Imputed income might not be something you think about every day, but if you offer fringe benefits like housing, gym memberships, or extra life insurance, it’s something you need to track. Why? Because even noncash perks can be taxable under IRS rules.

So, what is imputed income? In short, it’s the value of certain benefits you give employees, which you'll treat like cash compensation for tax purposes. That means it affects payroll taxes, Form W-2 reporting, and your employees’ taxable wages—even if no money changes hands.

In this guide, we’ll explore what counts as imputed income, how to calculate it, which benefits are excluded, and how to stay compliant without creating extra stress for your team.

Jump to:

- What is imputed income?

- How to calculate imputed income as an employer

- Navigating imputed income taxes

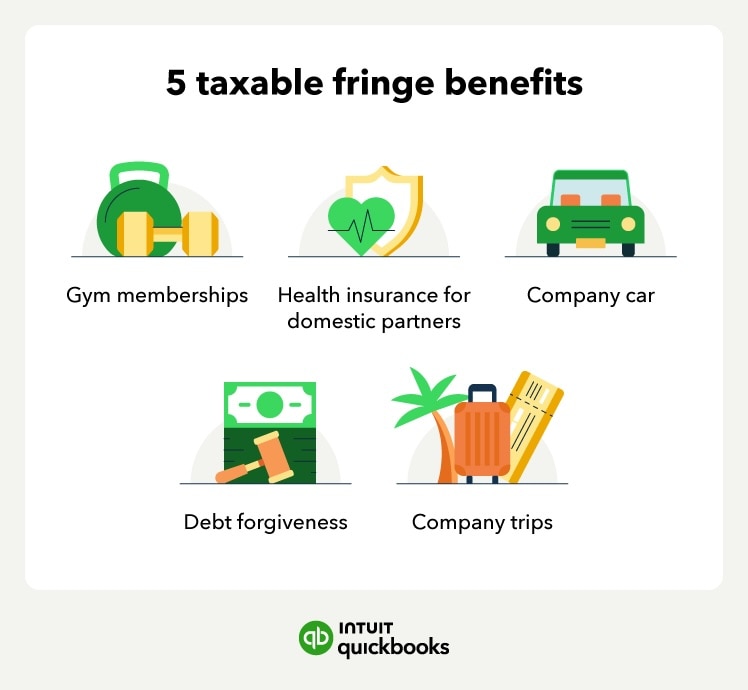

- Imputed income examples (taxable fringe benefits)

- Benefits excluded from imputed income

- Tips for managing imputed income

- How to improve employee satisfaction around imputed income

- Next steps for streamlining your payroll process