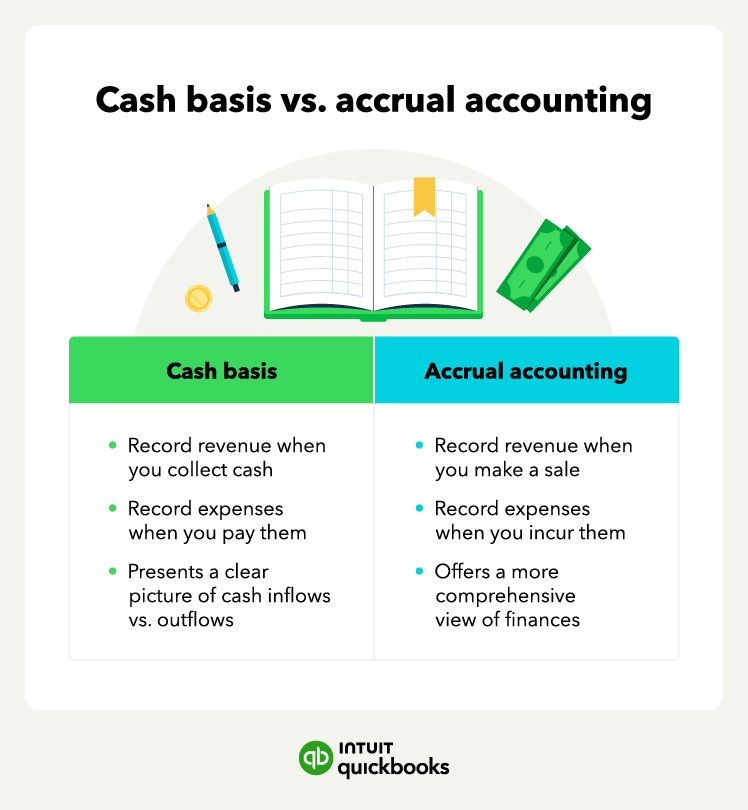

Choosing the right accounting method is one of the most important decisions a small business owner can make. For many, cash basis accounting offers a simple and effective way to track income and expenses while maintaining a clear picture of their financial health.

With more than half of accountants saying that rising prices are squeezing small businesses, finding the tools and methods to model your finances accurately is more important than ever. With the help of an AI accounting agent, cash basis accounting is simple—an agent can track transactions for you, automatically categorizing income as it's received and expenses as they're paid out.

But how do you know if this method aligns with your needs? Cash method accounting focuses on when money actually enters or leaves your account, making it ideal for small businesses with straightforward transactions. Learn more about all things cash basis accounting here.

How does cash basis accounting work?

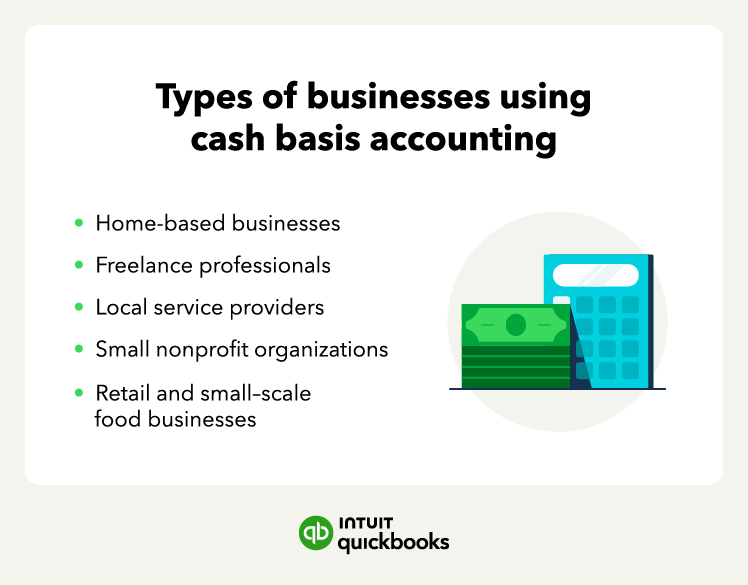

Who should use cash basis accounting?

Cash basis of accounting examples

Advantages of cash basis accounting

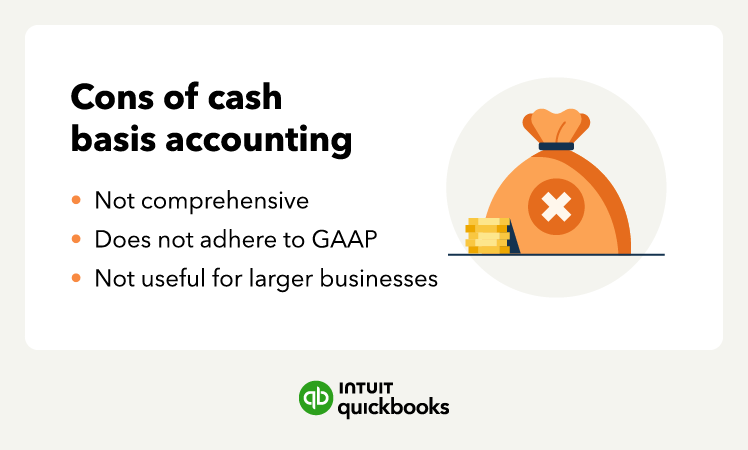

Disadvantages of cash basis accounting

When considering cash basis accounting, think about how stable and steady your income flows are, as this will have a major impact on whether this method makes sense for you.

When considering cash basis accounting, think about how stable and steady your income flows are, as this will have a major impact on whether this method makes sense for you.