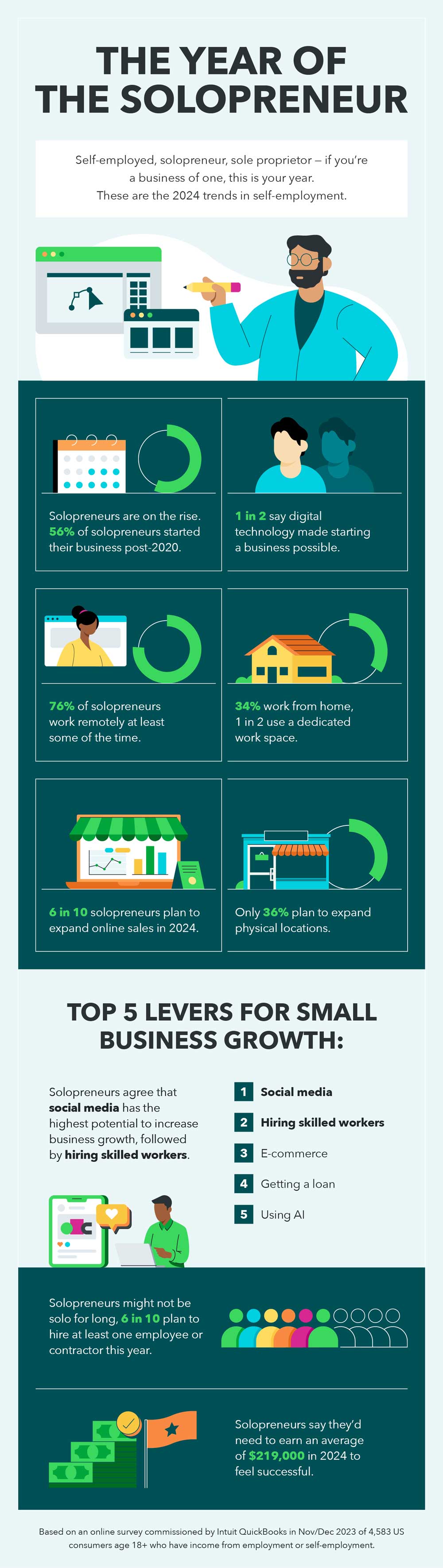

Solopreneurs (you might know them as self-employed, sole-proprietors, or businesses of one) are on the rise. Data insights from the Intuit QuickBooks Small Business Index Annual Report reveal that a growing share of US businesses have no employees — increasing from 76% in 1997 to 84% in 2020. And data from a recent survey commissioned by Intuit QuickBooks suggests this number could be even higher in 2024. More than half (56%) of solopreneurs surveyed say they launched their businesses within the last four years, post-2020. These business owners cite the pandemic and rising costs as their main motivations for starting a business — but say technology made it possible.

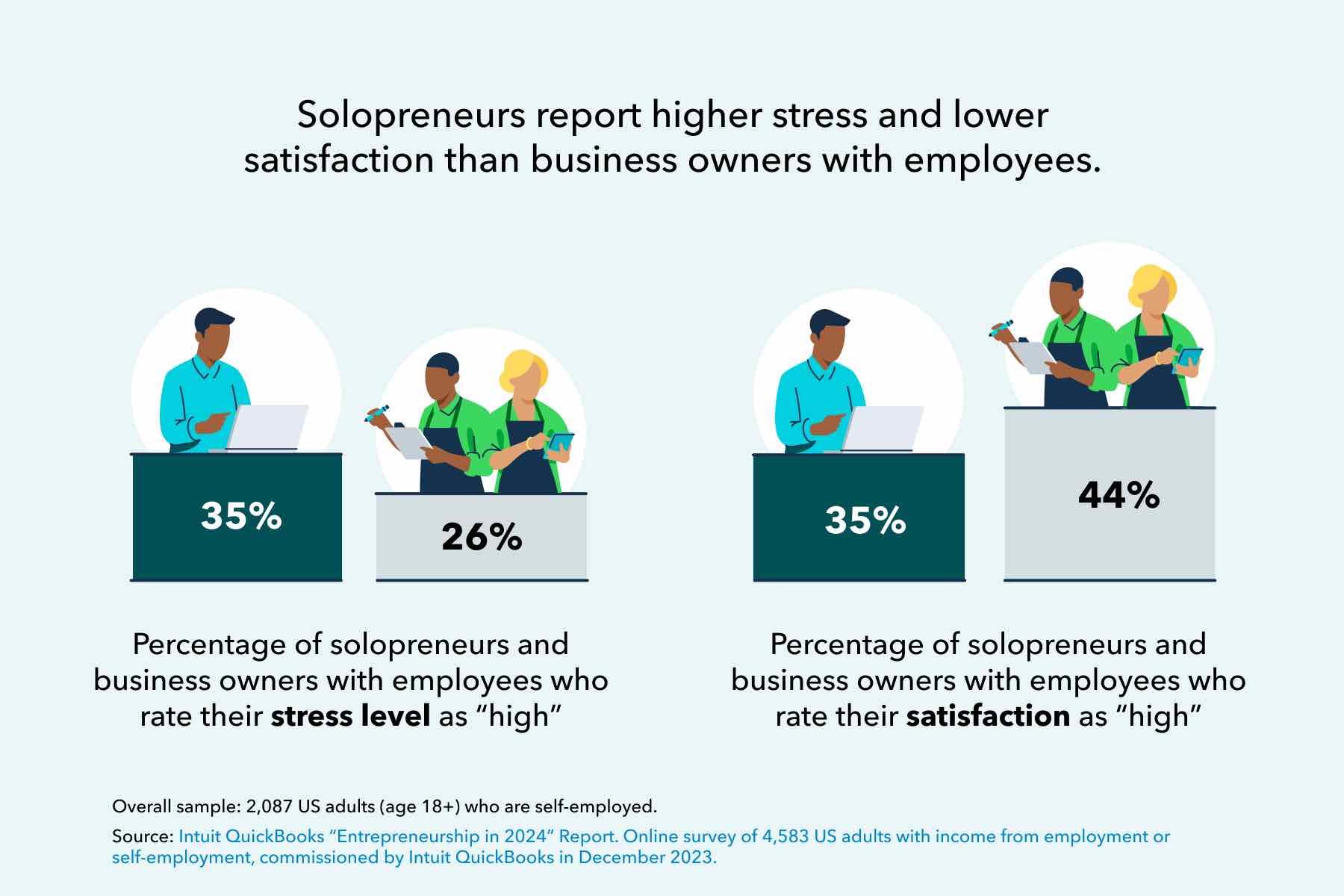

While solopreneurs typically enjoy the flexibility that comes with being their own boss (and only employee), self-employment comes with its own set of challenges. These business owners struggle with getting funding, maintaining cash flow, and the stress of wearing every hat needed to run a business. For some, the solution just might be taking the solo out of solopreneur. Nearly 6 in 10 solopreneurs say they plan to hire help this year in the form of employees, freelancers, or contractors.

To learn more about this ever-increasing cohort of small business owners, we analyzed data from the 2,087 solopreneurs (including self-employed business owners, freelancers, and contractors) in the US who responded to the Entrepreneurship in 2024 survey commissioned by Intuit QuickBooks in December 2023. Let’s take a deeper look at emerging trends for solopreneurs in 2024 to find out why they chose to go solo and if they plan to stay that way.

Key findings

Use these links to jump ahead.

- 56% of solopreneurs surveyed started their business post-2020 — inflation was the biggest motivator

- 52% of solopreneurs chose self-employment because they want to be their own boss — but some still rely on a day job

- Solopreneurs work fewer hours and take more time off than business owners with employees, but report higher levels of stress

- Solo no more: 6 in 10 solopreneurs plan to hire help in 2024

- Solopreneurs need to earn an average of $219,000 in 2024 to feel successful

- Solopreneurs turn to credit cards for fast funding — 55% say credit card payments could hinder building wealth

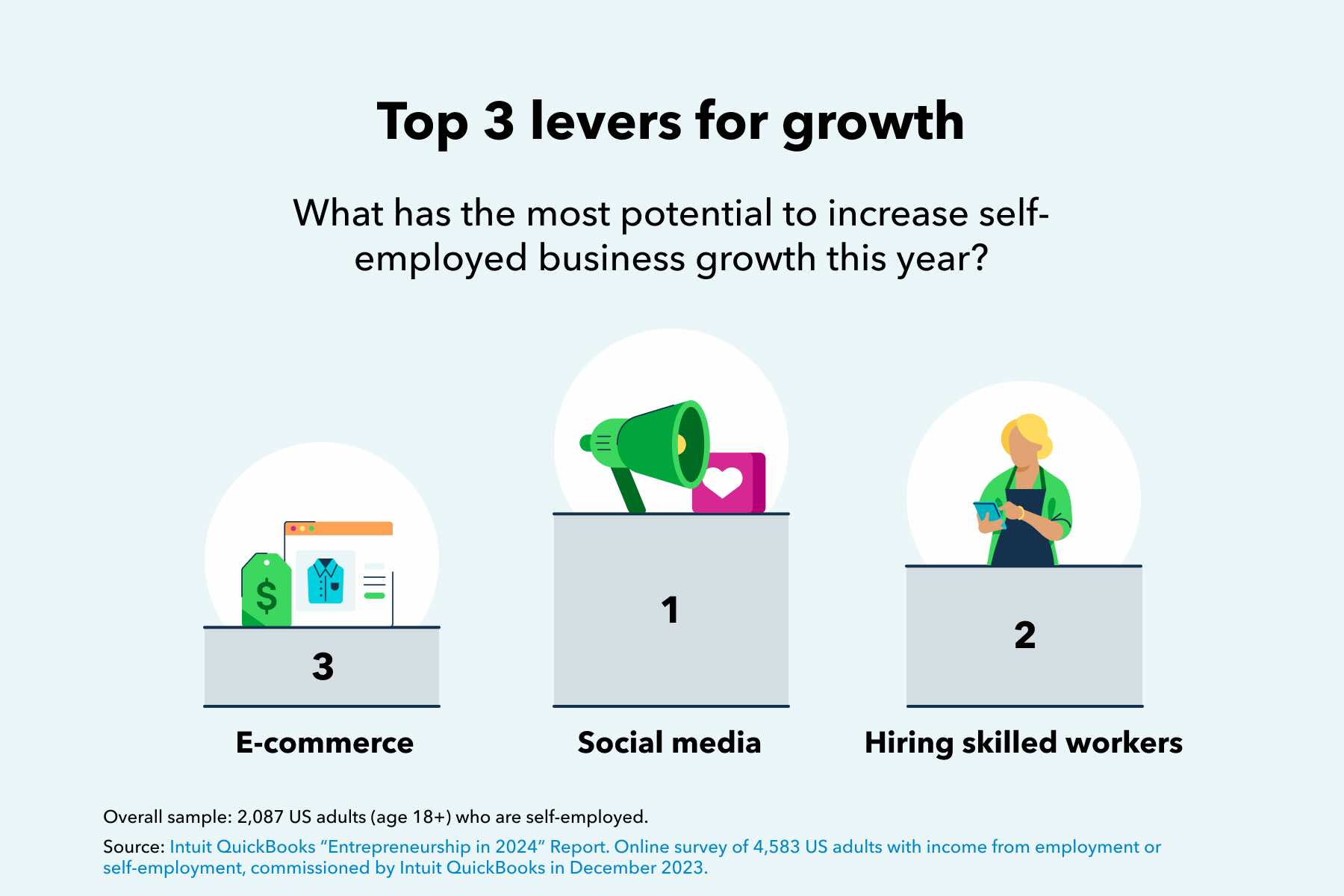

- Digital tools like social media and e-commerce are the keys to growth in 2024

- Short-term growth leads to long-term stability — 47% of solopreneurs say flexibility and a steady income is the long-term goal