1. It shelters pass-through income

The Section 199A deduction covers pass-through entities (as well as sole proprietorships). Pass-through entities may file a business tax return, but tax is not assessed on the entity. Instead, business profits and losses are taxed on the personal tax returns of the owners or partners.

The Section 199A deduction applies to qualified business income, not all pass-through income. Most commonly, this includes income from:

- Sole proprietors, who file Schedule C

- Real estate investors, who file Schedule E

- Farmers and ranches, who file, Schedule F

- Business and rental income from a partnership, S corporation, trust, or estate

However, the government may issue guidance around which activities qualify and which don’t.

The QBI deduction also applies to additional qualified items of income, such as real estate investment trust dividends, qualified agricultural and horticultural cooperative dividends, and publicly traded partnership income.

2. You can get up to a 20% deduction

The actual Section 199A deduction equals 20% of qualified business income, and you may need to adjust the total. For example, if your business has $100,000 of qualified business income, you may get a $20,000 deduction.

The actual calculations get complicated when factoring in PTP income and REIT dividends. But, the total will still come out to roughly 20% of income, no higher, but it may be lower depending on your numbers. It’s simply a matter of where that full 20% comes from: your total QBI or a mixture of other income types.

3. There are taxable income limits

The deduction formula includes several limits. The most important one says that the Section 199A deduction can’t exceed 20% of taxable income taxed at ordinary income rates.

For example, if your taxable income equals $100,000, including $20,000 of capital gains and no capital losses, the Section 199A deduction can’t exceed 20% of the $80,000 ($100,000 taxable income less $20,000 capital gains).

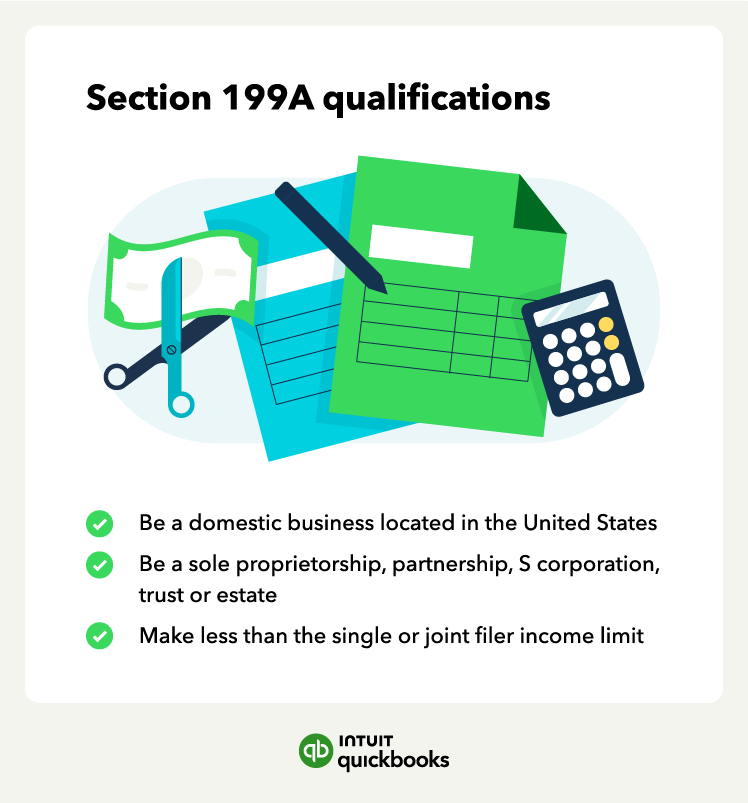

4. Section 199A deduction covers domestic business income

Section 199A only covers domestic income. If you operate your business outside the United States, you don’t get to use the deduction to reduce your taxable income. The Section 199A deduction only applies to domestic income generated in the United States. Foreign income that’s not taxed will not count in the deduction.

5. High-income taxpayers need W-2 wages and depreciable assets

According to the IRS provision for Section 199A, for eligible taxpayers with total taxable income in 2024 over $241,950 ($483,900 for married filing joint returns), the deduction for QBI may be limited by W-2 wages.

This part of the deduction formula gets complicated. Above these thresholds, the Section 199A deduction can’t exceed the greater of either 50% of the business’s W-2 wages or the sum of 25% of the W-2 wages concerning the qualified trade or business, plus 2.5% of the unadjusted basis immediately after acquisition of all qualified property.

6. There are phase-out zones for upper-income taxpayers

If your business is a specified service trade or business (SSTB), and your income falls in the phase-out zone, you may get a partial deduction. For single taxpayers, the phase-out zones range from $191,951 to $241,950, and for married taxpayers, it ranges from $383,900 to $484,900.

Beneath the phase-out range, you get the deduction even without wages or depreciable property or from a SSTB. If you’re not in the phase-out range, the rules of the section above don’t apply, and you can get the deduction as stated.

7. Section 199A deduction has a safe harbor for rent

An initial concern when Section 199A first took effect was whether or not rental properties would be counted as QBI. It’s official: Any kind of rental real estate income from a tangible property will be covered as business income. These amounts will still be subject to the same threshold as those listed before for single and joint filers.

8. QBI loss is carried over

Whether you have one business or several, your QBI is your total income. If you have multiple businesses and one does really poorly, it’s weighed against your other businesses. This makes it possible to have a negative QBI, in which case you have to carry the loss over into the following year.

For example, if you have one business where your QBI was $25,000 and another where it was a $30,000 loss, your overall QBI is technically a $5,000 loss. This will then be carried into the following year, where your total QBI will have to overcome the -$5,000 loss to get into the positive.

This can reduce your deduction for the current tax year and the following one.

QBI is normally calculated at an individual entity/activity level. But there are cases where the taxpayer could be subject to the wage and property limitation on two separate entities that can be combined to meet certain QBI thresholds to allow for the QBI deduction.

9. Specified service trades or businesses are complicated

If a business qualifies as an SSTB, it can't take advantage of the Section 199A deduction. But if a business only earns some income through SSTB activities, like consulting, it may still qualify for the deduction.

If its income is below the threshold, they can still get the deduction. If the income is within the phase-in range (at or below the earned income cap), they may still qualify, depending on how their taxable income compares to their SSTB earnings.

If your business does some SSTB business, you’ll want to keep the gross receipts to determine what percentage of your business falls within SSTB territory. You could still qualify for the deduction if your total SSTB-related income is less than 10% of your gross revenue.