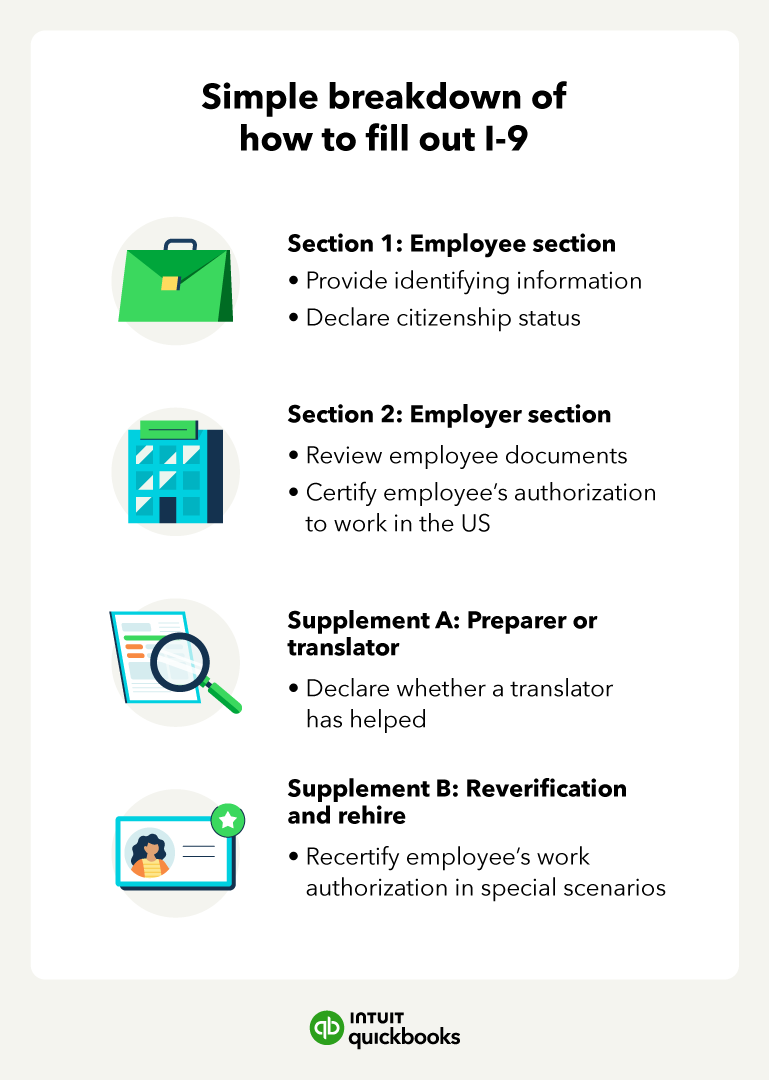

Section 1: Employee section

Section 1 is for employee information and attestation. In Section 1, employees provide basic information about their identity, including their:

- Name

- Address

- Date of Birth

- Social Security Number

- Email address (optional)

- Telephone number (optional)

- Citizenship status

Citizenship status often causes the most confusion in Section 1 of the I-9. The form asks employees to check one of four citizenship options. They must attest, under penalty of perjury, that they are:

1. A citizen of the United States: This includes those born in the US, including Puerto Rico, Guam, and the Virgin Islands, or those legally naturalized into the country.

2. A noncitizen national of the United States: Employees born in American Samoa, some former citizens of the Trust Territory of the Pacific Islands, and some children of noncitizen nationals born abroad are in this category.

3. A lawful permanent resident: This includes noncitizens who permanently and legally live in the United States. Lawful permanent residents usually have visas that document their status. When filling out the I-9, these employees must include their seven- to nine-digit Alien Registration Number or USCIS Number.

4. An alien authorized to work: Asylees, refugees, those with a Temporary Protected Status, and other unique circumstances fall under this category. Those who select this option must indicate in the space provided when their employment authorization expires. If the employee’s employment authorization documentation does not include an expiration date, the employee should enter “N/A” in the space.

Aliens authorized to work should include one of three document numbers to support their selection: Their Alien Registration Number/USCIS Number, Form I-94 Admission Number, or Foreign Passport Number, including the country of issuance.

Once the employee completes Section 1, they can sign and date the I-9. Make sure new hires complete this section during employee onboarding by the end of their first day of work.

The I-9 is available in English and Spanish. If needed, a translator, family member, or friend can help them prepare Section 1. In this case, also fill out Supplement A, which declares the use of a translator or preparer.

Section 2: Employer review

Section 2 is for employer review and verification. Employers must complete Section 2 by the third business day after an employee begins work. Section 2 includes three subsections:

- Subsection 1, Identification: In the first subsection, employers copy the employee’s name and citizenship or immigration status from Section 1.

- Subsection 2, Proof of Identity: Employers review employee documents that provide proof of identity and authorization to work. For a list of acceptable documents, check the IRS website. Remember that employers cannot accept photocopies of documents. Only the original copies comply with Section 2 rules.

- Subsection 3, Certification of Work Eligibility: An authorized representative of your business must provide their name, title, signature, and business contact information. The representative must also examine the provided documents and verify that they’re “genuine and relate to the employee named.” Finally, the representative must confirm that the employee is authorized to work in the US to their knowledge.

The certification subsection can be a little daunting. But you don’t have to be an immigration law expert or attorney to comply with this section. If you make a good-faith effort to complete this section and honestly review the documents provided, you meet the certification requirements.

Supplement B (formerly Section 3): Reverification and rehires

Supplement B (formerly known as Section 3) is for re-verification and rehires. You are not required to fill out this section for most new hires. You may complete Section 3 under the following circumstances:

- When an employee’s employment authorization expires.

- When you rehire a terminated employee whose original employment authorization documents have expired.

- When an employee’s name changes.

When reviewing Supplement B documents, you should evaluate them with the same good-faith standard you used to review Section 2.

Hiring the right people for your small business

So then, what is an I-9? Simply put, it’s a document employers must have employees complete in order to verify their authorization to work in the United States. Complying with this US Law puts employers in a better position to hire confidently and grow their business the right way.

Remember to invest in reliable accounting software that integrates with your payroll to help the hiring process go even smoother.