When you start your business, time and money are in short supply. Your top priorities are finding customers and delivering a great product or service. Bookkeeping and accounting likely aren’t at the top of your to-do list.

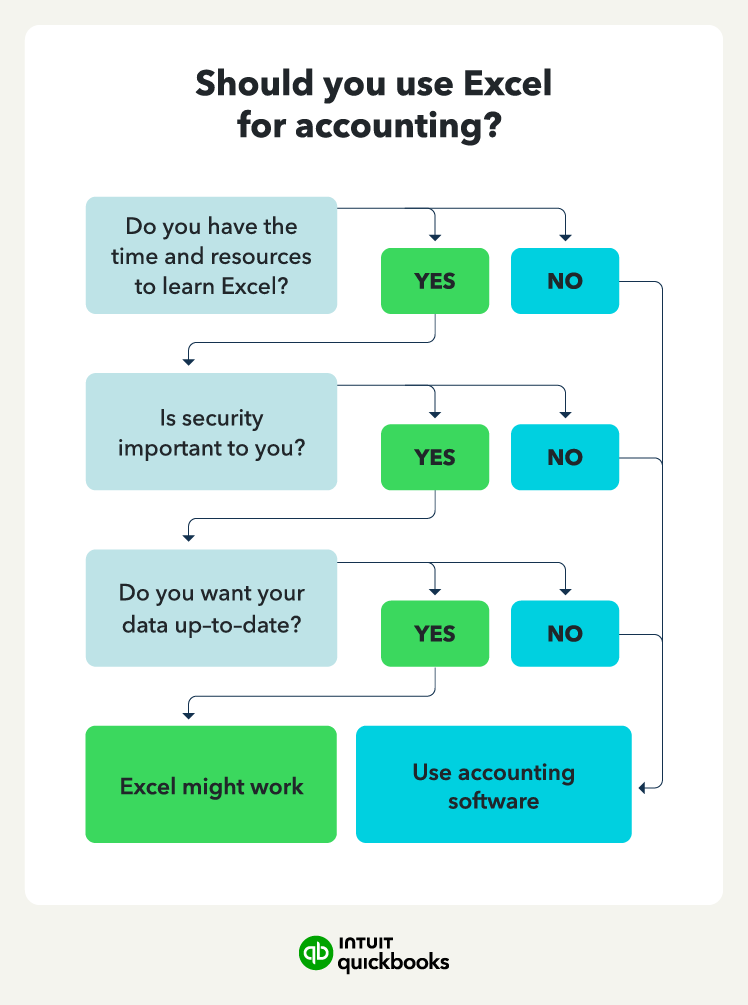

Many small business owners use an Excel accounting template at first because it’s more familiar and straightforward. However, most accounting professionals encourage the use of online accounting software for easy and more accurate accounting and bookkeeping.

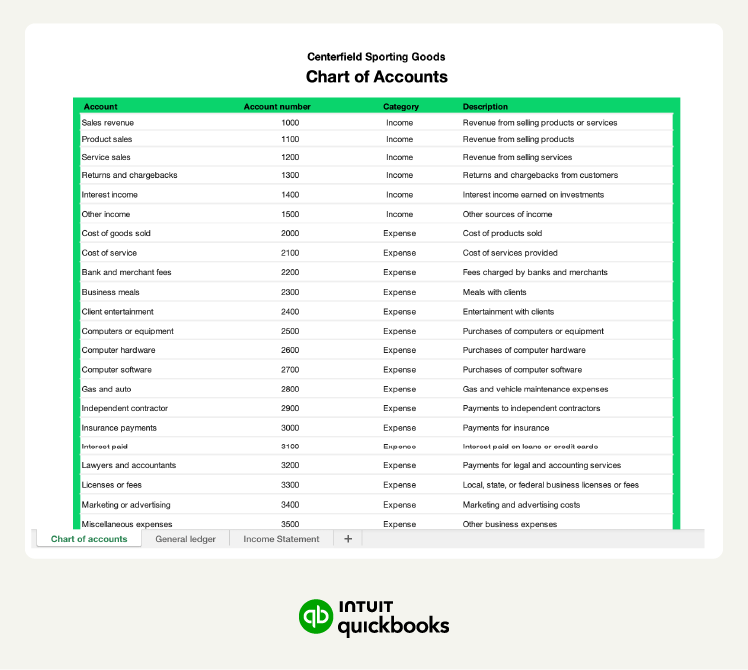

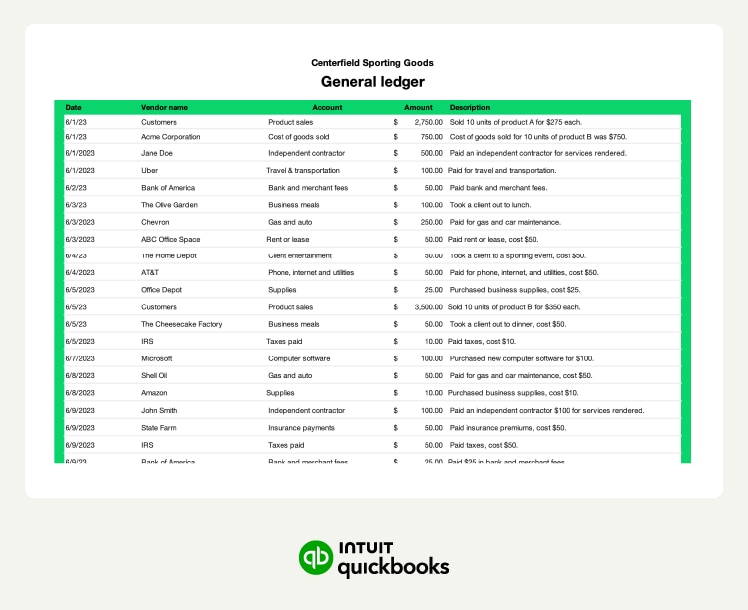

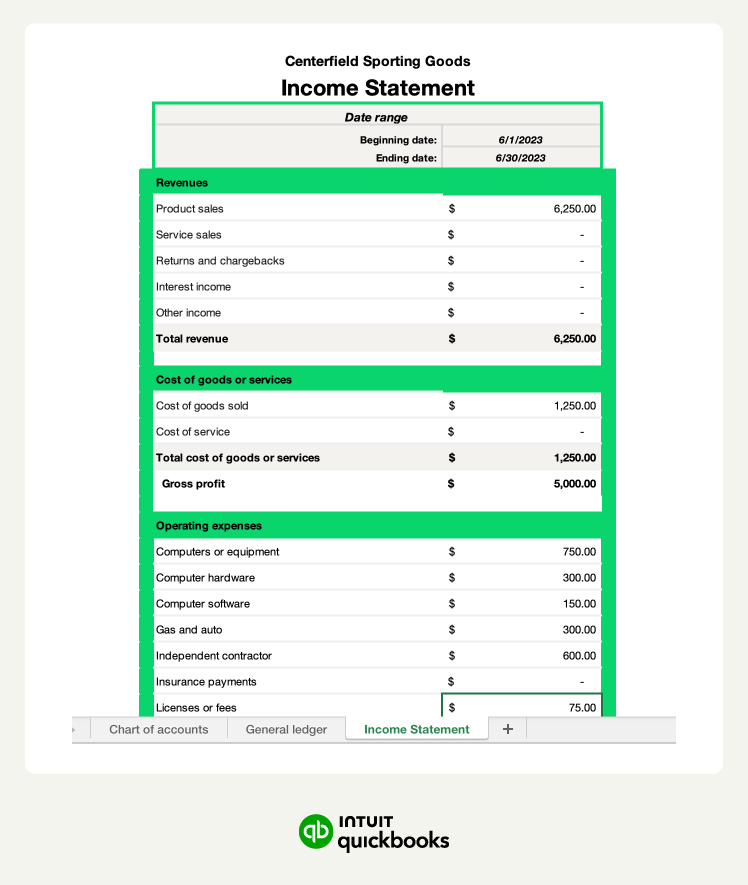

Excel is a very straightforward way to do it but you’ll still need to understand the accounting process and how to complete each task using Excel. You’ll need to set up accounts, post transactions, and create your income statement using Excel—that’s where this beginner’s guide comes in to simplify how to set up and use Excel for accounting.