Cost price is how much it costs you to make each product. It is one of the first and most important steps in successful businesses’ strategies for pricing new products.

.jpg)

Cost price formula: how to calculate cost price

The cost price formula

How to calculate cost price? Simply add together the labor cost, the components cost, the tools cost, the marketing costs and the overhead cost.

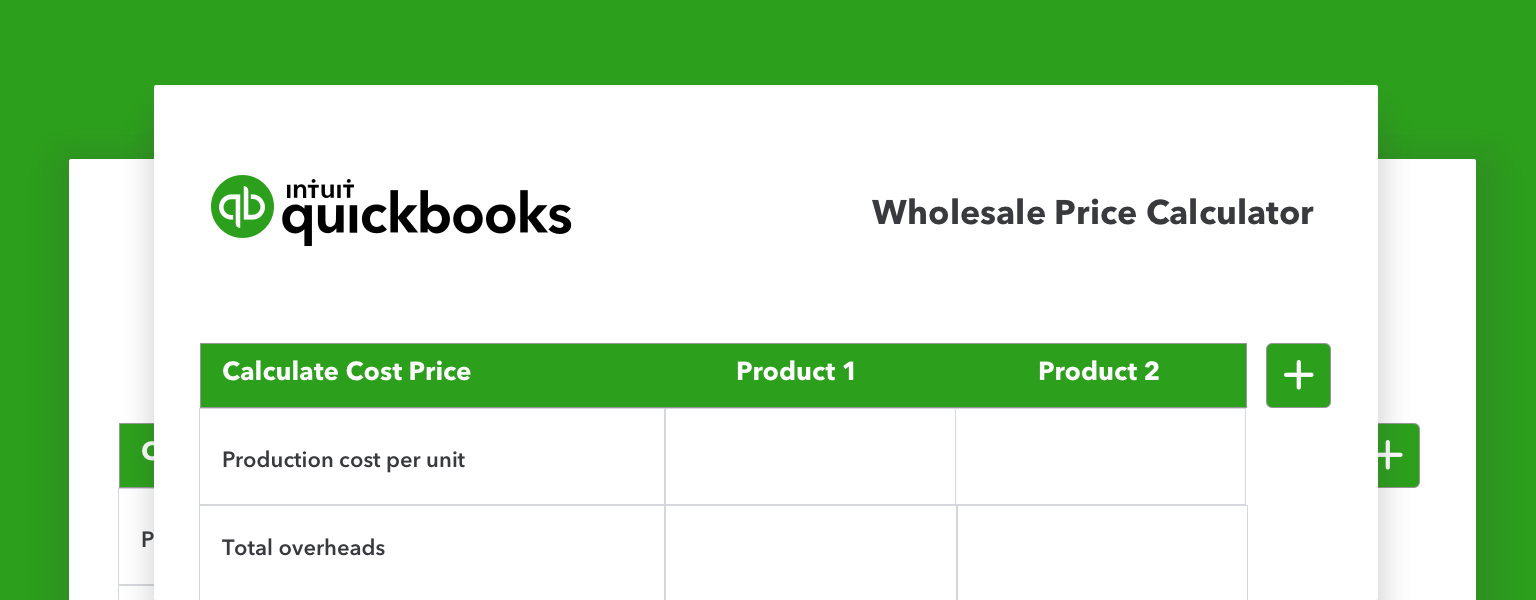

Cost price calculator

To save you time, we've built a cost price calculator for you:

To help you understand how this works, we’ve created a step-by-step guide on how to calculate the cost price of a product.

1. Detail all of your costs

The first step to calculating appropriate prices for your wholesale products is to detail all of your costs, including Cost of Goods Sold (COGS) and overhead costs.

Your COGS represents how much you spend to acquire the products that you'll resell. This includes costs such as:

- Acquisition of products from your vendors/suppliers

- Freight & handling cost

Overhead costs, also called indirect costs, exist regardless of the volume of products sold. They include fixed or variable expenses, such as:

- Customer care services

- Rent for warehouse space

- Utility bills

- Insurance

- Equipment and software used to run your business, such as computers and inventory management software

This list is by no means exhaustive, so think about the specific expenses your business incurs. For example, you might also want to consider the cost of inventory shrinkage due to theft or damage.

2. Calculate cost price per unit

Once you’ve calculated all your costs, it’s time to work out how much it costs to produce each individual unit or product.

For the sake of simplicity, let’s say a business produces 1000 units of one product over a year. The materials that make up the product cost $4.50, and the machine used to make the products needs servicing once per year at a cost of $1,000. The business also spends $6,000 per year on marketing, $10,000 per year on rent and storage, and $2,000 on other business costs.

In this case, the cost price per unit would be:

$1,000 + $6,000 + $10,000 + $2000 /1,000 + $4.50

= $22.50

The more product variability you have, the more complex this process will be, which is why it’s usually smarter to use tools like our free wholesale price calculator to do the hard work for you.

3. Work out your profit margin

The next step is to calculate how much profit you need and want to make on each product sold. Your profit margin will depend on a number of factors, such as your type of business (niche and low-volume vs. high-volume bargain) and how much your competitors are charging for comparable products.

Before setting a Recommended Retail Price based on your cost price plus profit margin, evaluate your competitors online and take a look at professional networks within your industry on forums or LinkedIn to gauge what’s appropriate for your products and business.

4. Use your cost price to work backward

Once you’ve calculated your cost price, you can work backward to calculate how many products you need to sell per year to cover your costs such as annual overheads, salaries, and direct costs or raw materials.

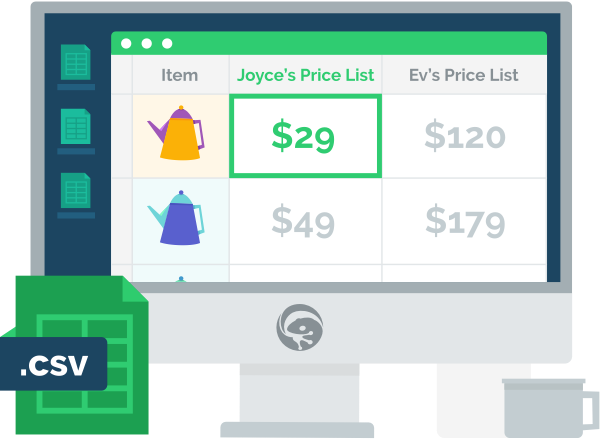

Also, if you use QuickBooks Commerce, don’t forget that the Price List Management feature can be used to import and update custom price lists quickly and easily – which potentially means saying goodbye to pricing spreadsheets forever!

Once you’ve imported your data, you can manage all aspects of multiple price lists on a single page without leaving the app. You can also easily assign custom price lists to specific customers and access custom price lists on the go via our mobile sales app. In other words, monitoring custom pricing and making sure you’re on track profit-wise is just another part of managing your day-to-day business operations.