Despite diligent precautions, workplace accidents and injuries can still occur, leaving employees in need of support and protection. This is where workers' compensation steps in as a vital safeguard, offering financial assistance and medical benefits to employees who suffer from work-related injuries or illnesses.

Understanding the intricacies of employees' compensation is crucial for both employers and employees to navigate the complexities of workplace safety and legal obligations effectively. In this guide, we share the fundamentals of workers' compensation, exploring its purpose, benefits, and the process involved in securing this essential form of protection.

How does workers’ comp work?

Workers’ compensation programs, or “workers’ comp,” are state-regulated insurance programs that assist workers suffering from work-related injuries or illnesses through payments for lost wages, medical treatment, and rehabilitation services.

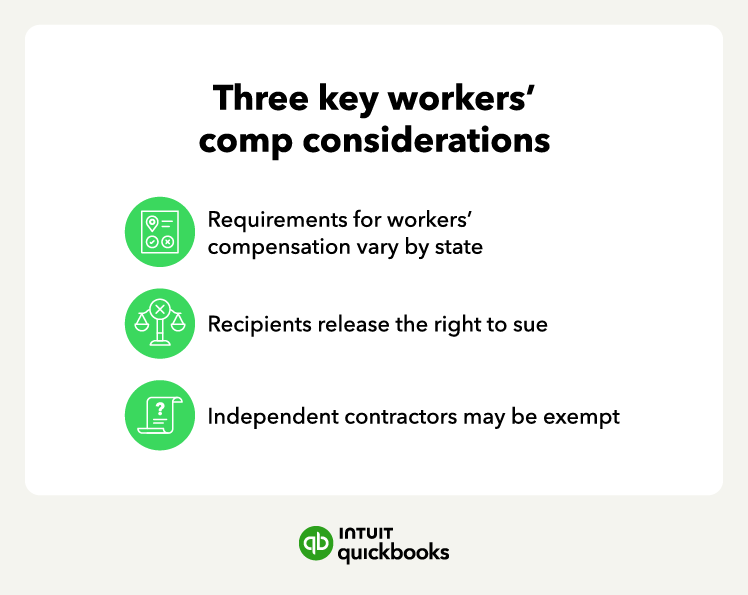

Unlike disability insurance, workers’ compensation benefits often vary by state. If you’re a worker looking to file a claim, check with your state’s workers’ compensation agency. Workers’ compensation is considered social insurance because it involves a social contract between employers and employees.

On the one hand, employees are protected if they suffer a workplace injury or illness. On the other hand, businesses are given limited liability and are protected from civil suits brought on by workers’ compensation lawsuits when an employee accepts workers’ comp benefits.

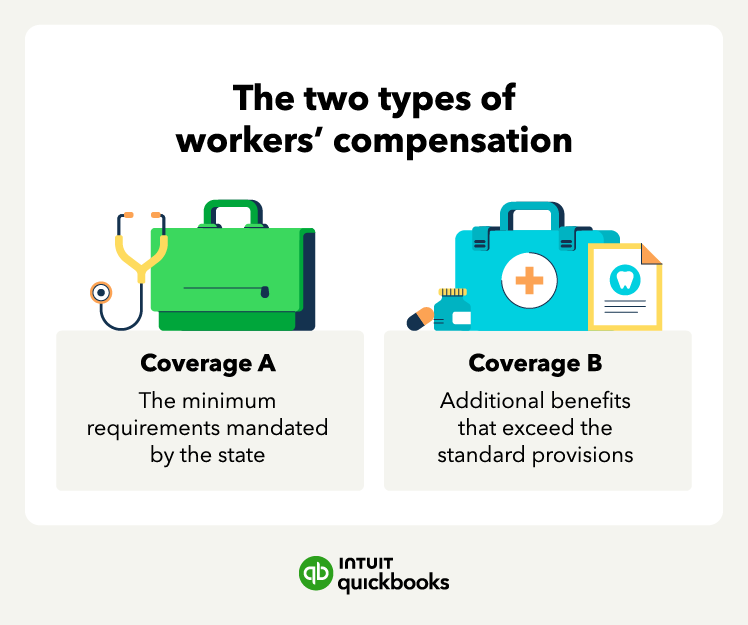

Workers’ compensation insurance coverage

Workers’ comp is not only a relief for workers, ensuring they receive the care they need without worrying about not being on payroll, but it also offers peace of mind for employers. Knowing they have a system in place to support their workforce in times of need, employers can build their team and scale their payroll expenses with confidence.