August is National Back-to-School Month. Because it’s such a busy time for young scholars and their families, we’ve kept this month’s update brief. Take a quick look at what’s new, then make sure to enjoy the rest of your hard-earned summer.

Here's what's new in QuickBooks Online for August 2024

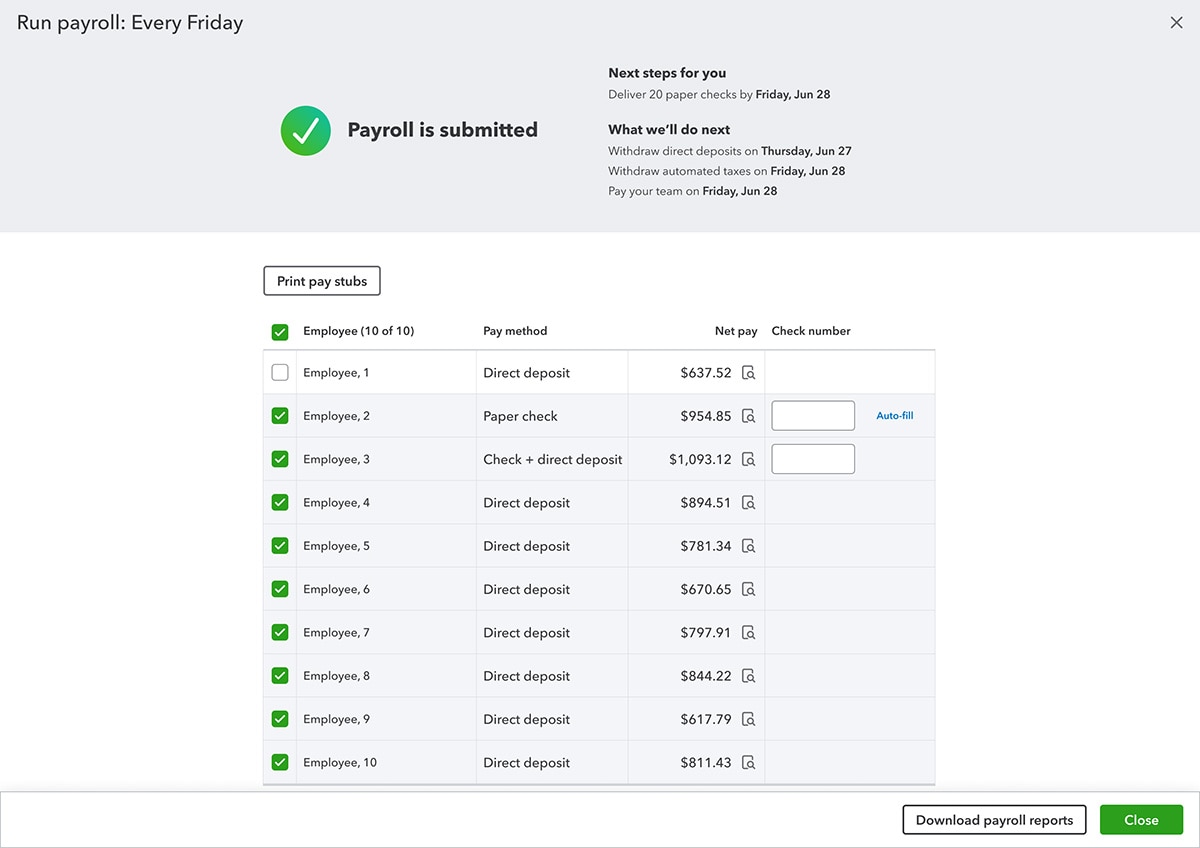

Upcoming changes to automated taxes in QuickBooks Payroll

In a nutshell: If you use QuickBooks Online Payroll, you’ll have your payroll taxes withdrawn when your tax liability increases—like at each payroll run—rather than at tax deadlines.

Instead of processing payroll taxes in large amounts at the end of a tax period, which can be disruptive and catch you off guard, the funds will be debited in smaller amounts and more frequently. Plus, withdrawals made toward your tax liabilities will be reflected in your total tax liability as of each withdrawal date.

In addition, any applicable payroll tax debits will also be withdrawn when you make paycheck corrections or have any other changes to your tax liabilities.

Note: These updates will be rolled out to new QuickBooks Online Payroll subscribers through Sept. 30, 2024. Existing Payroll subscribers will see the updates starting Oct. 2024.