No matter how much money you make, financial emergencies can happen. As a small business owner, you might be faced with a situation in which an employee requests a paycheck advance. You might also be asked questions about this process, and if it’s something your payroll team offers. Below are some common practices for providing a payroll advance, and tips for how to make it easy for both you and your employee.

- What is a paycheck advance?

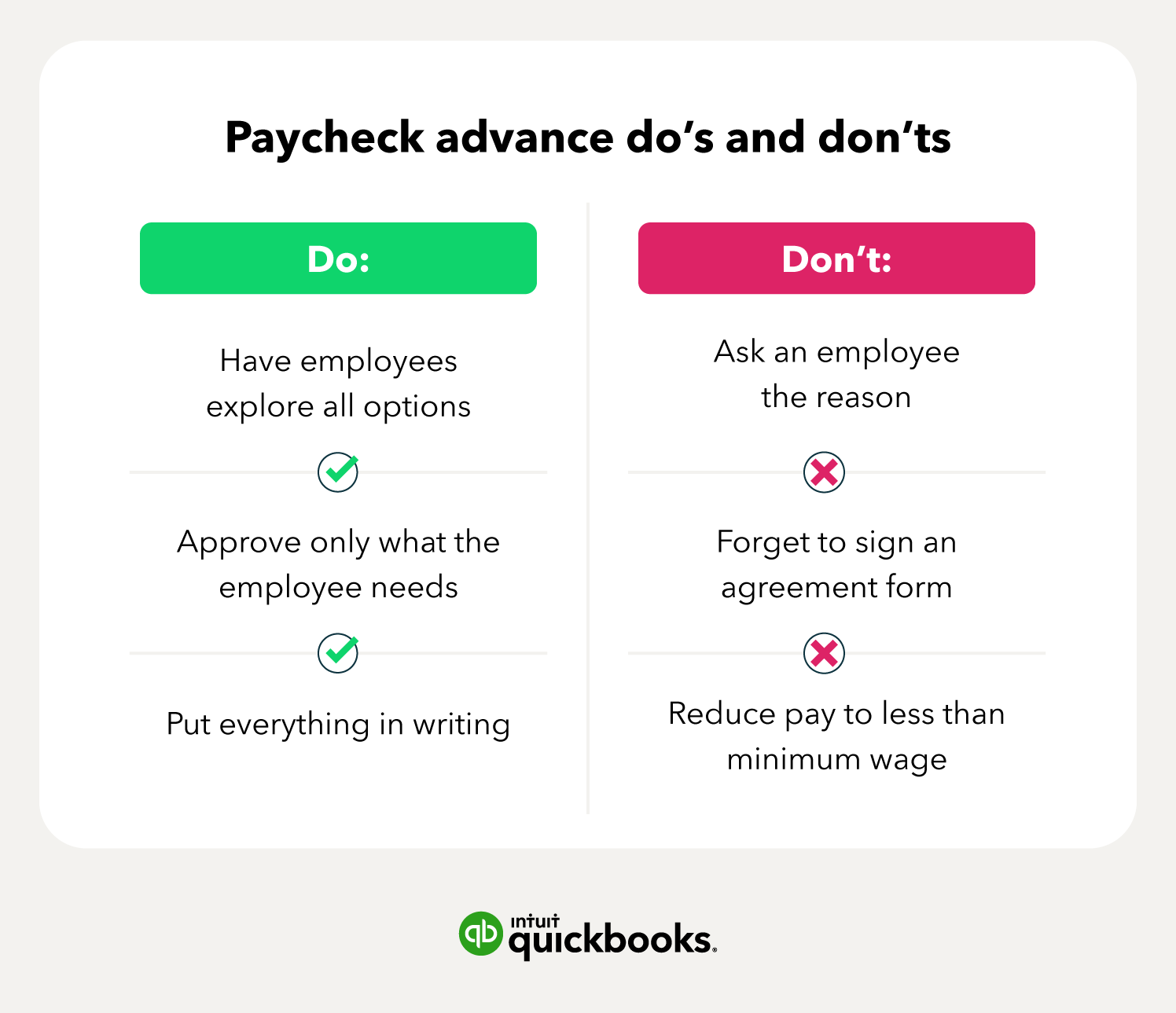

- How to talk to your employees about paycheck advances

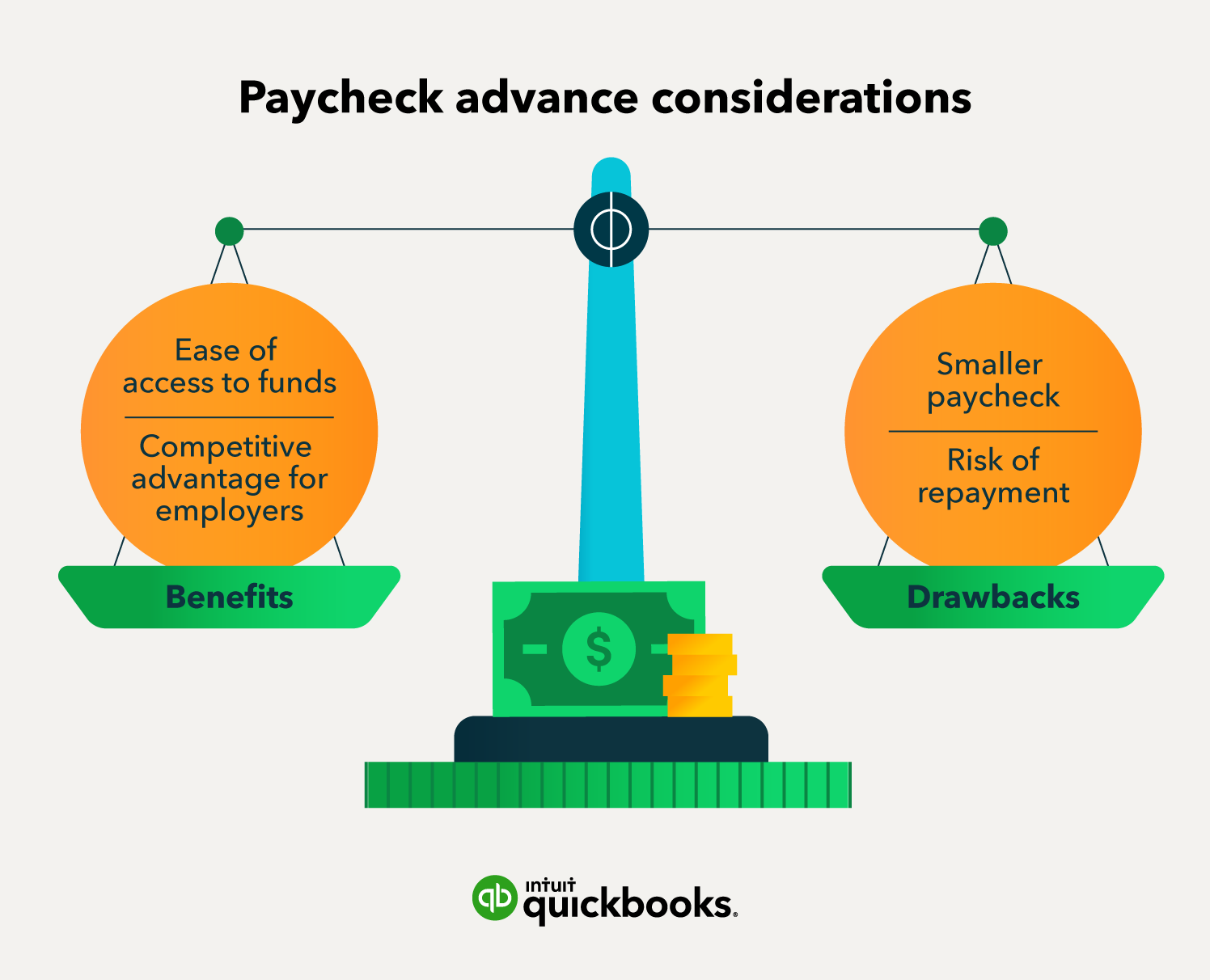

- Benefits and drawbacks

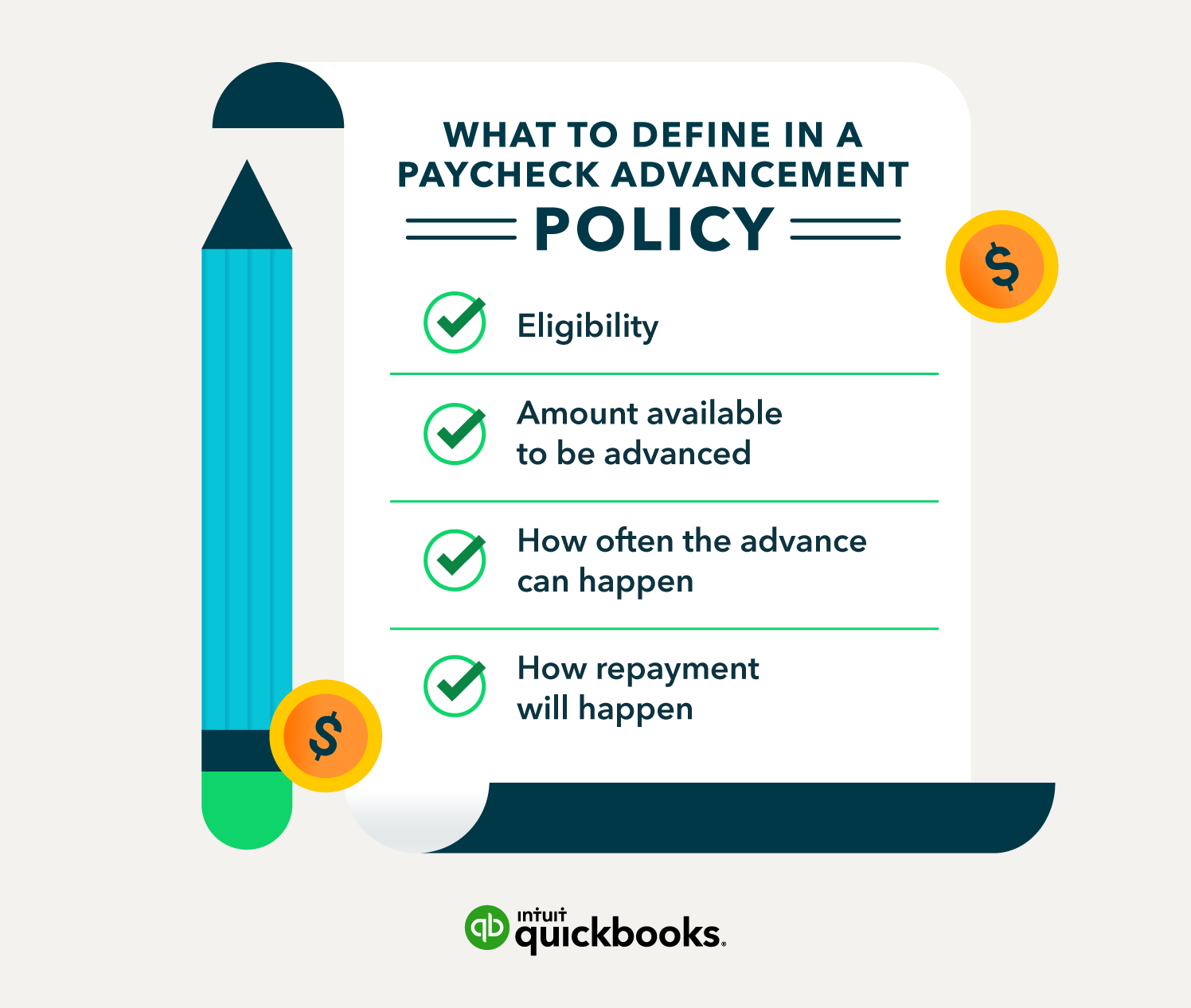

- How to avoid complications

- How to complete a paycheck advance

- For the employee

- For the employer