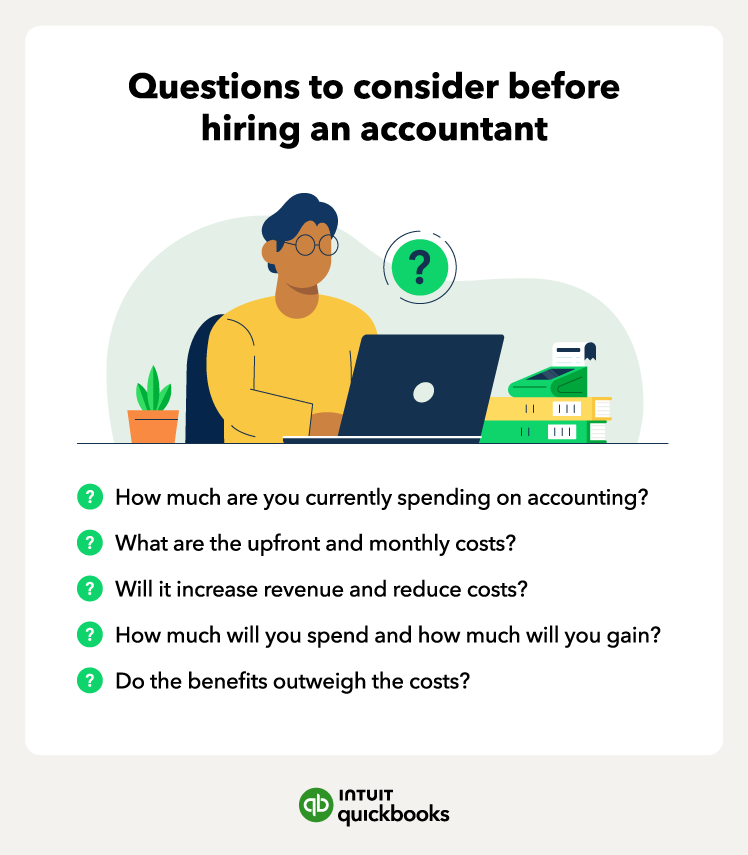

A cost-benefit analysis weighs the benefits and the costs of hiring an accountant by putting a price tag on the pros and cons. This analysis is only an estimate but helps determine if an investment makes sense for your business.

To analyze the cost-benefit of hiring an accountant, you can:

- Determine how much it will cost to keep doing what you’re doing: Consider what accounting efforts you already have in place and how much time and money you’re spending.

- Identify the costs of hiring an accountant: Get quotes from accountants in your area and determine costs, including upfront costs, monthly costs, accounting software costs, and any unexpected expenses.

- Identify the benefits of hiring an accountant: Determine what you will gain from hiring an accountant, including potential revenue, reduced costs, efficiency, time saved, and long-term benefits.

- Assign a monetary value to the benefits and the costs: Estimate how much you will have to spend and how much you will gain, even if they don’t have a monetary value, such as saving time on accounting and staying compliant.

- Compare your costs and benefits: Determine whether the benefits outweigh the costs and how long it will take you to break even after the initial investment.

Comparing costs and benefits may not be as straightforward as you think. After all, some factors can be difficult to put a price on. You can create different scenarios, such as hiring someone to manage accounting software or hiring an accountant for special projects.

How to find an accountant

If you decide that hiring an accountant will be most beneficial for your business, you might wonder how to find one. Finding an accountant that fits your business’s needs requires some research.

Here are some steps to finding an accountant:

- Determine what services you need: Decide if you’ll need accounting services year-long or only for special projects, like bookkeeping, auditing, or tax preparation.

- Identify what accounting firms can offer: Compare what services they can provide you and if they have all the services you need.

- Search for accountants around your area: Look at online resources such as the American Institute of Certified Public Accountants (AICPA) or ask for recommendations from other small business owners.

- Evaluate their typical accounting fees: Compare accountant fees and evaluate which one fits your budget.

Once you find potential accountants or firms you can hire, you can meet with them to talk about their services and what they can offer you. Then consider running another cost-benefit analysis to ensure the benefits outweigh the costs.

Hiring an accountant vs. using accounting software

But what happens when the accountant's costs don’t fit your budget? Sometimes, hiring an accountant might not be the best decision for your business yet, but you still have to take care of accounting.

Calculate how much an accountant will cost your business compared to using accounting software. Accounting software can help you automate your accounting services, track transactions as they happen, and even prepare tax documents and reports.

Consider looking for accounting software with advanced features such as mileage tracking, invoicing, and time tracking. Accounting software could be a more budget-friendly option, even if you have to hire someone to manage the platform.

Streamline your accounting and save time

Now that we’ve got the “how much does an accountant cost” question out of the way, you can have a better understanding of how much you may have to pay for accounting services.

If you still find that hiring an accountant is not the best decision yet, using accounting software can help you take care of your accounting needs so you can focus on your work.