According to QuickBooks research, 48% of small business owners plan to build personal wealth by growing their business.

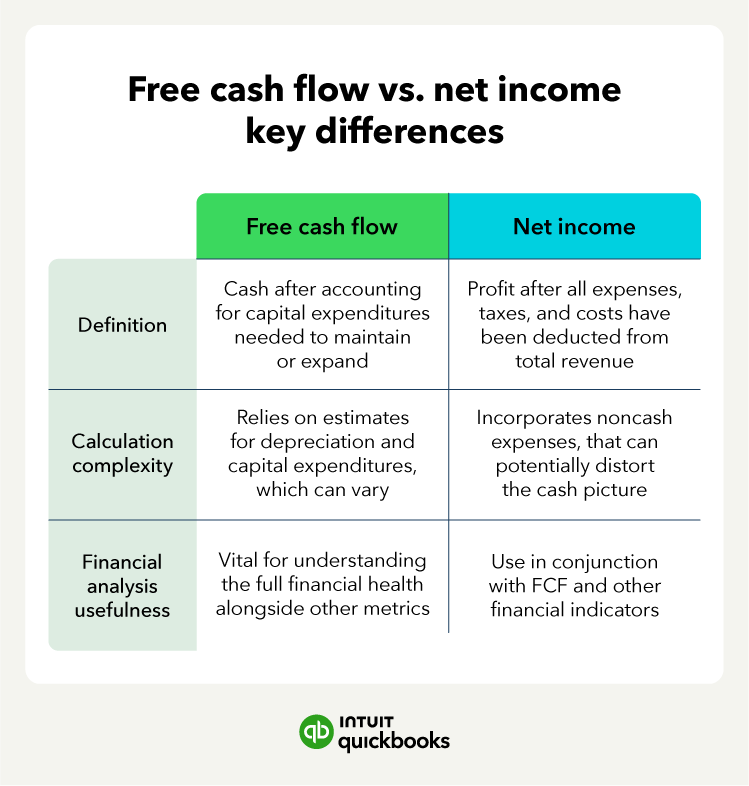

To manage a business and grow personal wealth, these business owners must understand the difference between free cash flow vs. net income. Free cash flow and net income are essential elements of a healthy, growing business, but they are not the same.

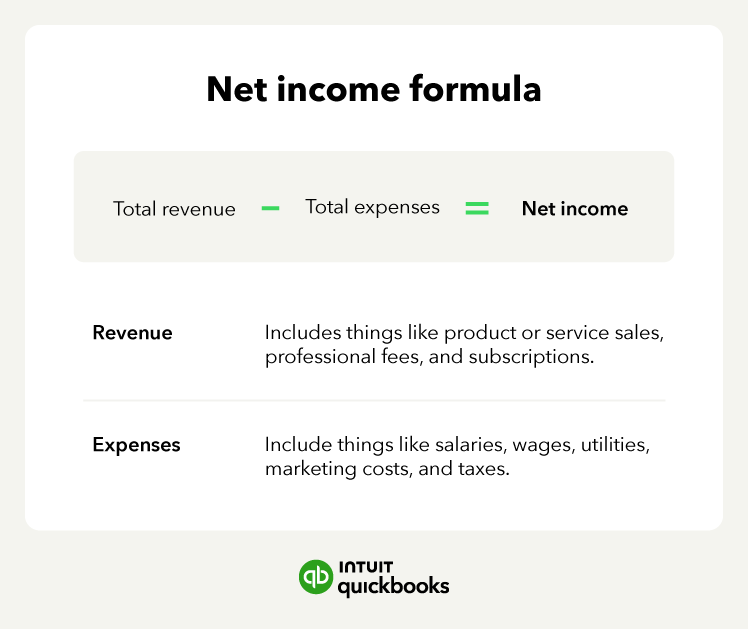

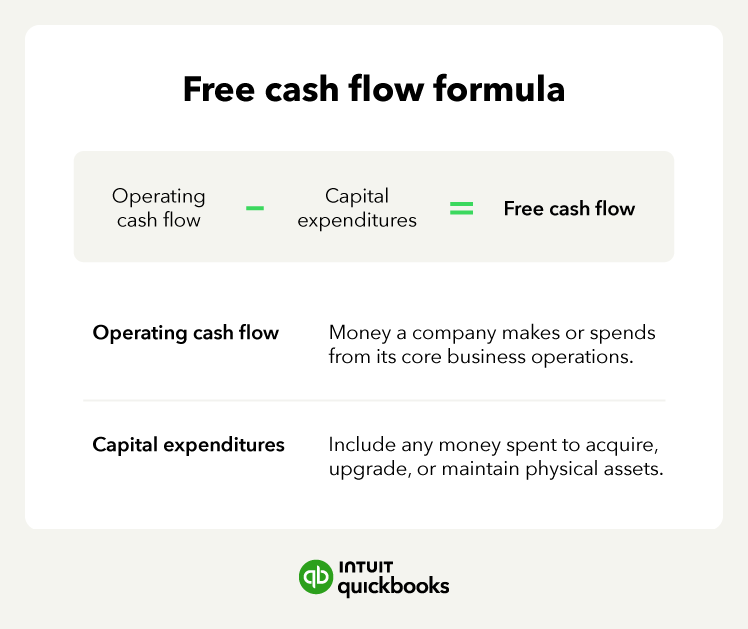

One refers to profitability, while the other simply shows how available cash moves. A business’s net income is listed on an income statement, but free cash flow is calculated using the company’s income statement and balance sheet.

Both, however, are instrumental in providing a comprehensive view of a company's financial health and sustainability. Let’s break down how these metrics work and how to use them to make more confident financial decisions.

Jump to:

Managing when and how bills get paid can directly affect free cash flow. Tools like

Managing when and how bills get paid can directly affect free cash flow. Tools like