* Important pricing details and product information

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation.

©2024 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

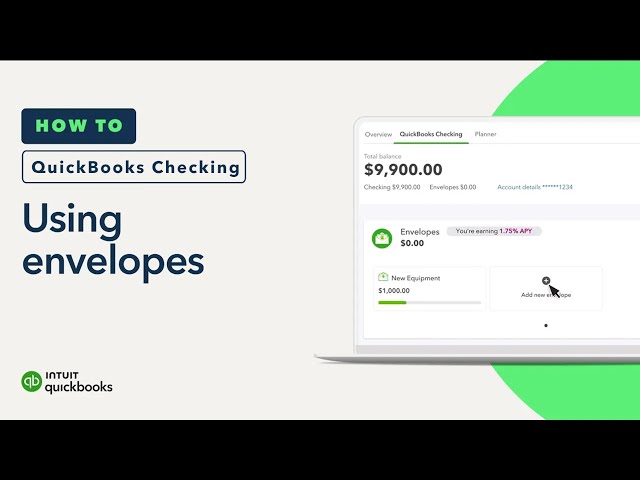

Annual percentage yield: The annual percentage yield (“APY”) is accurate as of December 13, 2023 and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

# Claims

- Competitive APY: Average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of December 18, 2023. Learn more. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

- Competitive APY: Competitive rate information based on publicly available data for small business checking accounts provided by the largest national and online banks as of December 18, 2023. APYs are subject to change at any time.