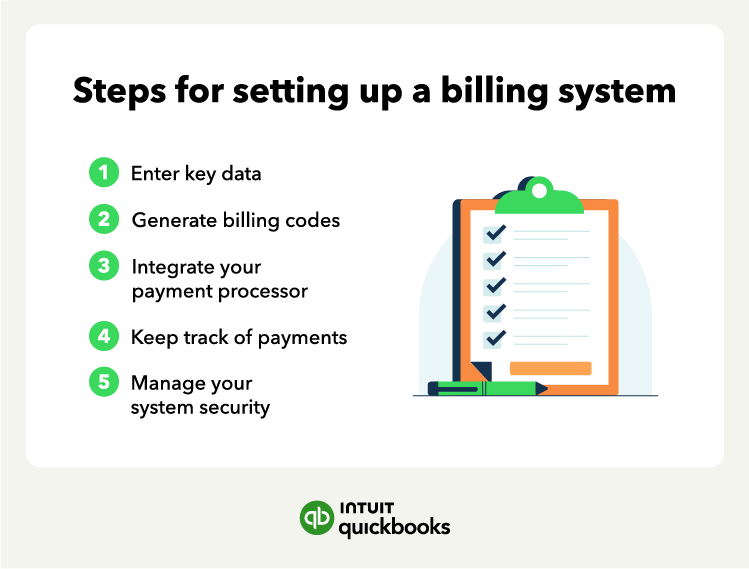

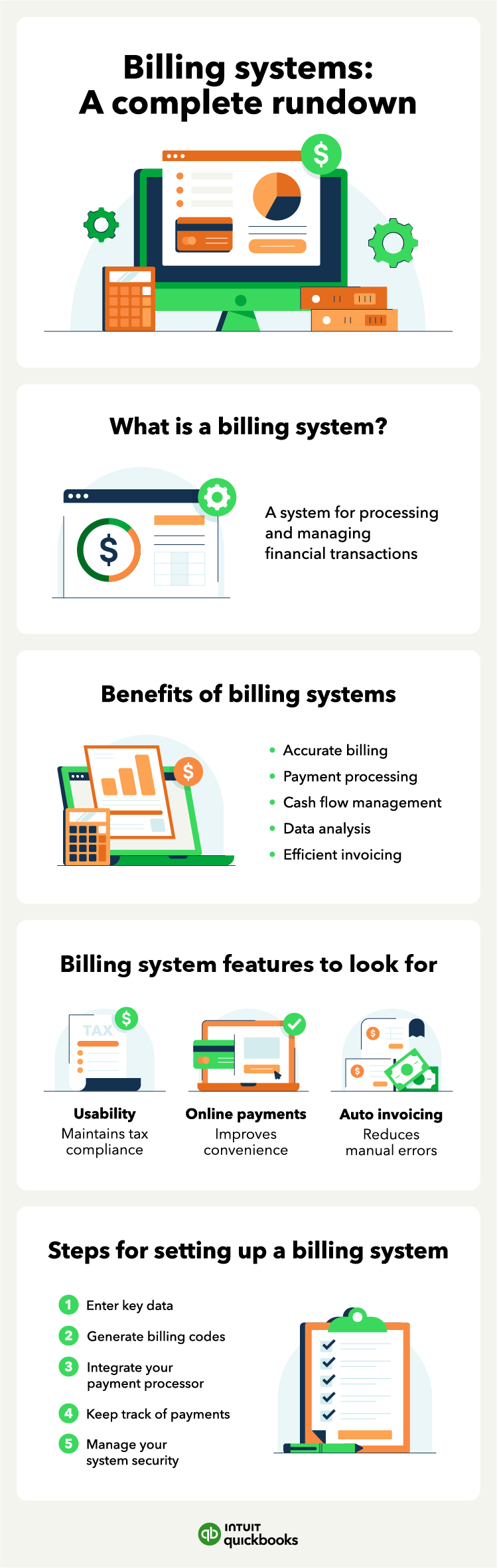

Small business billing systems are relatively easy to set up. Here’s how the process works in five steps:

1. Enter data

When you’re setting up your billing system, you’ll need to enter important details like customer or client names, billing addresses, and terms of payment. Besides customer info, you’ll also want to record and verify information about third-party payers like insurance companies. Smart accounting systems allow you to enter and verify this kind of information.

Other key data you’ll want to enter into your billing system is product and service information. Depending on your business, this might include prices, quantities, descriptions, and discounts. Usability should be a major feature to look for when you’re evaluating different billing solutions. You want a system that’s easy and intuitive to use.

2. Create billing codes

Next, you’ll want to create billing codes to track money and categorize the products or services you offer. Codes will help identify supplies, products, devices, services, or equipment.

You can also leverage billing codes to assess how you spend your resources and time. Recognizing price patterns and resource usage can help when you grow larger.

3. Integrate payment processor

It’s a good idea to accept as many payment methods as possible—and a solid payment processor will do just that. Your customers might pay you in cash, by check, through an online payment system like PayPal or Stripe, or by credit or debit card, which then goes to your business checking account.2

It’s in your best interest to provide customers with flexibility in the payment methods you accept. A good payment process will help you manage and accept business-to-business (B2B) payments to streamline operations with your vendors and suppliers.

4. Track payments

Invoices3 can slip through the cracks—leaving you with late payments. Late payments can also happen because of inaccurate invoicing.

You can configure your billing system to track payments, limit delinquencies, and remind you of approaching due dates. This prompts staff to send payment reminders for customers with an impending due date.

Your billing system should also make it easy to find and follow up with customers with delinquent accounts and set payment terms.

5. Manage security

Billing and invoicing systems often need access to your financial and banking information—information you’ll want to keep safe. So, ensure you’re accessing your billing system on a secure network and only allowing access by authorized users.

If you accept credit card payments, ensure that your billing platform meets payment card industry standards.