Ready or not, pumpkin-spice-everything season is upon us! So before you fall into familiar routines, check out our updates including a new migration tool (that’s not just a bird thing).

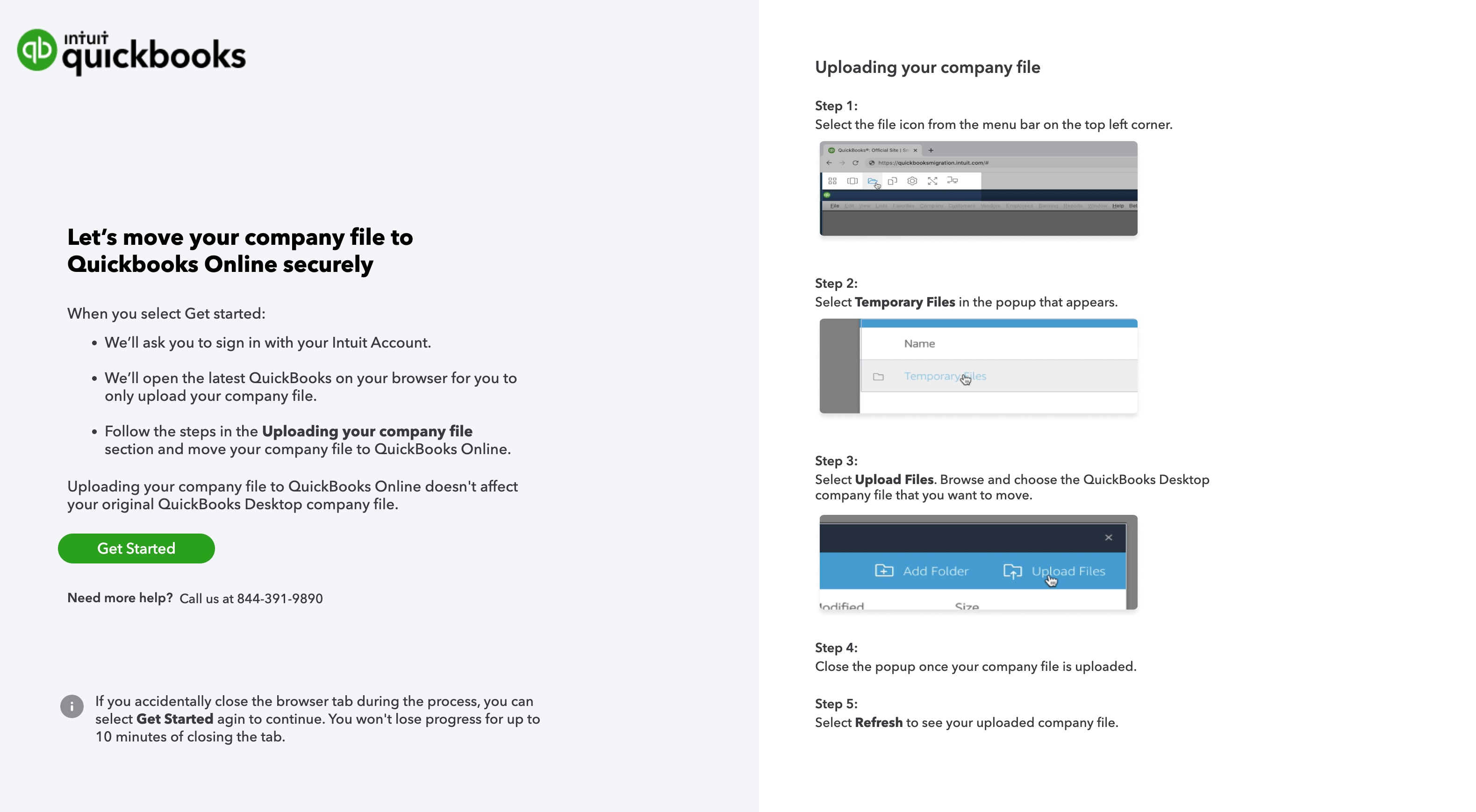

QuickBooks® Desktop Online migration tool

In a nutshell: Migration from QuickBooks Desktop to QuickBooks Online is easier than ever with the new online data migration tool.

Now, your accountant doesn't even need to have access to QuickBooks Desktop in order to help move you to QuickBooks Online. They will just need to launch the online tool, and it will securely move data from QuickBooks company files (.QBW), portable files (.QBM), backup files (.QBB), and QuickBooks for Mac files if you save a backup for Windows (.qbb) to QuickBooks Online.

Start here for Desktop Pro/Premier accounts, and if you have an Enterprise account, you can start here.