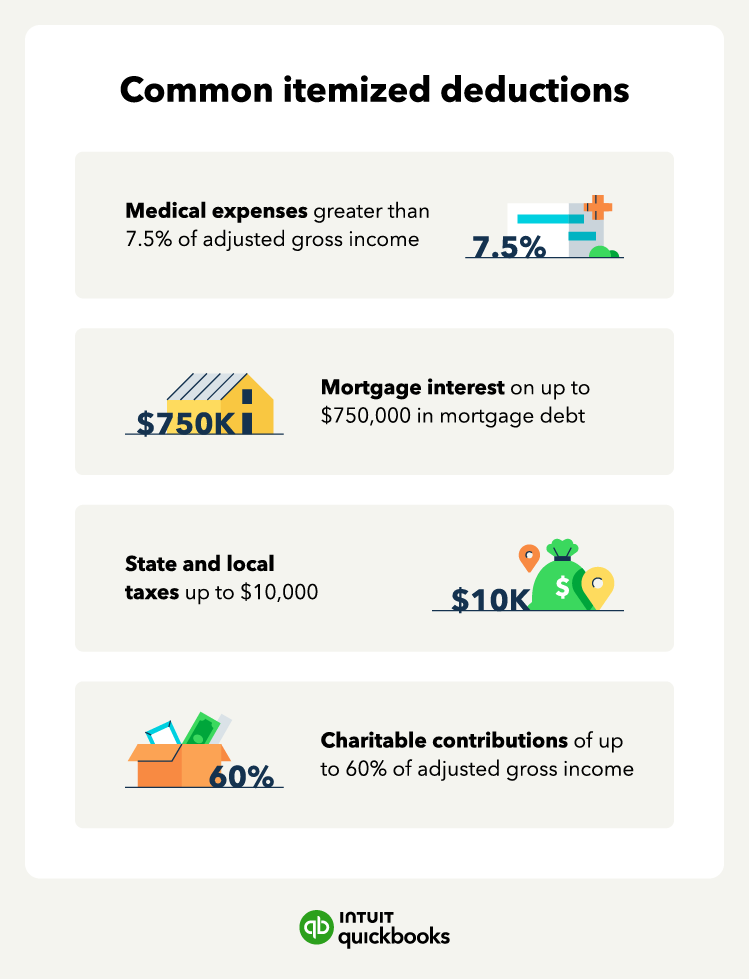

Charitable contributions

You can also include contributions to charities in your itemized deductions. You can only deduct up to 60% of your AGI for cash contributions. The limit is lower for other types of charitable contributions, such as property.

Donations can include those to nonprofits and religious organizations and be in the form of cash, property, or out-of-pocket expenses.

Contributions of $250 or more require a letter from the charity for tax documentation purposes.

State and local taxes

You also can elect to deduct either state and local income taxes or state and local sales taxes, but not both. Most taxpayers choose to deduct income taxes because the dollar amount is larger. Then, you can also deduct property and real estate taxes.

Your deduction of state and local taxes and property taxes is limited to $10,000, or $5,000 if married filing separately.

Note you can also itemize other expenses, such as casualty and theft losses from a federally declared disaster or gambling losses.

Pros and cons of standard deductions vs. itemized

The main reason individuals opt for taking the standard deduction on their tax returns is that it’s more convenient. The IRS sets the amount and typically increases it yearly.

The standard deduction can also be a larger amount for set groups. For example, If you’re 65 or older or blind, you get an additional deduction of $1,550 for 2024. However, standard deductions do have some filing limitations. If you are married but filing separately, you cannot take the standard deduction if your spouse itemizes.

Both of you must either take the standard deduction or itemize. Also, if someone can claim you as a dependent on their tax return, you get a smaller standard deduction.