Broadly speaking, payroll processing includes these four steps:

Step 1: Data collection

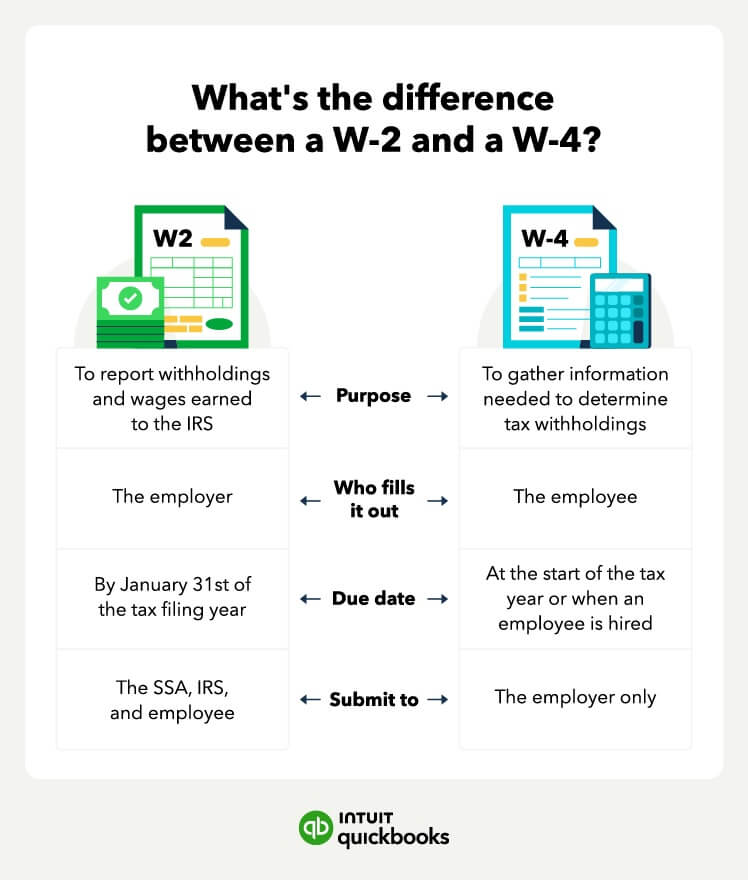

When an employee is hired, you need to collect information (via the W-4) on federal and state tax withholding. You also need to collect permission to withhold for company-provided benefits, like healthcare coverage, retirement plans, or dependent care.

For example, let’s say you hire a new employee, Laura. After reviewing the benefits, she decides she wants healthcare coverage just for herself and to contribute 2% of her pay to her 401(k). These benefit elections, along with her completed W-4, are used to calculate her payroll deductions.

If you use a tool like QuickBooks Payroll, employees like Laura provide all this information quickly and accurately through the employee portal.

Step 2: Net pay calculations

The next step is to calculate an employee's pay using their benefit selections, tax withholding information, and any post-tax deductions. The result is the employee’s take-home pay, that is, the dollar total of the paycheck you will issue them.

Let’s take another look at Laura. Her salary is $50,000/year, and she is paid biweekly. This means her gross pay (total before taxes and deductions) is $1,923. First, you would subtract $38.46 for her 401(k) contribution, then subtract $45 for healthcare coverage, leaving $1839.54 in taxable income.

Next, subtract income taxes and FICA taxes, which are:

- Federal Income Tax - $142.35

- Social Security Tax - $116.44

- Medicare Tax - $27.23

- Illinois State Income Tax - $91.06

This brings the tax total to $377.08. As Laura has no wage garnishments or other post-tax deductions, nothing else needs to be subtracted. This brings her net pay amount to $1,462.54.

This net pay calculation must be exact every time. Mistakes could result in a tax bill for Laura and IRS penalties for you. Instead of doing the math by hand, consider using software like QuickBooks Payroll to calculate withholdings and net pay automatically.

Step 3: Payments

After you have calculated each worker's net pay, you can issue payroll. This can be done using a physical check or via electronic transfer (ACH) to the employee’s bank account. If you choose the second option, you need the employee’s permission and their account information. You should also provide them with electronic access to a paystub.

In the new hire example, Laura opts to have her check deposited electronically. So, you will need to initiate a transfer from your business bank account to her bank account for the amount owed. To simplify the process, QuickBooks Payroll lets you auto-issue payroll for all employees for next-day (or same-day) deposit. And the employee portal lets employees like Laura view their pay stubs.

The day you issue payment affects the day you need to remit tax payments to the IRS. For instance, if you are on a monthly schedule, for a paycheck issued on Friday, October 24, taxes need to be deposited by November 15.

The day you issue payment affects the day you need to remit tax payments to the IRS. For instance, if you are on a monthly schedule, for a paycheck issued on Friday, October 24, taxes need to be deposited by November 15.