Accounts receivable turnover example

Centerfield Sporting Goods had $250,000 in net credit sales in 2024. They found this number using their annual income statement.

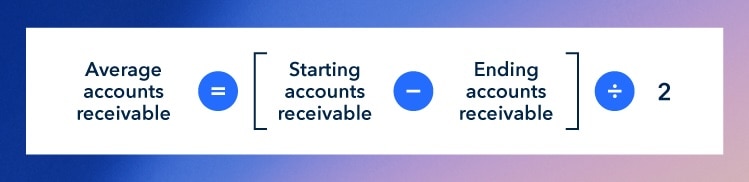

The company’s average accounts receivable for 2024 was $50,000. They found this number using their January 2024 and December 2024 balance sheets. At the beginning of the year, in January 2024, their accounts receivable totaled $40,000.

In December 2024, their accounts receivable totaled $60,000. To find their average accounts receivable, they used the average accounts receivable formula.

($40,000 + $60,000) ÷ 2 = $50,000

To find their accounts receivable turnover ratio, Centerfield divided its net credit sales ($250,000) by its average accounts receivable ($50,000).

$250,000 ÷ $50,000 = 5

Their accounts receivable turnover ratio is 5. They collect average receivables five times per year or every 73 days.

Centerfield Sporting Goods specifies in their payment terms that customers must pay within 30 days of a sale. Their lower accounts receivable turnover ratio indicates it may be time to work on their collections procedures.

In doing so, they can reduce the number of days it takes to collect payments and encourage more customers to pay on time.

Every industry has a unique accounts receivable turnover range. Research benchmarks for your sector to ensure your ratio aligns with industry standards.

Every industry has a unique accounts receivable turnover range. Research benchmarks for your sector to ensure your ratio aligns with industry standards.