Physical nexus

A physical nexus is one where you have a physical connection with the state. This can be things like:

However, it is important to note that physical nexus is not only based on business property. It can also pertain to sales activities via traveling personnel or even trade show attendance.

Economic nexus

You have economic nexus in a state if you meet a threshold, such as revenue or transactions. You can have economic nexus regardless of physical presence because it applies to both in-person and online sales.

To establish economic nexus, there must be sufficient business activity to warrant taxation. The economic nexus threshold can be either:

- The total dollar amount you sell

- Total number of transactions

In some states, you need to meet both thresholds to trigger economic nexus. If you’re using accounting software, it should automatically calculate your sales tax and help you determine whether you have sales tax nexus.

Affiliate nexus

Affiliate nexus is all about relationships. It's the connection created when you work with another business or individual in a different state to promote your products or services. This "affiliate" acts as a sort of brand ambassador or partner, and their efforts to drive sales in their state can create a sales tax obligation for your business.

Even though you don't have a physical presence in that state, your affiliate's activities essentially extend your reach there. They're like a virtual salesperson or representative, and their success in generating sales can trigger nexus for you.

The key factor is the agreement you have with the affiliate. This agreement usually involves some form of compensation for the affiliate, such as commissions or a flat fee, based on the sales they generate. This incentivizes them to promote your business in their state, which in turn can create nexus for you.

Click-through nexus

Click-through nexus focuses on online advertising and referrals. It's the connection formed when you pay someone in another state to place links to your website on their online platform. These links act as a bridge, bringing customers from that state to your online store.

You're essentially renting space on someone else's online property (a website, blog, etc.) to advertise your business. When people in that state click on those links and make purchases, it establishes a significant enough connection for you to be required to collect sales tax there.

The crucial element here is the payment you make to the other party for placing those links. This payment can be in the form of a flat fee, a pay-per-click arrangement, or some other form of compensation. This incentivizes them to drive traffic to your site, which can then lead to click-through nexus.

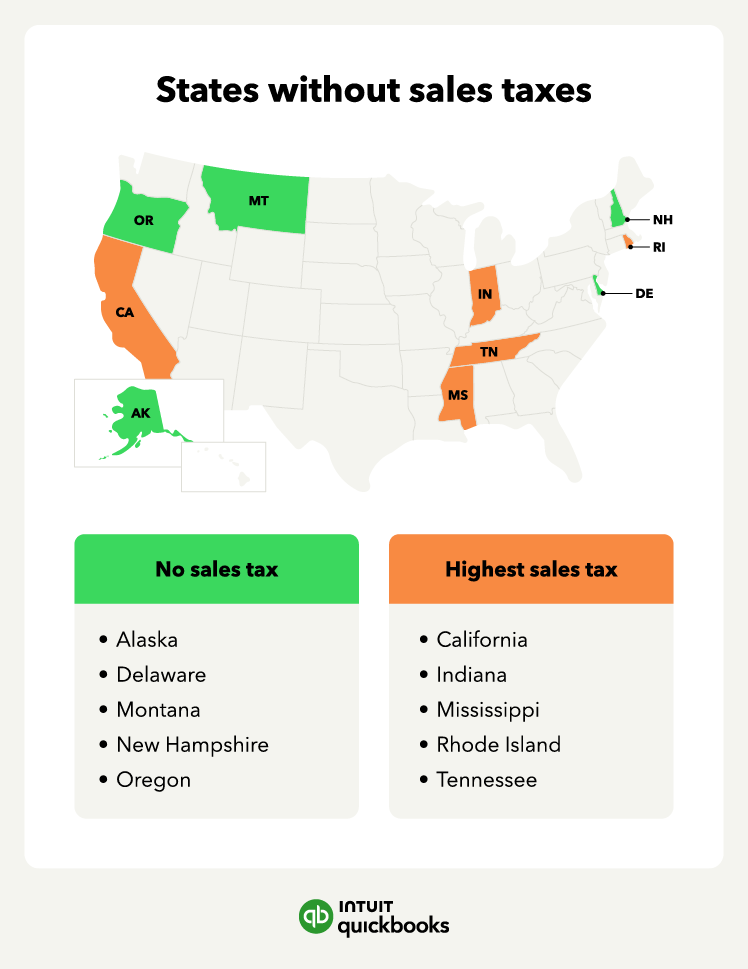

The deadline for filing sales tax returns and making payments varies by state. Some states require monthly filings, while others may allow quarterly or annual filings.

The deadline for filing sales tax returns and making payments varies by state. Some states require monthly filings, while others may allow quarterly or annual filings.

Be mindful of local sales tax rates, which you will add to your state sales tax rate to get your combined sales tax rate.

Be mindful of local sales tax rates, which you will add to your state sales tax rate to get your combined sales tax rate.