to-peer apps

Mobile peer-to-peer apps let people transfer money from their connected bank accounts to other users. Some of these apps (PayPal, for example) can be accepted by businesses on e-commerce sites or for in-person services.

Cash App, PayPal, and Venmo are popular examples of mobile peer-to-peer payment apps.

To accept payment via these apps at your business, check to see if they allow for integration into your e-commerce site or if they can be accepted using terminals or mPoS systems.