Managing revenue and expense types

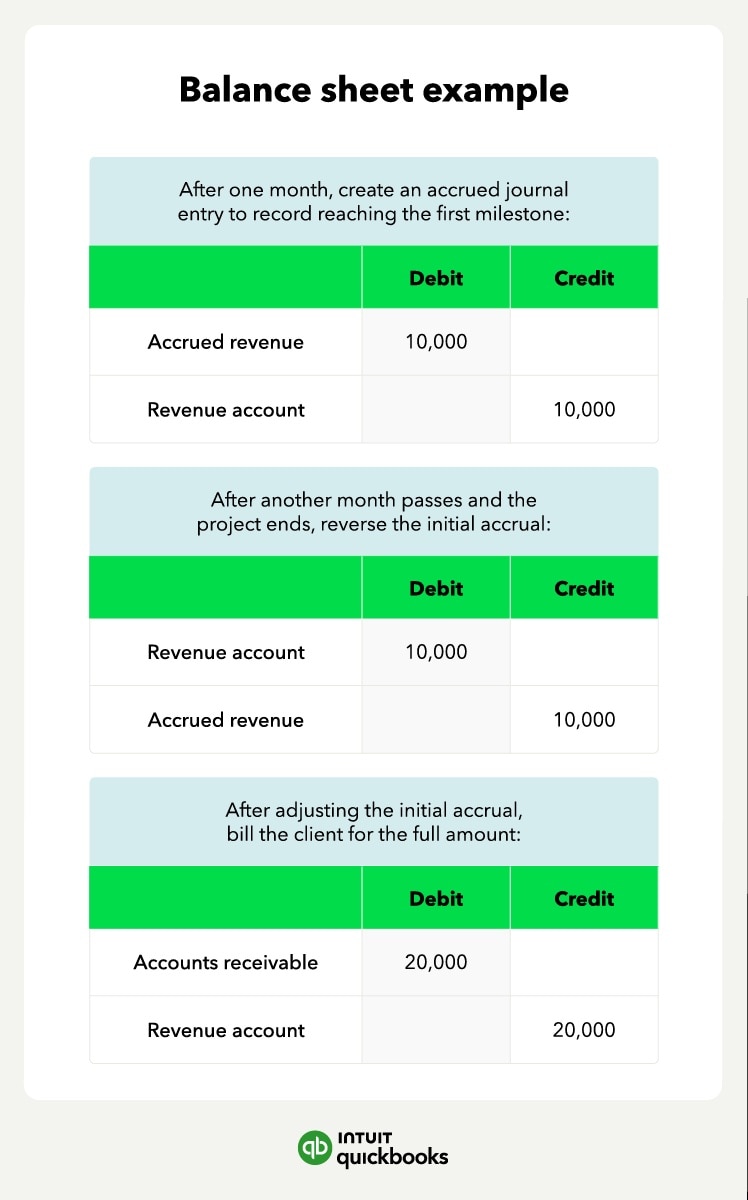

Inexperienced accountants can lose track of revenue accrual on a balance sheet. Certain financial statements call it unbilled revenue, and others set it next to other types of income. To help you manage these revenue types, we’ll break them down below. To recap:

- Accrued revenue is an asset.

- You should record it after performing a service.

- It appears on financial statements before the actual payment comes through.

Accrued revenue vs. deferred revenue

You earn deferred revenue when customers pay for a service before you provide it. Accrued revenue uses the reversed process where payment follows a service. So, while you recognize accrued revenue before receiving cash, you recognize deferred revenue afterward. Other differences include:

- Deferred revenue is a liability because you still need to earn it

- You can spread deferred revenue across multiple entries.

Example: A subscription service uses deferred revenue. Customers pay up-front for months or a year of access to a service. After a transaction goes through, the subscription begins.

Earned revenue vs. accrued revenue

Earned revenue refers to the money you get for providing a good or service. Unlike accrued revenue, you make earned revenue right after the transaction ends. Earned revenue is more common in retail and e-commerce.

- Earned revenue is an asset

- You record it after providing a service, the same time you earn the revenue

Example: Retail storefronts base their business model on earned revenue. When a customer chooses to leave with your product, they pay you at the same time you provide the good. With earned revenue, the monetary transaction and exchange of goods occur at once.

Accrued expenses vs. accrued revenue

Similar to accrued revenue, you record accrued expenses after incurring them. Unlike accrued revenue, an accrued expense refers to money a company owes, not income it’s due to receive. For example, purchasing goods from a supplier is an accrued expense until you pay the invoice.

- Accrued expenses are liabilities

- You record them upon incurring a charge and pay them later.

Example: Employee wages, bonuses, and commissions also count as accrued expenses. Because wages accrue in the period they occur but reach employees later, they're an accrued expense the company owes.

Still not quite sure how to manage the different revenue and expense types? Look into payment services to streamline accrual accounting in your business.