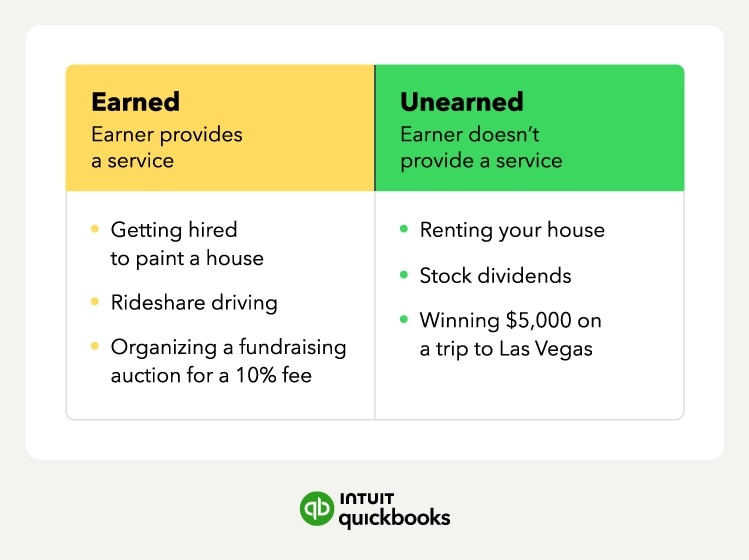

Earned income

Earned income is money you receive in exchange for providing a service or performing labor. It's sometimes called "active income" because it requires your direct participation.

This type of income is generally subject to federal and state income taxes. It's also where payroll taxes,like Social Security and Medicare,come into play.

Examples: The most common examples for small business owners are wages, salaries, commissions, and earnings from self-employment. If you're a freelance graphic designer, the money you get from a client for a completed project is earned income.

Why does the earned income distinction matter?

The Internal Revenue Service (IRS) uses the earned income distinction for more than just a classification system; it can directly affect your eligibility for tax credits and your ability to save for retirement.

For example, the Earned Income Tax Credit (EITC) is specifically designed to benefit low-to moderate-income workers. Eligibility limits apply to both investment income (unearned) and all earned income. The amount received is based on factors other than income; eligibility is based on both earned and unearned income.

Also, to contribute to a traditional or Roth IRA, you must have earned income. Unearned income, such as investment gains or rental profits, can't be used for these contributions.