January 2020 marked a significant change to the federal overtime rule for businesses across the U.S. More than a million more American workers are eligible for overtime pay. With 86% of employers taking on at least one financial activity for their business, the new rule could mean a lot more work. And, that’s on top of the almost five hours business owners say they spend managing payroll taxes each pay period. Overall, payroll is a frustrating, complicated, and confusing process, according to findings from a recent QuickBooks Payroll survey.

How to automate and simplify payroll tax deductions with QuickBooks

Surprise: Payroll taxes and finances are challenging

But, being in the weeds turns out to be more a necessity than preference. 1 in 3 business owners surveyed say they’re not comfortable doing payroll themselves at all. 6 in 10 admit they didn’t know how time-consuming payroll taxes could be when they first took it on. And, 79% struggle to stay on top of regulations and compliance.

When asked about the financial-related concerns keeping them up at night, the ripple effect posed by financial mistakes became apparent.

- 37% of business owners are concerned about not having enough cash to fund the business.

- 31% of business owners are concerned about handling all the financial and operational tasks themselves.

- 25% of business owners are concerned they’re unprepared for tax season.

- 22% of business owners are concerned about paying extra taxes due to a lack of knowledge around deductions.

- 16% of business owners are concerned about not being able to hire the right people for their finance team.

- 16% of business owners are concerned about missing deadlines for payments.

The right solution boosts confidence and execution

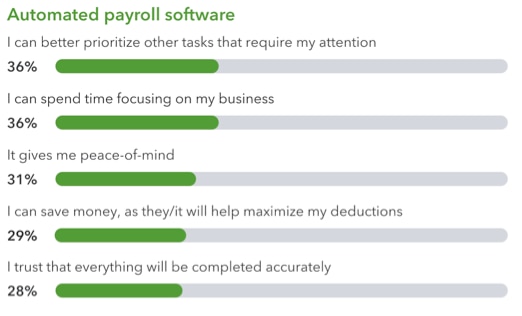

Payroll and payroll taxes aren’t easy. But, many business owners have discovered the benefits of an automated payroll solution. 81% of respondents who say they’re prepared for tax season use payroll software to process employee pay and calculate and file taxes. And, they’re saving big on time and money because of it.

So, what are they doing with these newfound resources? Putting them back into growing and nurturing their businesses, of course. But, it’s not all work and no play. When asked what they’d rather do than manage payroll taxes, the top answer was spending that time with family and friends.

Payroll tax penalties: The numbers that keep on growing

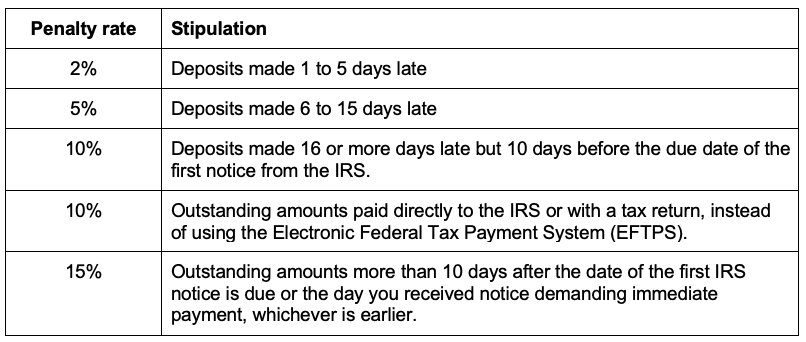

The IRS provides a detailed and updated tax guide for employers that defines violations and penalties. For amounts not deposited correctly or on time, penalty rates increase with time.

Let’s look at an example: It’s May 20. Side Hustle Inc. has 20 employees and owes the IRS $40,000 in payroll taxes. They received a notice from the IRS demanding payment, and the due date was May 7. This falls into the 15% penalty. So, Side Hustle will have to pay an additional $6,000 on top of what they owe.

From management to missed payments, there are a lot of ways to let payroll and payroll taxes get the better of you. But, rest assured that you can get ahead and make payroll tax headaches a thing of the past.

3 ways to minimize risks and foolproof your payroll process

- Set and forget with automation. Automation is more than just streamlining workflows. Imagine a payroll software that can calculate, file, and pay federal and state payroll taxes for you, every time you run payroll!

- Get help and protection you can depend on. When you outsource your payroll to man or machine, the partnership comes with a promise. You’re in this together. On top of automation, payroll providers will even offer a penalty-free guarantee to make sure you’re covered.

- Align solutions whenever possible. Payroll is just one part of having employees. There’s a slew of additional HR services business owners have to consider. Instead of patching different solutions together, find one that can do it all to keep everything and everyone in order.