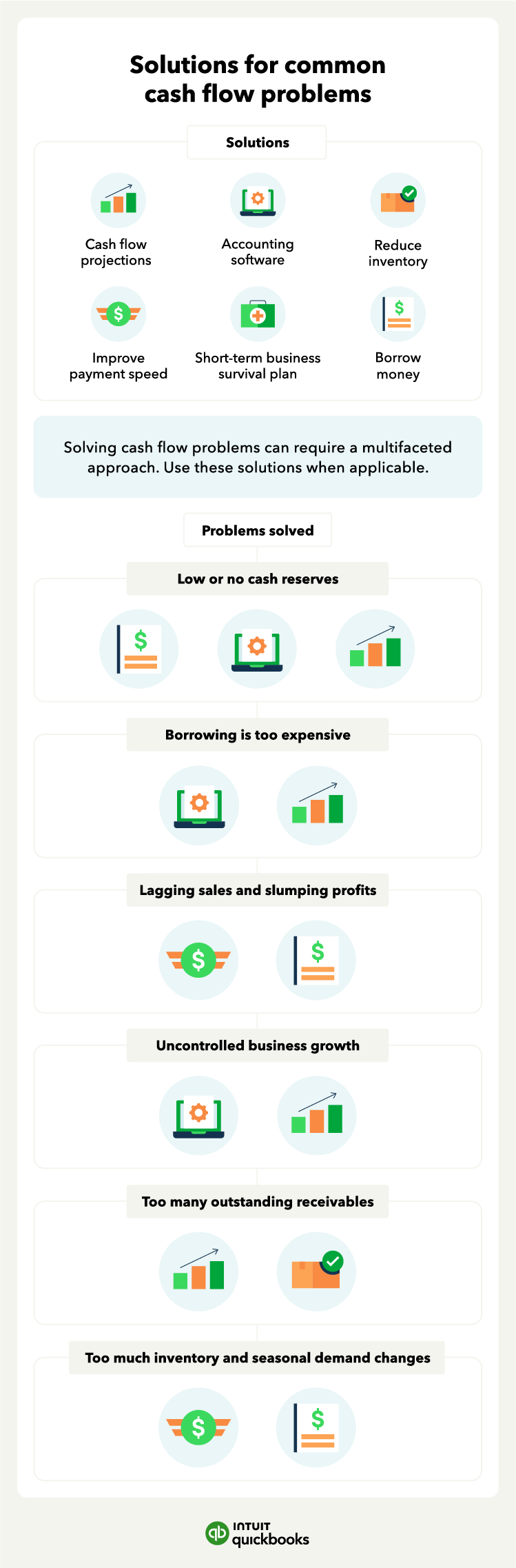

Other cash flow solutions

Cash flow problems can threaten your business’s health, whether you’re self-employed or a small business owner with employees. Fortunately, you can use these tactics to help tackle common cash flow problems.

Reduce and negotiate your expenses

Reducing or negotiating expenses is a smart way to encourage positive cash flow. With more working capital, you can prioritize expenses and prevent cash flow problems from spiraling out of control.

Depending on your circumstances, a few creative changes may help get you back to positive cash flow.

- Discontinue nonessential services temporarily.

- Expand virtual services.

- Cancel or reduce premium services.

- Move to a lower-cost supplier temporarily.

- Reduce operating costs.

Looking for methods to reduce operating expenses isn’t easy, but it will bring essential and non-essential expenses into the spotlight.

Create a short-term business survival plan

For small business success, examine your business plan, processes, operations, income, and expenses. If your business works on a per-project basis, use job costing to review your business’s profit and loss statements and margins. Identify the lion’s share of expenses and profits in products, services, clients, and labor.

Understanding this information can give you an accurate cash flow projection under normal circumstances. It can also help you predict how scaling back will affect your business.

Consider borrowing options

Borrowing money is another way to balance your cash flow. Ideally, you opened lines of business credit when your finances were in a better place. But if that isn’t the case, ask your current financial service provider what they can offer before turning to other lenders.

Although short-term loans can seem like a lifeline when you’re experiencing problems with cash flow, there are caveats. First, you may need to have a documented business plan and cash flow forecast to show lenders. Second, interest rates and other terms and conditions can have lasting consequences. It is important to read the fine print before borrowing. Finally, if there’s an internal flaw in your business, a fresh injection of cash won’t solve cash flow problems, it will only delay them.