Happy New Year! We wish you a prosperous year ahead. January is National Mentoring Month, so this might be a good time to check in with the young talent at your business to learn what goals they’re working toward. To help retain talent, you can pair each new hire with a mentor for consistent communication and feedback. And, be sure to check out the latest updates below.

Here's what's new in QuickBooks Online for January 2025

Table of contents

Table of contents

Discontinuing tags and switching to custom fields in QuickBooks Online

In a nutshell: In QuickBooks Online, you will no longer be able to create tags as of March 8, 2025.

If you’re currently using tags, here are a few facts to keep in mind:

- From February 5, 2025 - March 7, 2025, you can migrate your tags to a custom field.

- From March 8, 2025 - April 30, 2025, you’ll have read-only access to your tags. Be sure to download reports for your tagged transactions to keep in your records.

- As of May 1, 2025, tags will be removed from QuickBooks Online, and you’ll no longer be able to run reports for tagged transactions.

In QuickBooks, custom fields are a versatile alternative to tags. With custom fields, you can capture data that’s important to your business and get actionable insights by running reports on these new data points. For example, you could create a “Sales rep” field to appear on all sales forms and later generate reports on sales per rep.

Note: Custom field availability varies by QuickBooks Online plan. As you can see from the table below, we’ve added a custom field to most plans. This change is being rolled out to all customers, regardless of their use of tags. Custom fields will support both sales and expense forms.

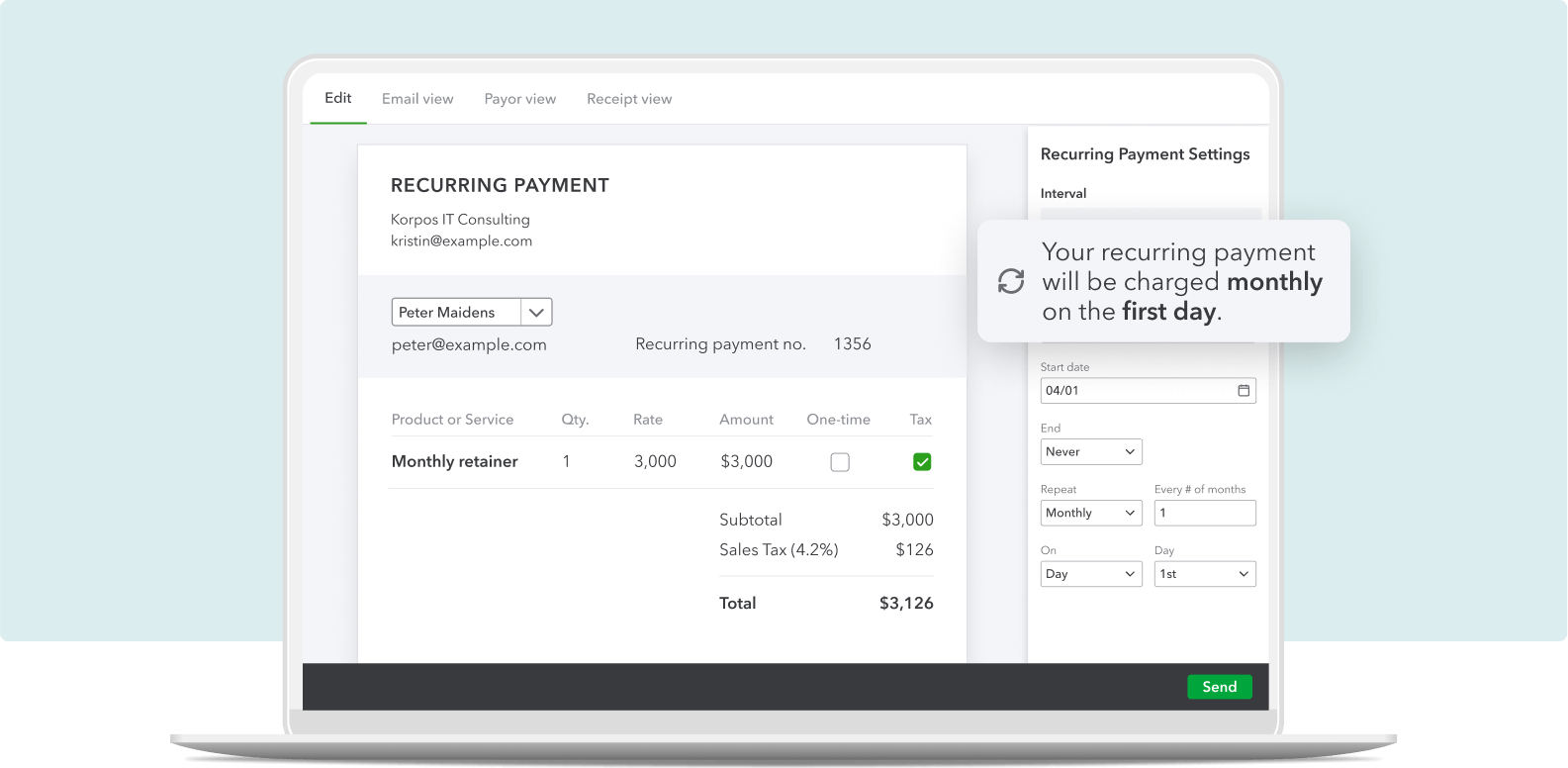

Get paid automatically with recurring payments

In a nutshell: By scheduling recurring payments in QuickBooks Online Payments, you can automatically charge your customers, eliminating the need to keep up with payment on recurring invoices.

Rather than having to pester customers for payments or suffer a cash flow crunch, you can choose to schedule recurring payments to manage ongoing charges. This helps ensure continuous cash flow and minimizes disruptions and manual work.

When you set up recurring payments for a customer, QuickBooks will email them a link to accept the terms and enter their payment info. You will not need to maintain card on file records, since QuickBooks Online securely stores your customer’s info for future payments.

QuickBooks then charges your customer automatically on schedule, so you get paid on time, every time. Your books will update automatically with each recurring payment, saving up to 60% of the time you’d otherwise spend matching transactions year-round.**

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

**Saves up to 60% of matching time: Calculation based on a comparison of total monthly QuickBooks Payments transactions with those that were automatically categorized from January 2024 through March 2024.