Standard deduction

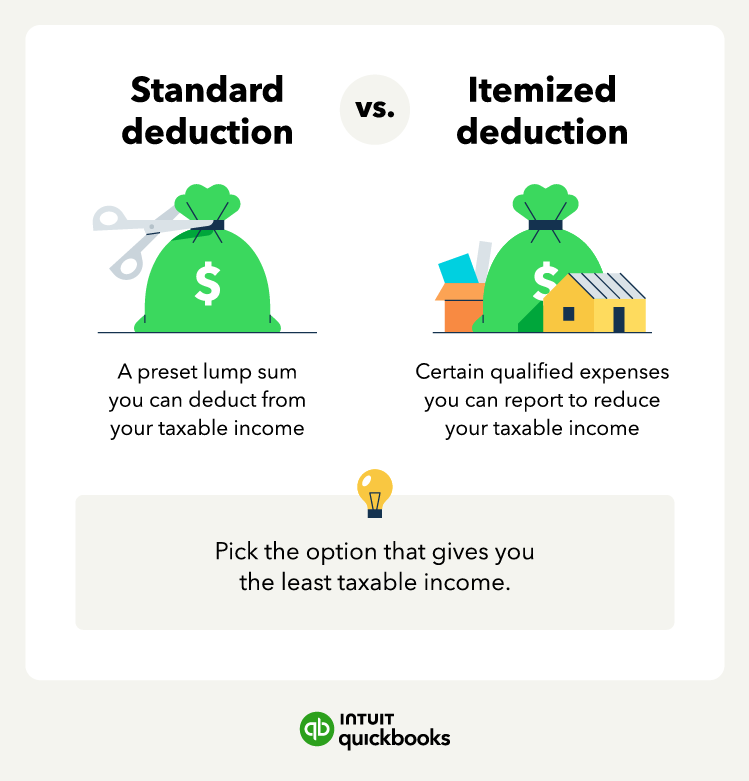

The standard deduction is a fixed amount set by the IRS that reduces your taxable income without requiring proof of expenses. It’s simple, requires no extra paperwork, and is often the default choice for taxpayers without significant itemized expenses.

The amount varies based on your filing status and offers additional deductions for those who are 65 or older or blind.

Convenience: The IRS sets the amount, which adjusts annually.

Additional benefits: If you're 65 or older or blind, you get an extra $2,000 for 2025.

Limitations: Married filing separately? Both spouses must either itemize or take the standard deduction. If someone claims you as a dependent, your standard deduction is smaller.

Here are common scenarios where it’s optimal:

Low out-of-pocket expenses: If you don’t have substantial medical bills, mortgage interest, or charitable donations, the standard deduction is likely more advantageous.

Simple tax situations: Taxpayers with straightforward finances, such as renters or those without dependents, usually benefit from the simplicity of the standard deduction.

Dependents with limited income: If someone claims you as a dependent and your income is low, you’re generally better off taking the standard deduction.

Time constraints: If gathering receipts and calculating itemized deductions seems daunting or time-consuming, the standard deduction saves effort while still reducing taxable income.

Itemized deductions

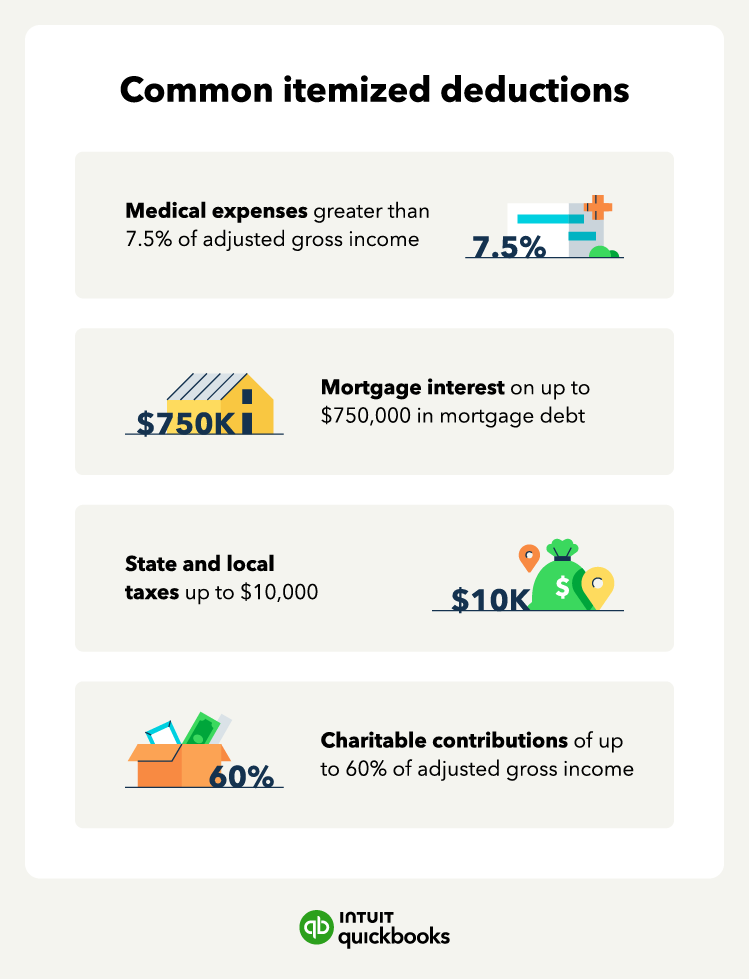

Itemized deductions allow you to deduct specific expenses, such as medical bills, mortgage interest, and charitable donations, but require detailed record-keeping and filing Schedule A.

This option is beneficial for taxpayers with deductible expenses that exceed the standard deduction, although it requires more effort and is subject to certain caps and limitations.

Higher potential deduction: Itemizing might save more if you:

- Have high medical expenses.

- Pay mortgage interest.

- Claim other eligible expenses.

Limitations: Requires more effort to track expenses and follow the rules. Some limits apply, like caps on mortgage interest.

Note that for mortgages you took out before Dec. 15, 2017, you can deduct mortgage interest on the first $1,000,000 in debt or $500,000 if you’re married, filing separately.

Note that for mortgages you took out before Dec. 15, 2017, you can deduct mortgage interest on the first $1,000,000 in debt or $500,000 if you’re married, filing separately.