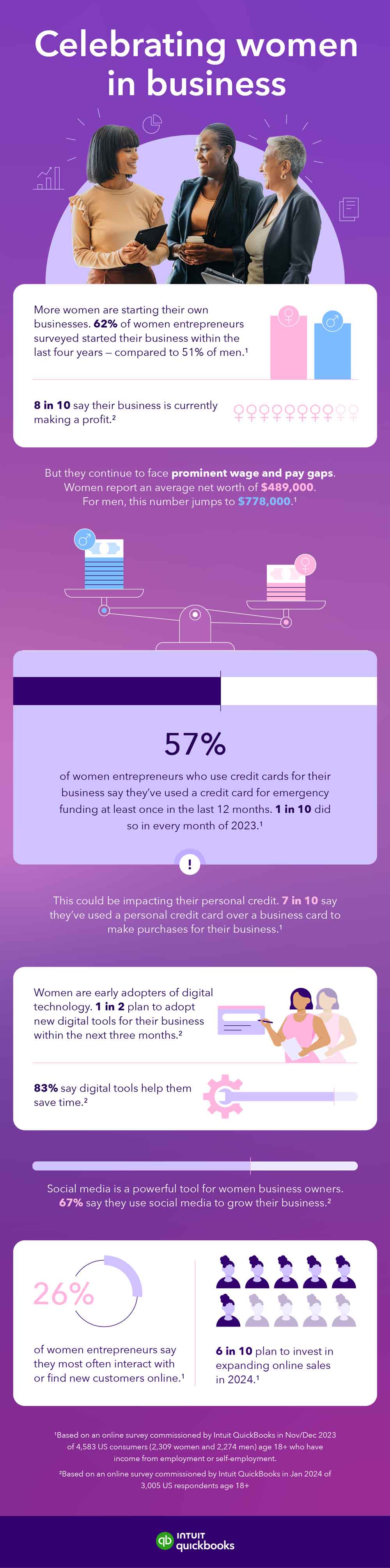

Nearly 4 in 10 US businesses are women-owned, accounting for over 14 million businesses — that’s more than a 13% increase from 2019. Rather than hindering women-owned business growth, the pandemic seems to have bolstered it. According to recent QuickBooks data, more than 6 in 10 women business owners started their business within the last four years, compared to 5 in 10 men. Many of these women cite the pandemic as their top motivation. When the going gets tough, women get going. And when the economy started running out of steam, women stepped in to fuel it.

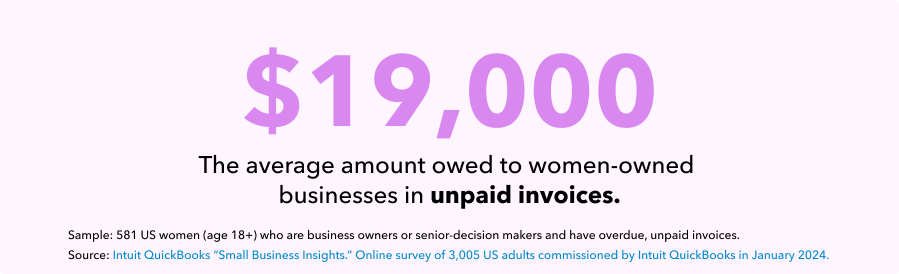

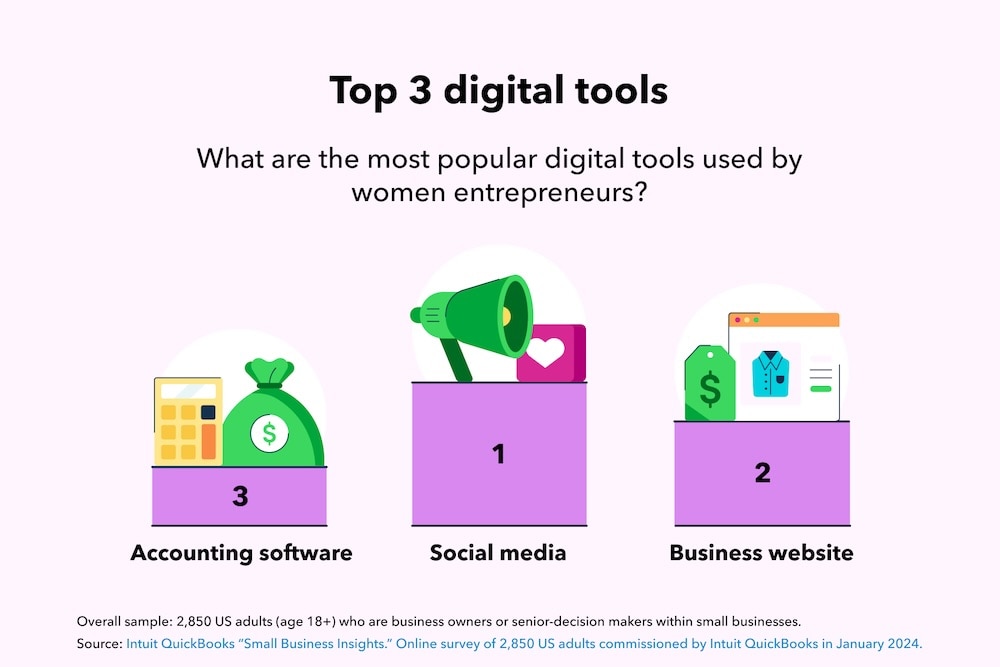

These women are running one or multiple businesses while juggling family and social responsibilities, financial burdens, and the added weight that comes with being a woman in charge. Research shows they’re facing age-old gender biases and barriers to things like funding and capital. Women still make and get paid less than their male counterparts — but in many ways, they’re doing more. They’re opening more businesses, adopting more digital tools, and putting more of their own money into their firms.

This Women’s History Month, we explore what motivates women business owners, the unique challenges they face, and how digital tools may be the key to women’s success in 2024 and beyond.