Chase Bank requires bank account reconnection in QuickBooks

In a nutshell: If you have connected a Chase Bank account to QuickBooks Online or QuickBooks Desktop, you’ll need to update your connection soon.

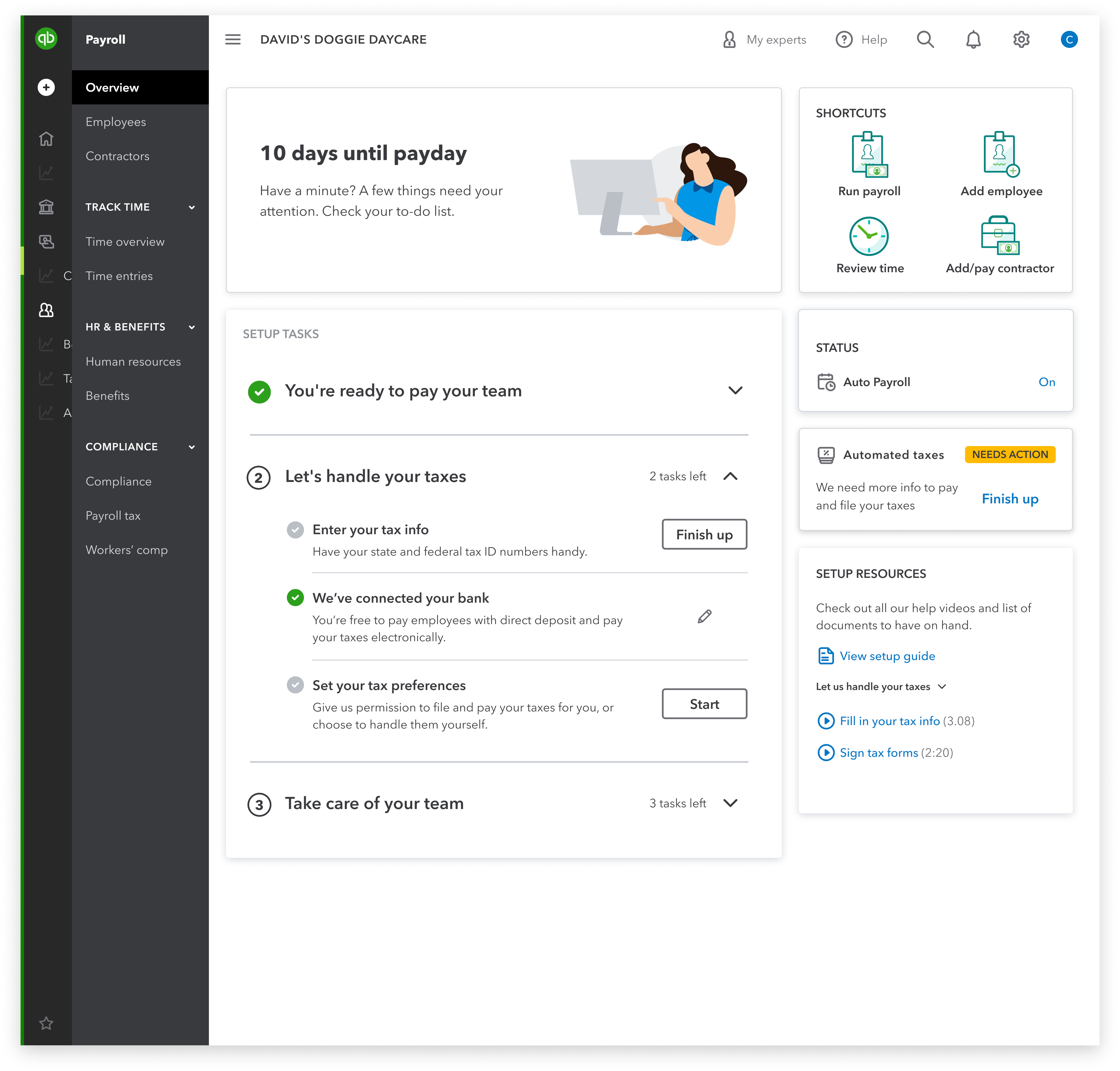

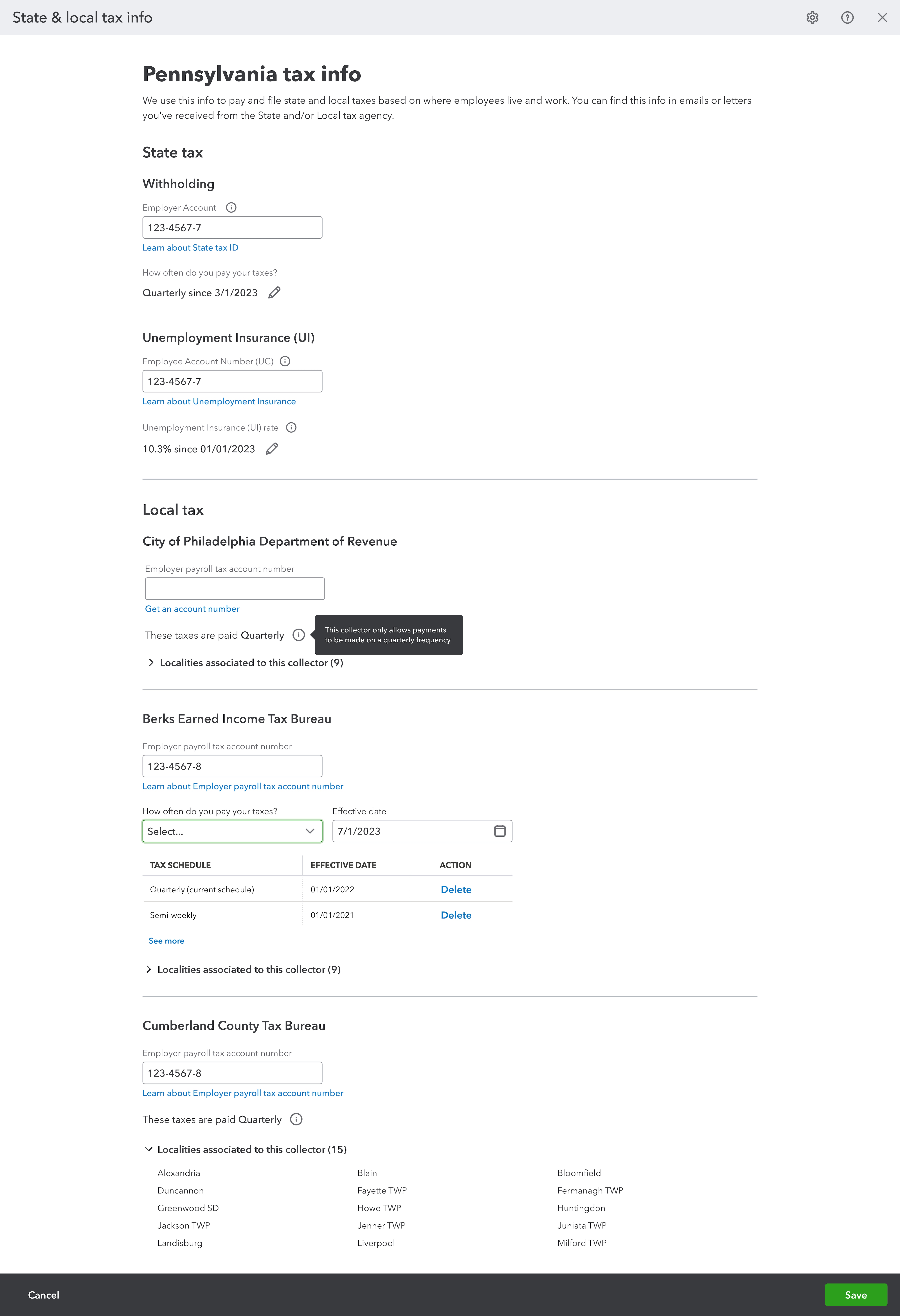

As part of two upcoming security enhancements in October and November, Chase Bank will require any QuickBooks customers with a connected Chase account to update their bank connection to continue using QuickBooks services. These services include payroll direct deposit, payroll tax payments, loan funding, pre-authorized loan repayments, QuickBooks Payments, bill payments, bank transfers, and more.

If you have a connected Chase account in QuickBooks, you’ll receive detailed instructions about what to do via email and through notifications in QuickBooks. If you receive two different notifications about Chase Bank, be sure to follow the instructions for each of them. This means that both of the security enhancements require action to resync your data.