Nonprofit accounting software made to do more for others

Simplify how you take, track, and manage donations with accounting software for your nonprofit organization.

Simplify how you take, track, and manage donations with accounting software for your nonprofit organization.

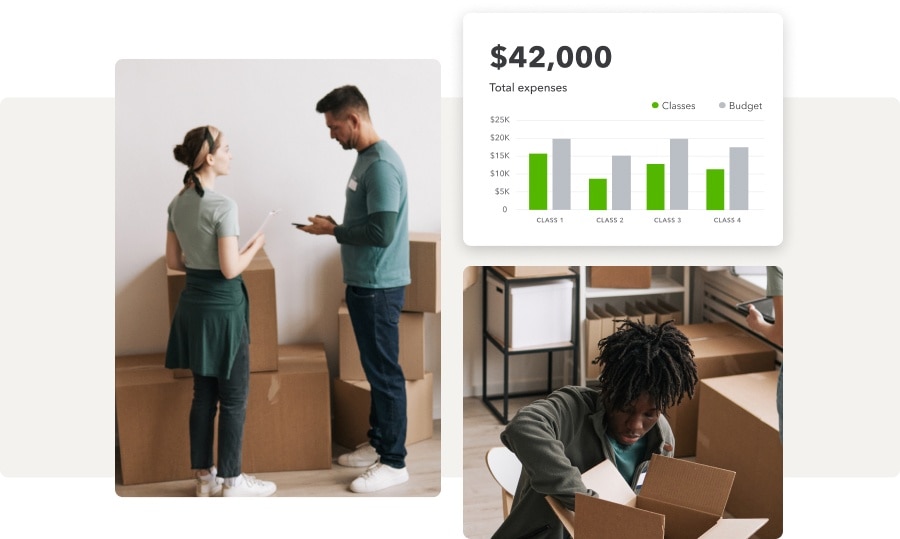

Categorize revenue expenditures by fund or program, and create custom reports based on the data that matters most to your nonprofit organization.

Track budgets by fund or program with donor and grant management, financial reporting, and bank reconciliations. Available only in QuickBooks Online Plus and Advanced.

Add up to 40 users with custom permissions and securely manage thousands of donors, vendors, and items easily with QuickBooks Enterprise.

Financial management is easy with QuickBooks fund accounting software. Connect your bank and get instant updates for expense tracking and cash flow.

Accept your donations by credit card, debit card, bank transfer, cash, or check. Use the QuickBooks mobile app to record money on mobile devices.

Keep doing what works for you. Import transactions from apps like Fundly or DonorPerfect to QuickBooks easily so all your data is in one place.

QuickBooks accounting system handles nonprofit management throughout the year so you’re ready for tax time.

Instantly create reports as needed to keep stakeholders in the loop, or to prepare for the annual IRS filing.

Have reports created and emailed automatically, from a statement of financial position, statement of financial activities, budget versus actual, and more.

Sync your nonprofit accounting software with apps to help fundraise on the go and efficiently manage donations.

Plans for every kind of nonprofit

*Offer terms

Bundle may include (1) a QuickBooks Online subscription and/or (2) a QuickBooks Live Bookkeeping plan and/or (3) QuickBooks Online Payroll, at your option.

QuickBooks Products: Offer available for QuickBooks Online and/or QuickBooks Online Payroll Core, Premium, or Elite (collectively, the "QuickBooks Products"). The offer includes either a free trial for 30 days ("Free Trial for 30 Days") or a discount for 3 months of service ("Discount") (collectively, the "QuickBooks Offer"). QuickBooks Live Bookkeeping is not included in the QuickBooks Offer. Free trial for 30 days: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. To continue using the QuickBooks Products after your 30-day trial, you'll be asked to present a valid credit card for authorization. Thereafter, you'll be charged on a monthly basis at the then-current fee for the service(s) you've selected until you cancel. To be eligible for this offer you must sign up for the free trial plan using the "Try it free" option.

Discount offer: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price.To be eligible for this offer you must sign up for the monthly plan using the "Buy Now" option. Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can't be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers only. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation terms: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select "Cancel." Your QuickBooks Products cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

QuickBooks Online Payroll terms: Each employee is an additional $6/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $6/month for Core, $8/month for Premium, and $10/month for Elite. Service optimized for up to 50 employees or contractors and capped at 150. The service includes 1 state filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. There is no additional charge for additional state tax filings in Elite. The discounts do not apply to additional employees and state tax filing fees.

QuickBooks Enterprise

Enterprise subscription: Your subscription of QuickBooks Desktop Enterprise Silver, Gold or Platinum is valid for the first 12 months starting from purchase date. After 12 months, your credit/debit card account on file will automatically be charged on a monthly or annual basis at the then-current fee for the QuickBooks Desktop Enterprise product and plan you’ve selected until you cancel. You can cancel at any time by going to Account & Settings in QuickBooks and select “Cancel” or by calling 800-300-8179, prior to your renewal date.

Both the Annual and Monthly Option Plan commits you to a 12-month term; fees vary per plan. If you select the Monthly Option Plan then you will pay the then-current fee over the course of 12 months. Intuit will authorize your card to ensure prompt order processing, resulting in a temporary hold on your account. If you cancel inside the 60 day money back guarantee period you can opt to receive a refund (see: money back guarantee terms and conditions). If you cancel outside of the 60 day money back guarantee period you will have access to QuickBooks Enterprise for the remainder of the 12 month term in which you paid for. Upon expiration of your paid subscription you will no longer have access to the product or any of its connected services. See Subscription Terms & Conditions for details.

QuickBooks Enterprise Diamond: Is sold in increments of 1-10, 20, 30, and 40 users. It is compatible with, but does not include hosting. (Hosting sold separately.) It is a subscription and is only available on a monthly payment plan with no annual commitment. Each month, your account will be automatically charged the agreed-upon price unless and until you cancel.

Diamond includes all the features of QuickBooks Desktop Enterprise Platinum edition with the exception of Enhanced Payroll. Diamond also includes QuickBooks Assisted Payroll and QuickBooks Time Elite time tracking.

Cancel Enterprise Diamond at any time by calling Intuit at 800-300-8179, prior to your monthly renewal date. When you cancel, you will have access to QuickBooks Desktop Enterprise Diamond for the remainder of the month for which you have already paid. The following month, you will no longer have access to the product or any of its connected services. We will authorize your card to ensure prompt order processing, resulting in a temporary hold on your account. See Subscription Terms & Conditions.

Automatic QuickBooks product updates: Active QuickBooks Desktop Enterprise subscription members receive new versions of our products, along with updates to your current version, when and if released within 12 months of QuickBooks Desktop Enterprise purchase date or subscription renewal date.

**Product information

Microsoft Word and Excel integration requires Word and Excel 2003, 2007 or 2010. Data can be imported to QuickBooks Online Simple Start, Essentials, or Plus from the following QuickBooks desktop versions: Pro 2008 or later, Premier 2008 or later, Mac 2013 or later. Earlier versions: Basic 99-2005, Simple Start Edition, Pro & Premier 99-2007 can be imported using a downloadable tool. Import from QuickBooks desktop must be completed within the first 60 days of setting up your new QuickBooks Online account.

QuickBooks Enterprise - Industry editions: Industry-specific editions for Manufacturing & Wholesale/Distribution, Nonprofit, Contractor/Construction and Retail have all the key features of the standard edition of QuickBooks Desktop Enterprise plus additional reports and tools tailored to the industry type. Unit of Measure feature not included in the Retail edition. Billing Rate Levels only available in Premier Professional Services, Contractor, and Accountant Editions; not available in Pro, Premier, Nonprofit, Manufacturing & Wholesale, and Retail editions.

**Features

QuickBooks features

Receipt capture: Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Collaborate with your accountant: You can connect up to the following for each product: 1 billable user and 2 accounting firms for QuickBooks Online Simple Start, 3 billable users and 2 accounting firms for QuickBooks Online Essentials, 5 billable users and 2 accounting firms for QuickBooks Online Plus, 25 billable users and 3 accounting firms for QuickBooks Online Advanced. Accounting firms must connect using QuickBooks Online Accountant.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Additional terms, conditions and fees apply.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Instant deposit: Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard payment processing fees also apply to each transaction. Deposits are sent to the bank account linked to an eligible debit card in up to 30 minutes from the initiation of the deposit. Deposit times may vary for third party delays.

Cash flow: QuickBooks Cash Account opening is subject to identity verification and approval by Green Dot Bank. QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank. QuickBooks Payments account subject to eligibility criteria, credit and application approval.

Free Instant Deposit: Includes use of Instant Deposit without the additional cost. Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Deposits are sent to the bank account linked to your QuickBooks Debit Card or another eligible debit card in up to 30 minutes. Deposit times may vary for third party delays.

Cash flow planner: Cash flow planning is provided as a courtesy for informational purposes only. Actual results may vary.

QuickBooks Payments and QuickBooks Cash accounts: Users must apply for both QuickBooks Payments and QuickBooks Cash accounts. QuickBooks Payments’ Merchant Agreement and QuickBooks Cash account’s Deposit Account Agreement apply.

QuickBooks Cash account:Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A. Inc. Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Account funds are FDIC-insured up to the allowable limits upon verification of Cardholder’s identity. Visa is a registered trademark of Visa International Service Association. Green Dot is a registered trademark of Green Dot Corporation. ©2020 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.FDIC insured up to $250,000: QuickBooks Cash Account funds are FDIC-insured up to the allowable limits through Green Dot Bank, Member FDIC upon verification of Cardholder’s identity. Coverage limit is subject to aggregation of all of Cardholder’s funds held on deposit at Green Dot Bank.

Mobile signatures:Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Pay-enabled invoices:Requires a separate QuickBooks Payments account which is subject to eligibility criteria, credit and application approval. Additional fees may apply. Additional terms and conditions apply.

Third party apps:Third party applications available on apps.com. Subject to additional terms, conditions, and fees.

Automated 1099 e-file & delivery:Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Bill Pay:Bill Pay services powered by Melio with funds held by Evolve Bank & Trust or Silicon Valley Bank (members of the FDIC and the Federal Reserve). Requires a Melio account and acceptance of their Terms of Service and Privacy Statement. Subject to additional terms, conditions, and fees.

Accelerated Invoicing:QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 20% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

Premium Apps:Apps may require a third-party subscription. Subject to additional eligibility criteria and fees.

Account team benefits for Priority Circle:Only available with a paid subscription. Trial customers have access to QuickBooks Online Advanced product experts.

Priority Circle: Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging Premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

Automatic data backup and recovery:QuickBooks Online uses technical and administrative security measures such as, but not limited to, firewalls, encryption techniques, and authentication procedures, among others, to work to maintain the security of your online session and information.

Payroll Features

Auto Payroll:Available if setup for employees and the company are complete, all employees are salaried employees, or hourly employees on default hours, and set up on direct deposit. Requires bank verification, the account must not have been on hold in the last 6 months, and the first payroll must have been run successfully.

Health benefits:Powered by SimplyInsured and requires acceptance of SimplyInsured’s Privacy Policy and Terms of Use. Additional fees will apply. SimplyInsured does not offer insurance in HI, VT, and DC. Insurance coverage eligibility is not guaranteed, and depends solely on the rules of the insurance carrier. The insurance carrier has sole and final discretion as to the eligibility for health insurance products.

Guideline 401(k):401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline's Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and payroll access required to sign up for a 401(k) plan with Guideline.

Automated 1099 e-file & delivery:Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Expert product support:Included with your paid subscription to QuickBooks Online Payroll. Chat support available 24/7. US-based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Your subscription must be current. Get more information on how to contact support. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Next-day direct deposit:Available to only QuickBooks Online Payroll Core users. Payroll processed before 5PM PST the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Next-day direct deposit may be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control. Next-day direct deposit is available for contractors and employees. Direct deposit for contractors is $6 per month. Each employee is $6 per month with no additional fees for direct deposit.

Same-day direct deposit:Available to QuickBooks Online Payroll Premium and Elite users. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Same-day direct deposit may be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Same-day direct deposit available only for employees.

Workers’ comp administration:Benefits are powered by AP Intego and require acceptance of AP Intego’s Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by AP Intego Insurance Group. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

HR services:HR support is provided by experts at Mammoth, Inc. Requires acceptance of Mammoth’s Privacy Policy and Terms of Use. HR Support Center available only to QuickBooks Online Premium and Elite subscriptions. HR Advisor support only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients

Expert review:Available upon request to QuickBooks Online Payroll Premium and Elite users.

QuickBooks Time:Additional fees may apply. Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Time Mobile:The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Expert setup: Available to QuickBooks Online Payroll Elite users only.

24/7 expert product support:24/7 customer support is included with your paid subscription to QuickBooks Online Payroll. Chat support available 24/7. U.S. based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Automated tax payments and filings:Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

QuickBooks Workforce:Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

Garnishments and deductions:Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

Enterprise features

QuickBooks Desktop Enterprise with Hosting: QuickBooks Desktop Enterprise with Hosting is a subscription and only available on a monthly payment plan. If you purchase QuickBooks Desktop Enterprise with Hosting user licenses 1-10, you must purchase an equal number of hosted users as you purchase Enterprise licenses. If you wish to purchase QuickBooks Desktop Enterprise with Hosting with 11-30 licenses, please call for custom pricing.

The Hosting Service is a monthly subscription. Each month, your account will be automatically charged the agreed-upon price of the Hosting service unless and until you cancel. Cancel at any time by calling Intuit at 800-300-8179, prior to your monthly renewal date. When a customer calls to cancel, it is canceled and refunded at the date through the end of the current billing period. The QuickBooks Desktop Enterprise software portion of the QuickBooks Desktop Enterprise with Hosting bundle is an annual subscription.

If you choose to purchase QuickBooks Desktop Enterprise using the Monthly Payment Plan or QuickBooks Desktop Enterprise with Hosting, you elect to pay your annual subscription in equal payments over the course of 12 months. Purchasing an annual subscription for QuickBooks Desktop Enterprise commits you to a 12 month term. You must pay for all 12 months of the subscription in full based on the then current rate of QuickBooks Desktop Enterprise. If you choose to cancel inside the first 60 days, you can opt to receive a refund per the 60 day money back guarantee (see https://quickbooks.intuit.com/software-licenses/ for details). However, if you choose to cancel after the first 60 days and prior to the end of month 12 you will be subject to a termination fee equal to the amount of monthly payments left on your annual subscription. For purpose of clarity, if you pay for 6 months and have 6 months remaining on your annual subscription, which starts at date of enrollment, you will be charged a termination fee equal to the then current monthly fee of QuickBooks Desktop Enterprise multiplied by 6 months (remaining months left on annual subscription).

Right Networks:Support for QuickBooks Desktop Enterprise with Hosting is provided by Right Networks. A valid QuickBooks Desktop Enterprise license code must be provided to Right Networks to receive support. Contact Right Networks to contract third-party software.

Right Networks performs backups of all Hosted data on a nightly basis and retains the back-ups for a rolling 90-day period in a protected offsite facility as an additional level of protection. There is no limitation to the size of a customer’s back-up. Customers are responsible for verifying the integrity of the hosted data at least every 90 days. Right Networks employs Snapshot technology to backup customer data. Snapshots are taken daily and then replicated to another physical Right Networks facility for Disaster Recovery.

Right Networks uses top-tier data centers and multiple layers of redundancy within its infrastructure to provide 24×7 availability. However, availability can vary, is subject to occasional downtime and may change without notice. Right Networks encrypts all backup files and backup tapes. Virtual desktop connections are protected via TLS with a minimum of 128 bit encryption and authentication. Each customer has a unique Right Networks virtual desktop. Access to each QuickBooks company file is controlled at multiple layers including file access permissions. Access is locked out after multiple failed login attempts for the same user. Security features, functionality and access are subject to change without notice as deemed necessary by Right Networks. Availability can vary and are subject to occasional downtime and may change without notice. Click here for a list of compatible devices.

Internet connectivity required:Desktop Enterprise with Hosting is subject to availability of a reliable Internet connection. See detailed list of systems requirements, and a list of what RDP clients work with the hosting service here.

Remote Desktop Services compliant:QuickBooks Desktop Enterprise is Remote Desktop Services compliant. Additional fees may apply. Requires certain hardware, Microsoft Server operating systems, Microsoft Windows Server software licenses, and Remote Desktop Services Server Client Access Licenses, sold separately. For multiple remote users, a Remote Desktop Services Client Access License is required for each user.

Advanced InventoryIncluded in the Platinum and Diamond subscriptions only. Requires an internet connection. Includes related sub-features such as mobile barcode scanning, alternate vendors center and alternate vendors report, cycle count, bin location tracking, enhanced pick pack and ship, express pick pack and ship, landed cost. Shipping subject to terms and conditions set forth by UPS, FedEx, and USPS. Barcode scanners sold separately.

Advanced Reporting is included in all QuickBooks Desktop Enterprise subscriptions. Requires an internet connection.

Advanced Pricing is included in the Platinum and Diamond subscriptions only. Requires an internet connection.

List capacity:QuickBooks Enterprise allows you to add up to 1 million names (e.g., customers, vendors, employees) and up to 1 million items (e.g., inventory, non-inventory, and service items). Some performance degradation is likely as your lists approach these size thresholds.

User licenses:Each unique user requires a license. Each license sold separately. All copies of QuickBooks must be the same version-year. Licenses are available in single-user increments from 1 to 10 users. 20 or 30 user licenses are also available. Diamond can support up to 40 users. Fees apply.

Technical Specifications

Click here to read the Minimum technical requirements and system requirements.

Terms, conditions, pricing, features, service and support are subject to change without notice.

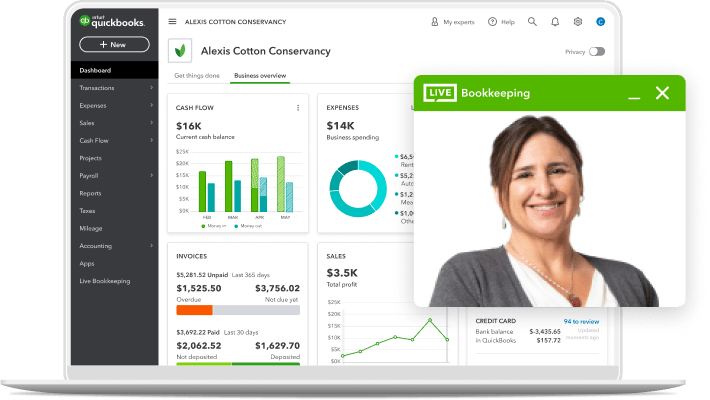

Get your nonprofit’s books done for you

Get matched with a QuickBooks-certified bookkeeper who understands nonprofits and keeps your books up to date.

Find more of what you need with these tools, resources, and solutions.

Nonprofits rely on accurate, timely financial information throughout the year. Here are a few items to watch closely each month on your nonprofit financial statements.

Stakeholders are the glue that holds a nonprofit together. Find out who they are and how to properly manage their involvement so you can improve your programs and fundraising efforts.

Fund accounting means tracking expenses by fund or program. Rather than track how much profit is earned like small businesses, nonprofit organizations track how money is spent. QuickBooks makes it easy to allocate revenue and expenditures to specific funds or programs, automatically allocates overhead to programs, fundraising, general, and administrative expenses for you. You can instantly create financial reports to see where you stand.

Many nonprofit organizations rely on volunteers to help with their accounting. That’s why we’ve made QuickBooks easy to learn and to use. Create unique user IDs for volunteers and assign access levels for each. And because it’s online, volunteers can help from anywhere, anytime.

QuickBooks does a lot of the work automatically, saving you and your volunteers precious time. Connect your bank account and QuickBooks will learn to categorize expenses for you. Set reports to be automatically created and emailed to board or committee members on any schedule you’d like.

QuickBooks lets you accept all types of donations. You and your volunteers can accept donations from a credit card, debit card, bank transfer, cash, or check. Your team can take and record donations right on their phone or mobile device. Tag donations to a specific program or fund for accurate bookkeeping.

Nonprofits use a variety of specialized reports such as annual board member reports, donor reports, and grant reports. With QuickBooks, you can easily customize your reporting templates and run any report you need. Create presentation-worthy reports with your logo, an introduction, and notes.

Set up automatic reports to be created and emailed to colleagues, board members, and donors. With QuickBooks Online and QuickBooks Advanced, you can Instantly review the statement of financial position, the statement of financial activities to budget, actual reports, and more. Send your donors yearly donation statement with thank you letters attached.

My nonprofit has to file IRS Form 990 every year. Can QuickBooks help? Not all nonprofits need to report to the IRS, but the ones that do need to report where the money came from, how it was spent, and why it was spent. QuickBooks makes it easy to tag expenditures to fundraising, programs, or general admin so that you can report exactly how each dollar was spent for each program or fund across your organization. At the end of the year, all of your data is organized in one location to save you time when preparing IRS Form 990.

Yes. QuickBooks offers discounted products for nonprofits through TechSoup, a nonprofit tech marketplace. We recommend that churches and other houses of worship use QuickBooks Online Plus or QuickBooks Advanced so they can get all the tools, tracking, and reporting features we offer.

Give us a call if you need help picking a QuickBooks product.

Call 1-877-683-3280

Mon-Fri, 5 AM to 6 PM PT

Sat, 7 AM to 4 PM PT

Find help articles, video tutorials, and connect with other businesses in our online community.

Monday - Friday, 5 AM to 6 PM PT

*Offer terms

Bundle may include (1) a QuickBooks Online subscription and/or (2) a QuickBooks Live Bookkeeping plan and/or (3) QuickBooks Online Payroll, at your option.

QuickBooks Products: Offer available for QuickBooks Online and/or QuickBooks Online Payroll Core, Premium, or Elite (collectively, the "QuickBooks Products"). The offer includes either a free trial for 30 days ("Free Trial for 30 Days") or a discount for 3 months of service ("Discount") (collectively, the "QuickBooks Offer"). QuickBooks Live Bookkeeping is not included in the QuickBooks Offer. Free trial for 30 days: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. To continue using the QuickBooks Products after your 30-day trial, you'll be asked to present a valid credit card for authorization. Thereafter, you'll be charged on a monthly basis at the then-current fee for the service(s) you've selected until you cancel. To be eligible for this offer you must sign up for the free trial plan using the "Try it free" option.

Discount offer: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price.To be eligible for this offer you must sign up for the monthly plan using the "Buy Now" option. Offer terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can't be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers only. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation terms: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select "Cancel." Your QuickBooks Products cancellation will become effective at the end of the monthly billing period. You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

QuickBooks Online Payroll terms: Each employee is an additional $6/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $6/month for Core, $8/month for Premium, and $110/month for Elite. Service optimized for up to 50 employees or contractors and capped at 150. The service includes 1 state filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. There is no additional charge for additional state tax filings in Elite. The discounts do not apply to additional employees and state tax filing fees.

QuickBooks Enterprise

Enterprise subscription: Your subscription of QuickBooks Desktop Enterprise Silver, Gold or Platinum is valid for the first 12 months starting from purchase date. After 12 months, your credit/debit card account on file will automatically be charged on a monthly or annual basis at the then-current fee for the QuickBooks Desktop Enterprise product and plan you’ve selected until you cancel. You can cancel at any time by going to Account & Settings in QuickBooks and select “Cancel” or by calling 800-300-8179, prior to your renewal date.

Both the Annual and Monthly Option Plan commits you to a 12-month term; fees vary per plan. If you select the Monthly Option Plan then you will pay the then-current fee over the course of 12 months. Intuit will authorize your card to ensure prompt order processing, resulting in a temporary hold on your account. If you cancel inside the 60 day money back guarantee period you can opt to receive a refund (see: money back guarantee terms and conditions). If you cancel outside of the 60 day money back guarantee period you will have access to QuickBooks Enterprise for the remainder of the 12 month term in which you paid for. Upon expiration of your paid subscription you will no longer have access to the product or any of its connected services. See Subscription Terms & Conditions for details.

QuickBooks Enterprise Diamond: Is sold in increments of 1-10, 20, 30, and 40 users. It is compatible with, but does not include hosting. (Hosting sold separately.) It is a subscription and is only available on a monthly payment plan with no annual commitment. Each month, your account will be automatically charged the agreed-upon price unless and until you cancel.

Diamond includes all the features of QuickBooks Desktop Enterprise Platinum edition with the exception of Enhanced Payroll. Diamond also includes QuickBooks Assisted Payroll and QuickBooks Time Elite time tracking.

Cancel Enterprise Diamond at any time by calling Intuit at 800-300-8179, prior to your monthly renewal date. When you cancel, you will have access to QuickBooks Desktop Enterprise Diamond for the remainder of the month for which you have already paid. The following month, you will no longer have access to the product or any of its connected services. We will authorize your card to ensure prompt order processing, resulting in a temporary hold on your account. See Subscription Terms & Conditions.

Automatic QuickBooks product updates: Active QuickBooks Desktop Enterprise subscription members receive new versions of our products, along with updates to your current version, when and if released within 12 months of QuickBooks Desktop Enterprise purchase date or subscription renewal date.

**Product information

Microsoft Word and Excel integration requires Word and Excel 2003, 2007 or 2010. Data can be imported to QuickBooks Online Simple Start, Essentials, or Plus from the following QuickBooks desktop versions: Pro 2008 or later, Premier 2008 or later, Mac 2013 or later. Earlier versions: Basic 99-2005, Simple Start Edition, Pro & Premier 99-2007 can be imported using a downloadable tool. Import from QuickBooks desktop must be completed within the first 60 days of setting up your new QuickBooks Online account.

QuickBooks Enterprise - Industry editions: Industry-specific editions for Manufacturing & Wholesale/Distribution, Nonprofit, Contractor/Construction and Retail have all the key features of the standard edition of QuickBooks Desktop Enterprise plus additional reports and tools tailored to the industry type. Unit of Measure feature not included in the Retail edition. Billing Rate Levels only available in Premier Professional Services, Contractor, and Accountant Editions; not available in Pro, Premier, Nonprofit, Manufacturing & Wholesale, and Retail editions.

**Features

QuickBooks features

Receipt capture: Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Collaborate with your accountant: You can connect up to the following for each product: 1 billable user and 2 accounting firms for QuickBooks Online Simple Start, 3 billable users and 2 accounting firms for QuickBooks Online Essentials, 5 billable users and 2 accounting firms for QuickBooks Online Plus, 25 billable users and 3 accounting firms for QuickBooks Online Advanced. Accounting firms must connect using QuickBooks Online Accountant.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit and application approval. Additional terms, conditions and fees apply.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Instant deposit: Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard payment processing fees also apply to each transaction. Deposits are sent to the bank account linked to an eligible debit card in up to 30 minutes from the initiation of the deposit. Deposit times may vary for third party delays.

Cash flow: QuickBooks Cash Account opening is subject to identity verification and approval by Green Dot Bank. QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank. QuickBooks Payments account subject to eligibility criteria, credit and application approval.

Free Instant Deposit: Includes use of Instant Deposit without the additional cost. Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Deposits are sent to the bank account linked to your QuickBooks Debit Card or another eligible debit card in up to 30 minutes. Deposit times may vary for third party delays.

Cash flow planner: Cash flow planning is provided as a courtesy for informational purposes only. Actual results may vary.

QuickBooks Payments and QuickBooks Cash accounts: Users must apply for both QuickBooks Payments and QuickBooks Cash accounts. QuickBooks Payments’ Merchant Agreement and QuickBooks Cash account’s Deposit Account Agreement apply.

QuickBooks Cash account:Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A. Inc. Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Account funds are FDIC-insured up to the allowable limits upon verification of Cardholder’s identity. Visa is a registered trademark of Visa International Service Association. Green Dot is a registered trademark of Green Dot Corporation. ©2020 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.FDIC insured up to $250,000: QuickBooks Cash Account funds are FDIC-insured up to the allowable limits through Green Dot Bank, Member FDIC upon verification of Cardholder’s identity. Coverage limit is subject to aggregation of all of Cardholder’s funds held on deposit at Green Dot Bank.

Mobile signatures:Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Pay-enabled invoices:Requires a separate QuickBooks Payments account which is subject to eligibility criteria, credit and application approval. Additional fees may apply. Additional terms and conditions apply.

Third party apps:Third party applications available on apps.com. Subject to additional terms, conditions, and fees.

Automated 1099 e-file & delivery:Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Bill Pay:Bill Pay services powered by Melio with funds held by Evolve Bank & Trust or Silicon Valley Bank (members of the FDIC and the Federal Reserve). Requires a Melio account and acceptance of their Terms of Service and Privacy Statement. Subject to additional terms, conditions, and fees.

Accelerated Invoicing:QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 20% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

Premium Apps:Apps may require a third-party subscription. Subject to additional eligibility criteria and fees.

Account team benefits for Priority Circle:Only available with a paid subscription. Trial customers have access to QuickBooks Online Advanced product experts.

Priority Circle: Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging Premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

Automatic data backup and recovery:QuickBooks Online uses technical and administrative security measures such as, but not limited to, firewalls, encryption techniques, and authentication procedures, among others, to work to maintain the security of your online session and information.

Payroll Features

Auto Payroll:Available if setup for employees and the company are complete, all employees are salaried employees, or hourly employees on default hours, and set up on direct deposit. Requires bank verification, the account must not have been on hold in the last 6 months, and the first payroll must have been run successfully.

Health benefits:Powered by SimplyInsured and requires acceptance of SimplyInsured’s Privacy Policy and Terms of Use. Additional fees will apply. SimplyInsured does not offer insurance in HI, VT, and DC. Insurance coverage eligibility is not guaranteed, and depends solely on the rules of the insurance carrier. The insurance carrier has sole and final discretion as to the eligibility for health insurance products.

Guideline 401(k):401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline's Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and payroll access required to sign up for a 401(k) plan with Guideline.

Automated 1099 e-file & delivery:Prepare your 1099s in QuickBooks at no extra charge. If you choose the 1099 E-File Service, Intuit will e-file your Federal 1099 information with the IRS, and then print and mail a copy directly to your contractors; fees apply. As part of the paid 1099 E-File Service, we also give your contractors online access to their 1099s. State filing not included. You should check with your state agency on any state filing requirements.

Expert product support:Included with your paid subscription to QuickBooks Online Payroll. Chat support available 24/7. US-based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Your subscription must be current. Get more information on how to contact support. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Next-day direct deposit:Available to only QuickBooks Online Payroll Core users. Payroll processed before 5PM PST the day before shall arrive the next business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Next-day direct deposit may be subject to eligibility criteria. Deposit delays may occur because of third party delays, risk reviews, or issues beyond Intuit’s control. Next-day direct deposit is available for contractors and employees. Direct deposit for contractors is $6 per month. Each employee is $6 per month with no additional fees for direct deposit.

Same-day direct deposit:Available to QuickBooks Online Payroll Premium and Elite users. Payroll processed before 7 AM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Same-day direct deposit may be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Same-day direct deposit available only for employees.

Workers’ comp administration:Benefits are powered by AP Intego and require acceptance of AP Intego’s Privacy Policy and Terms of Use. Additional fees will apply. There is a monthly fee (currently, $5 per month) for QuickBooks Online Payroll Core users for the QuickBooks Workers' Comp Payment Service. This non-refundable fee will be automatically added to each monthly Intuit invoice at the then-current price until you cancel. The fee is separate from any workers’ comp insurance policy premium by AP Intego Insurance Group. Workers’ Compensation Service requires an active and paid QuickBooks payroll subscription. Eligibility criteria applies to transfer active insurance policy broker of record, including insurance carrier, policy renewal date, and payment method. Workers compensation insurance is not available in OH, ND, WA and WY.

HR services:HR support is provided by experts at Mammoth, Inc. Requires acceptance of Mammoth’s Privacy Policy and Terms of Use. HR Support Center available only to QuickBooks Online Premium and Elite subscriptions. HR Advisor support only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients

Expert review:Available upon request to QuickBooks Online Payroll Premium and Elite users.

QuickBooks Time:Additional fees may apply. Time tracking included in the QuickBooks Online Payroll Premium and Elite subscription services. Features vary. The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

QuickBooks Time Mobile:The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Expert setup: Available to QuickBooks Online Payroll Elite users only.

24/7 expert product support:24/7 customer support is included with your paid subscription to QuickBooks Online Payroll. Chat support available 24/7. U.S. based phone support is available Monday through Friday 6 AM to 6 PM PT and Saturday 6 AM to 3 PM PT. Your subscription must be current. Intuit reserves the right to limit the length of the call. Terms, conditions, features, pricing, service and support are subject to change without notice.

Automated tax payments and filings:Automated tax payments and filing available for state and federal taxes. Enrollment in e-services is required for tax payments and filings only. Automated tax payments and filings for local taxes available in QuickBooks Online Payroll Premium and Elite only.

QuickBooks Workforce:Available to employees. Requires an Intuit Account and acceptance of the Intuit Terms of Service and Privacy Statement.

Garnishments and deductions:Available for employees only. User is responsible for setting the garnishment amount and making the garnishment payment to the appropriate entity.

Enterprise features

QuickBooks Desktop Enterprise with Hosting: QuickBooks Desktop Enterprise with Hosting is a subscription and only available on a monthly payment plan. If you purchase QuickBooks Desktop Enterprise with Hosting user licenses 1-10, you must purchase an equal number of hosted users as you purchase Enterprise licenses. If you wish to purchase QuickBooks Desktop Enterprise with Hosting with 11-30 licenses, please call for custom pricing.

The Hosting Service is a monthly subscription. Each month, your account will be automatically charged the agreed-upon price of the Hosting service unless and until you cancel. Cancel at any time by calling Intuit at 800-300-8179, prior to your monthly renewal date. When a customer calls to cancel, it is canceled and refunded at the date through the end of the current billing period. The QuickBooks Desktop Enterprise software portion of the QuickBooks Desktop Enterprise with Hosting bundle is an annual subscription.

If you choose to purchase QuickBooks Desktop Enterprise using the Monthly Payment Plan or QuickBooks Desktop Enterprise with Hosting, you elect to pay your annual subscription in equal payments over the course of 12 months. Purchasing an annual subscription for QuickBooks Desktop Enterprise commits you to a 12 month term. You must pay for all 12 months of the subscription in full based on the then current rate of QuickBooks Desktop Enterprise. If you choose to cancel inside the first 60 days, you can opt to receive a refund per the 60 day money back guarantee (see https://quickbooks.intuit.com/software-licenses/ for details). However, if you choose to cancel after the first 60 days and prior to the end of month 12 you will be subject to a termination fee equal to the amount of monthly payments left on your annual subscription. For purpose of clarity, if you pay for 6 months and have 6 months remaining on your annual subscription, which starts at date of enrollment, you will be charged a termination fee equal to the then current monthly fee of QuickBooks Desktop Enterprise multiplied by 6 months (remaining months left on annual subscription).

Right Networks:Support for QuickBooks Desktop Enterprise with Hosting is provided by Right Networks. A valid QuickBooks Desktop Enterprise license code must be provided to Right Networks to receive support. Contact Right Networks to contract third-party software.

Right Networks performs backups of all Hosted data on a nightly basis and retains the back-ups for a rolling 90-day period in a protected offsite facility as an additional level of protection. There is no limitation to the size of a customer’s back-up. Customers are responsible for verifying the integrity of the hosted data at least every 90 days. Right Networks employs Snapshot technology to backup customer data. Snapshots are taken daily and then replicated to another physical Right Networks facility for Disaster Recovery.

Right Networks uses top-tier data centers and multiple layers of redundancy within its infrastructure to provide 24×7 availability. However, availability can vary, is subject to occasional downtime and may change without notice. Right Networks encrypts all backup files and backup tapes. Virtual desktop connections are protected via TLS with a minimum of 128 bit encryption and authentication. Each customer has a unique Right Networks virtual desktop. Access to each QuickBooks company file is controlled at multiple layers including file access permissions. Access is locked out after multiple failed login attempts for the same user. Security features, functionality and access are subject to change without notice as deemed necessary by Right Networks. Availability can vary and are subject to occasional downtime and may change without notice. Click here for a list of compatible devices.

Internet connectivity required:Desktop Enterprise with Hosting is subject to availability of a reliable Internet connection. See detailed list of systems requirements, and a list of what RDP clients work with the hosting service here.

Remote Desktop Services compliant:QuickBooks Desktop Enterprise is Remote Desktop Services compliant. Additional fees may apply. Requires certain hardware, Microsoft Server operating systems, Microsoft Windows Server software licenses, and Remote Desktop Services Server Client Access Licenses, sold separately. For multiple remote users, a Remote Desktop Services Client Access License is required for each user.

Advanced InventoryIncluded in the Platinum and Diamond subscriptions only. Requires an internet connection. Includes related sub-features such as mobile barcode scanning, alternate vendors center and alternate vendors report, cycle count, bin location tracking, enhanced pick pack and ship, express pick pack and ship, landed cost. Shipping subject to terms and conditions set forth by UPS, FedEx, and USPS. Barcode scanners sold separately.

Advanced Reporting is included in all QuickBooks Desktop Enterprise subscriptions. Requires an internet connection.

Advanced Pricing is included in the Platinum and Diamond subscriptions only. Requires an internet connection.

List capacity:QuickBooks Enterprise allows you to add up to 1 million names (e.g., customers, vendors, employees) and up to 1 million items (e.g., inventory, non-inventory, and service items). Some performance degradation is likely as your lists approach these size thresholds.

User licenses:Each unique user requires a license. Each license sold separately. All copies of QuickBooks must be the same version-year. Licenses are available in single-user increments from 1 to 10 users. 20 or 30 user licenses are also available. Diamond can support up to 40 users. Fees apply.

Technical Specifications

Click here to read the Minimum technical requirements and system requirements.

Terms, conditions, pricing, features, service and support are subject to change without notice.

Call Sales: 1-800-285-4854

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.