Visual workflows builder and multi-conditional approvals in QuickBooks Online Advanced

In a nutshell: Workflows in QuickBooks Online Advanced are now more flexible and customizable ways.

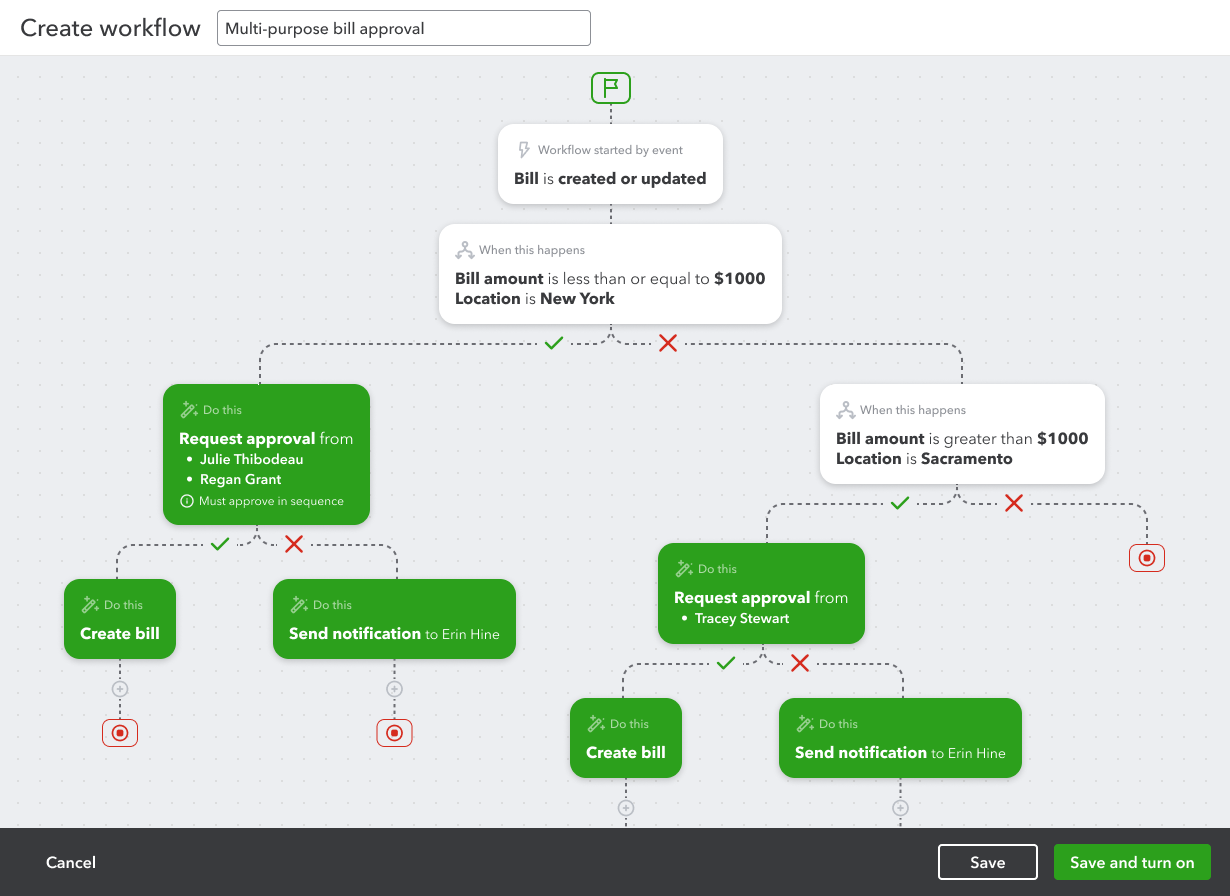

Previously, you could only use one condition when creating an invoice-approval workflow. Now, you can more easily reflect different real-life scenarios by including multiple conditions in an invoice approval workflow. For example, your workflow can send invoices of more than $5,000 to person A for approval and invoices of less than $5,000 to person B for approval. This new level of customization allows businesses to operate within their company procedures while reducing repetitive tasks and the chance for error.

In addition, you’ll have a better view of workflows in QuickBooks Online Advanced with a visual workflow builder. You’ll see a visual representation of the workflow as you create it, which is especially helpful when including more conditions.

NOTE: Once a QuickBooks Online Advanced subscriber begins using the visual workflow builder, they will not be able to revert to the old interface.