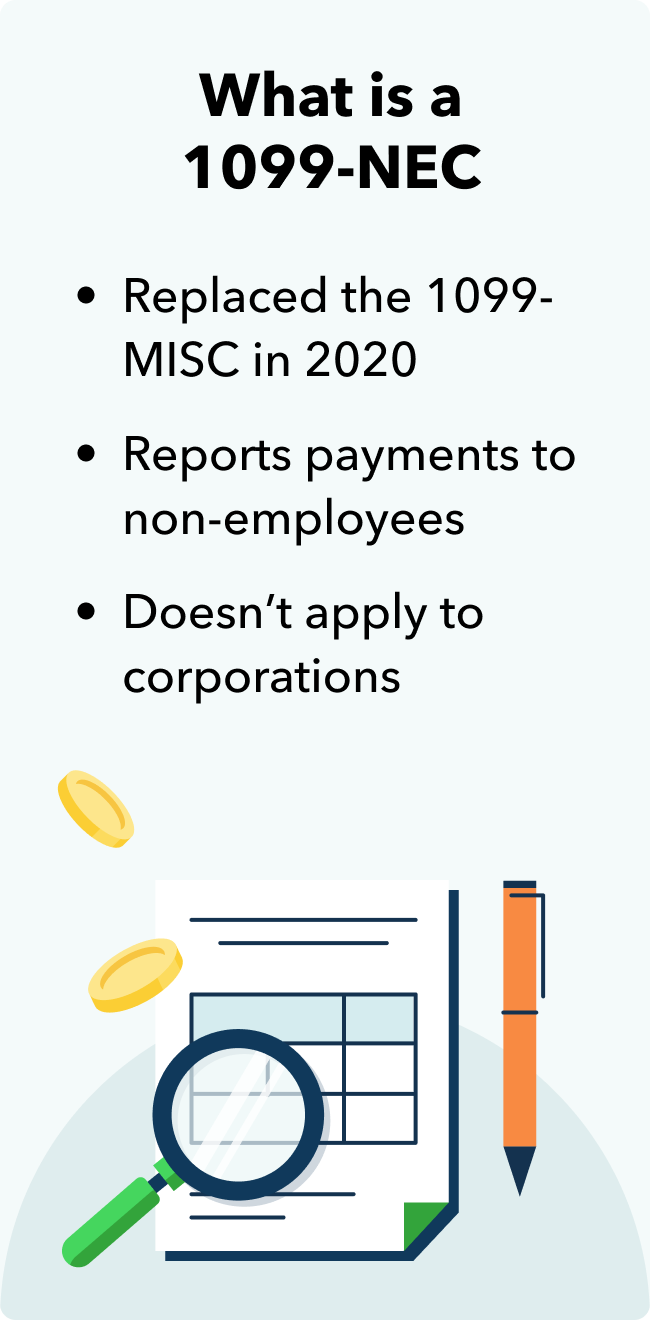

Tax season can be a bit more complex for freelancers and small businesses that hire independent contractors. Instead of the familiar W-2 forms, you'll be dealing with 1099 forms. More specifically, the 1099-NEC. This form is essential for reporting payments you’ve made to nonemployees—getting it right is crucial.

This guide will cover everything you need to know about the 1099-NEC, from identifying which workers qualify as independent contractors to correctly filling out and submitting the form. We'll even cover how to file online and what to do if you make a mistake.

Jump to:

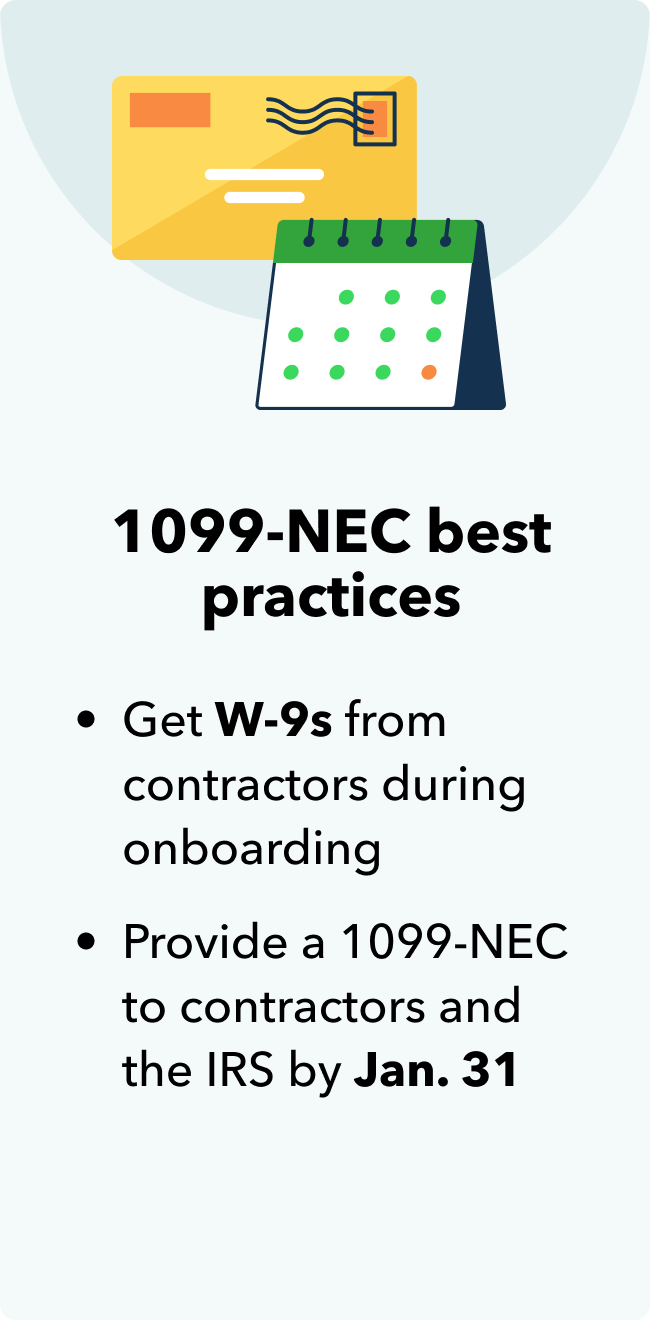

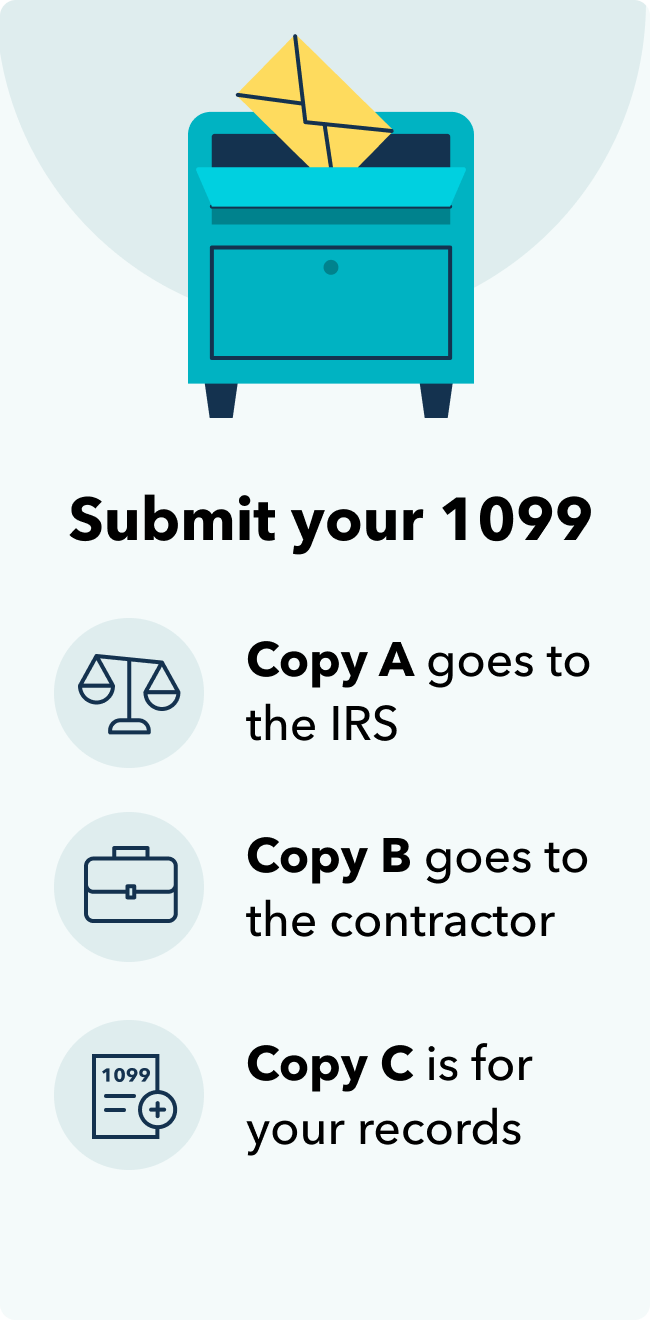

The 1099-NEC form filing deadline is the same whether you file online or by mail.

The 1099-NEC form filing deadline is the same whether you file online or by mail.

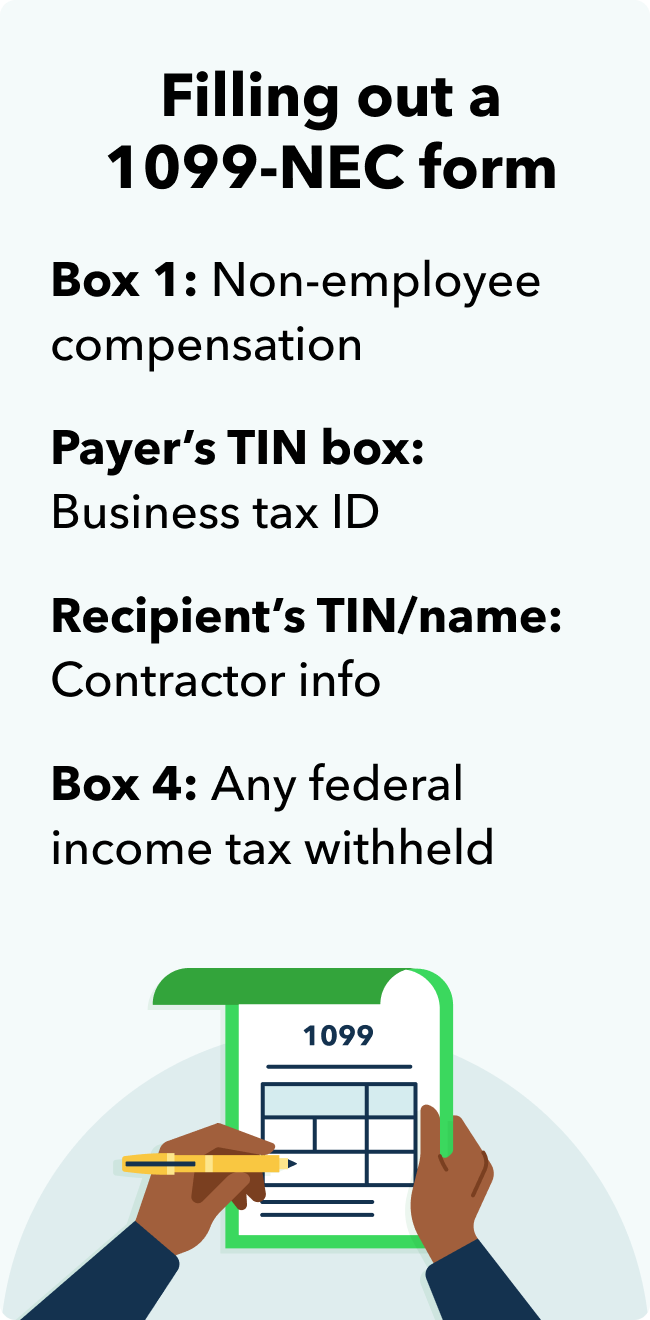

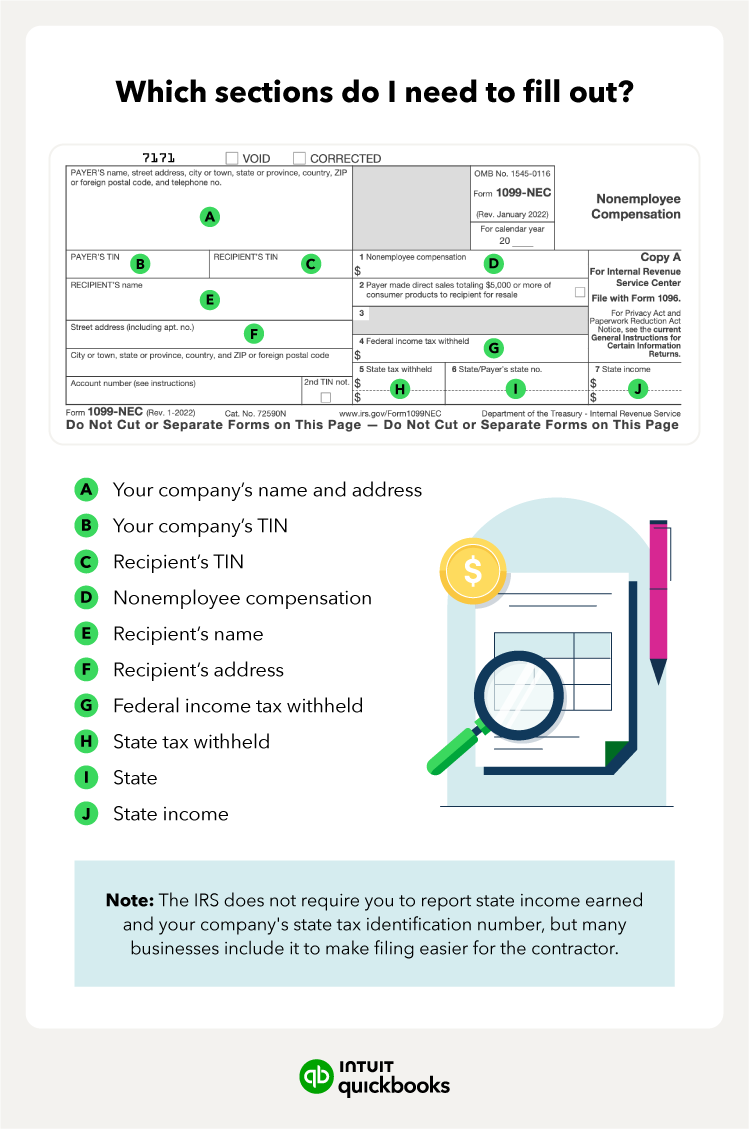

To avoid any issues with the IRS, make sure the information you enter matches exactly what's on the contractor's W-9 form.

To avoid any issues with the IRS, make sure the information you enter matches exactly what's on the contractor's W-9 form.