If you’re dreading your tax bill this season, the small business deductions you choose to claim can make all the difference in how much you’ll owe (or save). As we head into tax season 2025, all taxpayers must decide whether to take the standard deduction or itemize personal or “individual” expenses to reduce their taxable income.

When you’re self-employed or a small business owner, sometimes the line between personal and business expenses can get blurry. Depending on your situation, itemizing your deductions may be the best choice to maximize your savings.

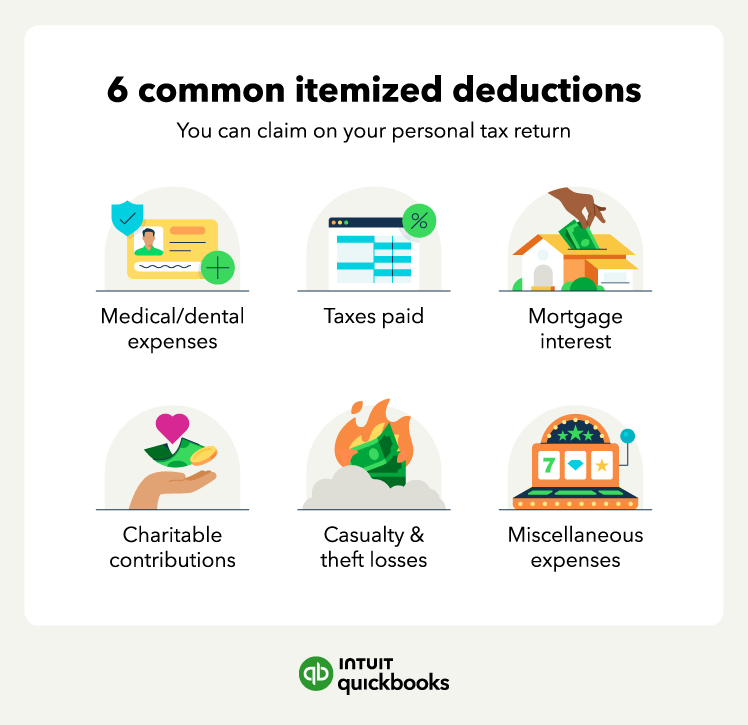

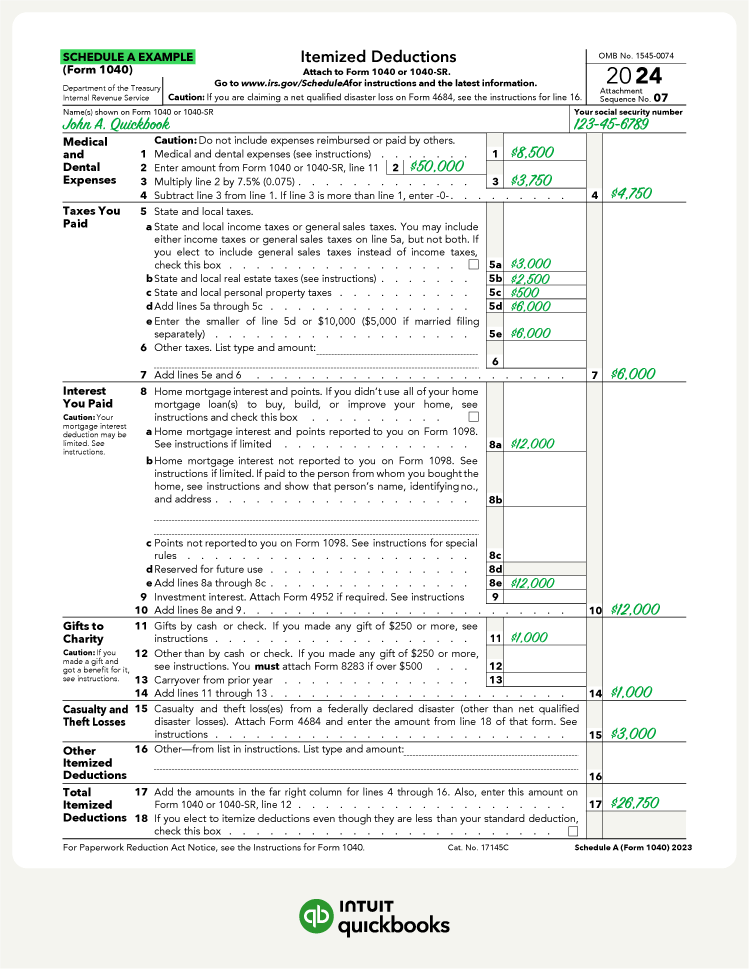

In this article, we’ll cover everything you need to know about itemized deductions for the 2025 tax year, including the most common ones and the forms you’ll need to file.

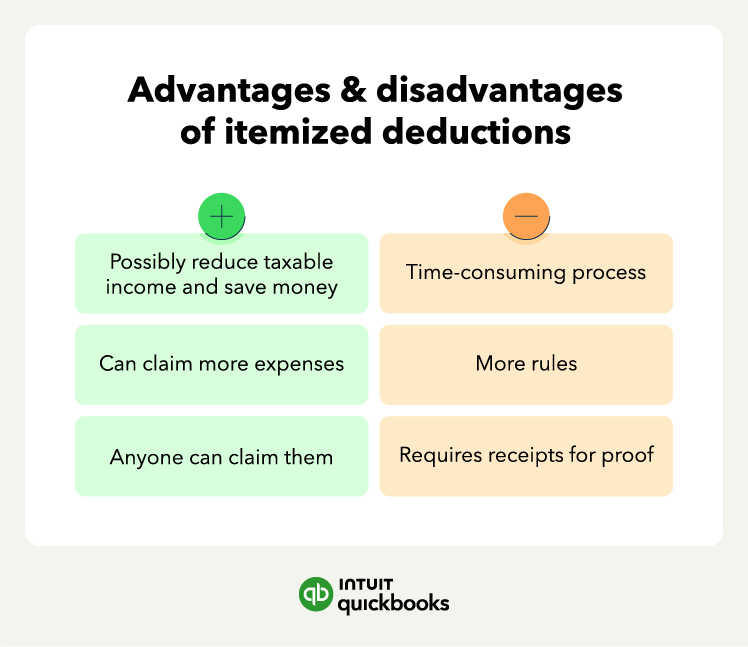

Itemize deductions only if they exceed the standard deduction—though it takes more effort, the payoff could mean a bigger refund or smaller tax bill.

Itemize deductions only if they exceed the standard deduction—though it takes more effort, the payoff could mean a bigger refund or smaller tax bill.