There is always a great deal of paperwork to be completed when you bring a new hire onboard, and in many situations, the majority of the information that you collect will be private. These files should be treated with care. If a paper with sensitive information is ever discarded, it should be shredded to maintain privacy.

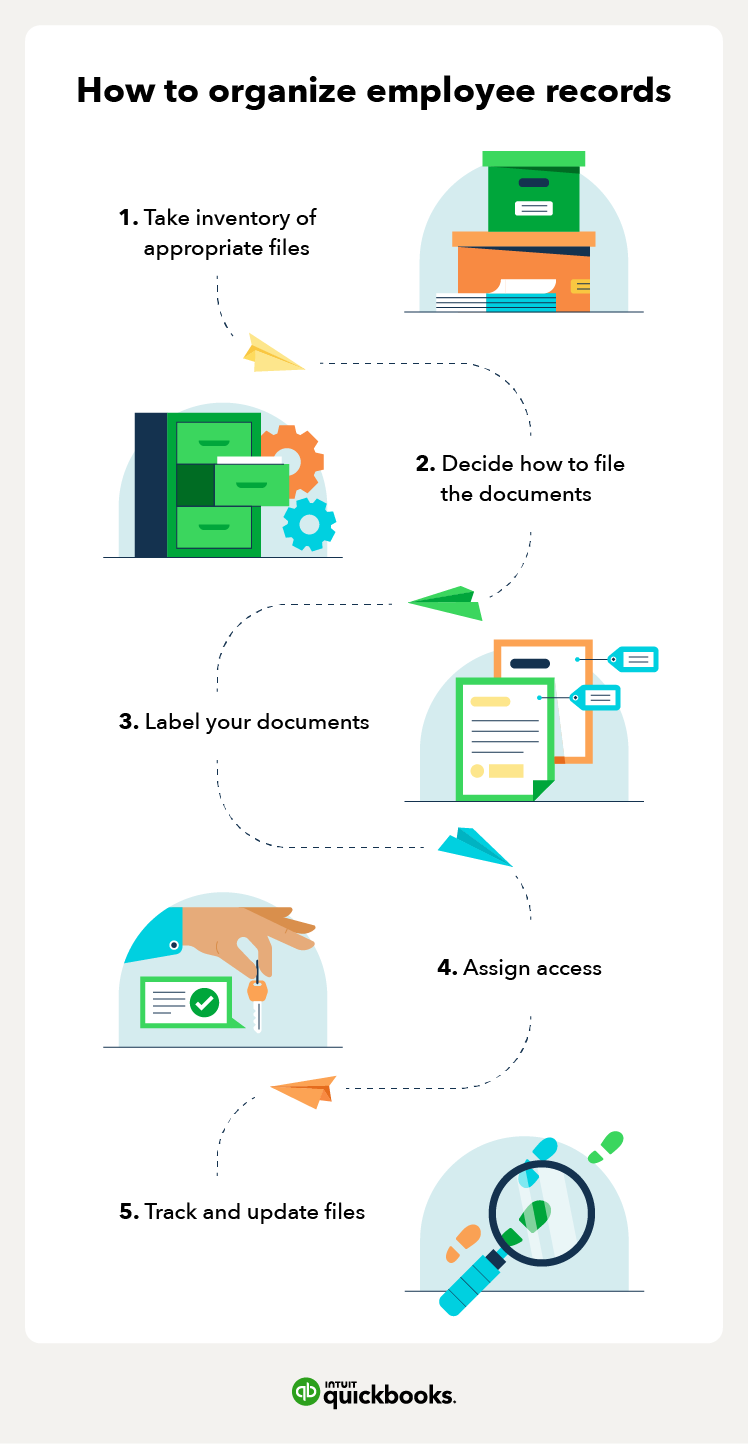

Organizing all these documents is a timely process, and you shouldn’t go into it blindly. Follow the steps below to take a systematic approach to organizing and updating your employee files.

1. Take inventory of appropriate files

Federal and state recordkeeping requirements may insist you separate and store documents in different places. Medical records, for example, have to be stored separately from personnel documents in order to comply with HIPAA regulations.

Before starting the filing process, take inventory of all documents and review state, federal, and company policies to see what categories they need to be separated into.

Tip: Keep a running checklist of the documents you’re required to keep. Before you separate them into personnel, payroll, and medical, ensure you have them all.

2. Decide how to file the documents

The method of filing personnel documents has changed significantly over the past few years. While the tried and true method of filing documents away in a filing cabinet used to do the trick, asynchronous work and cloud-based filing tools brought the process online.

For larger companies, an online filing system will be more effective in managing employee documents than physically doing it. You should look for a filing system that aligns with your company’s size and style of work.

Tip: If you’re still debating between paper or electronic, remember that it’s ok to do both as a safety precaution. Having physical copies of employee files is a great fallback if things go awry online.

3. Label your documents

Choosing a standardized template for labeling your documents will make the overall process more organized and help you easily access specific documents when you need them.

You can do this in whatever way suits you best. If you want to organize them by employee, using the employee’s last name followed by the document type might be helpful. If you want to label by document, doing the opposite may be your best bet. Some examples include:

[Employee Last Name, Document Name]

[Document Name, Employee Last Name]

Tip: Keep your labeling consistent, even for different documents. Once you find a template you like, stick with it for all documents to create uniformity and avoid confusion down the road.

4. Assign access

While companies typically have a standardized process for determining what staff members have access to what documents, state laws additionally regulate the access process. As a result, it’s imperative you’re well-versed in state laws while being an expert in internal processes.

Tip: Build a spreadsheet that lists the different documents and indicates which employees can access them. You can reference and update this regularly.

5. Track and update files

As your company fluctuates in size and federal regulations shift, you’ll find that you’re constantly updating your database.

This is where tracking software comes in handy. Since these records are constantly changing, you need a centralized system that you can easily access and update. As a result, opting for online software rather than paper documents and various spreadsheets tends to be a better medium—especially for larger organizations.

Tip: Online HR software tools give up-to-date information on changing federal and state laws to ensure you never get behind.

Tips for storing and tracking employee files

When it comes to handling employee personnel files, processes differ from company to company. However, regardless of your company’s policies, there are a few best practices you should always keep in mind. Some of these considerations include:

- Keeping a backup: Whether you’re keeping paper or electronic files, it’s always good to make copies to ensure you never find yourself with missing documents.

- Automating your process: Adding automation to your process, no matter how it’s organized, will save you a huge amount of time in the long run.

- Performing regular audits: You’ll need to update your files every now and then. Whether it’s to comply with internal changes or state and federal regulations, you’ll have to make changes regularly—so it’s best to bake in a regular audit process.

Frequently Asked Questions

We recognize that this is a complex process, and questions are certain to arise. Some common questions and answers around employee records include:

How long do you keep employee records?

According to the EEOC, it is mandatory to keep all personnel and employment records for at least one year from the date of termination, whether that termination was mutual or unilateral. Employers are required to keep payroll records for three years in order to stay compliant with the Fair Labor Standards Act (FLSA), which ensures fair wages are being paid.

Employment files are usually the foundation of many lawsuits. If a government agency asks for any of these files, and the files they want are missing or adulterated, it could put your company in hot water. To be on the safe side, retain these documents for the required amount of time, and dispose of them securely when the appropriate time comes.

Are employees able to access their files?

While this depends from state to state, it’s generally smart to allow employees access to their files, as it can help avoid mishaps down the road. It may not be best to let employees edit these documents, but allowing them to see performance reviews and related documents allow for transparency between departments.

What do I do with employee records when I don’t need them anymore?

When you no longer need to retain employee documents, it’s best to completely destroy them so as to leave no chance of them being stolen. The Federal Trade Commission (FTC) suggests shredding or burning physical documents and wiping electronic ones completely.

You can also utilize a contractor who specializes in security through document destruction.

Remember that the FLSA requires employers to hold onto certain documents for at least three years. Some of these documents include collective bargaining agreements, wage rates, and job evaluations

Streamline your HR filing process

If you have a structured process in place, then the filing process should be a breeze. Since your organization will likely go through structural changes, it’s best to have a process in place that can easily adapt to changing circumstances.

At QuickBooks, we strive to take the pain out of HR processes. Visit our Employee Management hub for more free tools and resources to help you manage your growing team.