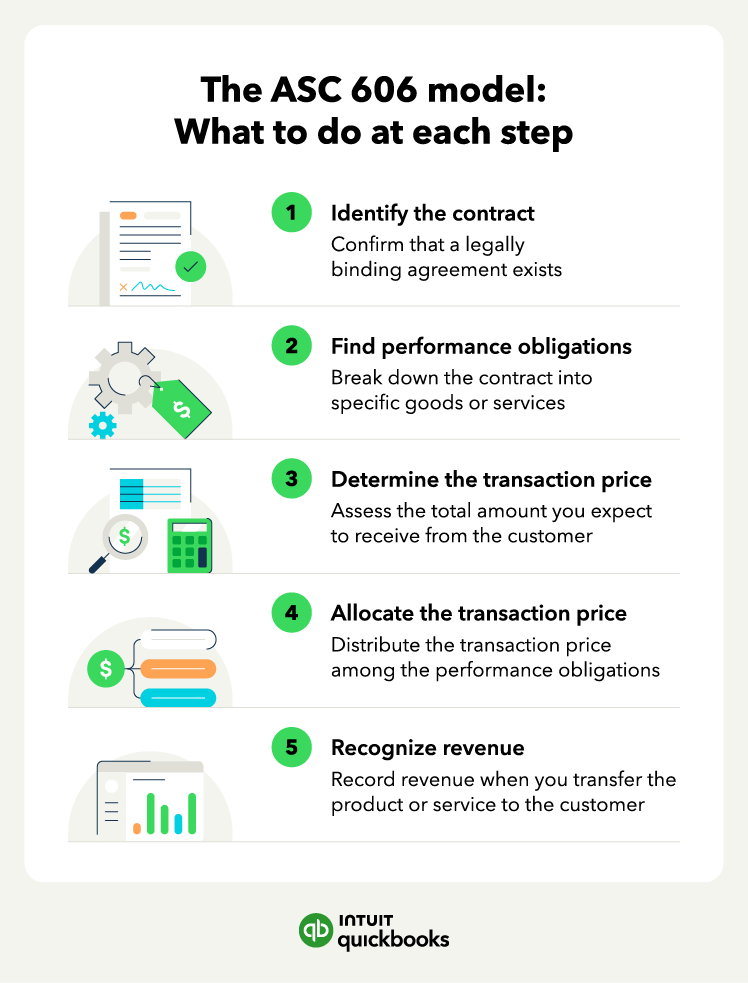

The 5-step ASC 606 model for revenue recognition

ASC 606 introduces a five-step model that guides businesses through revenue recognition, creating consistency across industries.

This model ensures that revenue is recorded based on the transfer of promised goods or services, aligning income recognition with the actual value delivery to the customer.

1. Identify the contract with a customer

The first step under ASC 606 is identifying whether a contract exists between your business and its customer. A valid contract outlines the terms and creates enforceable rights and obligations for each party.

Contracts can be written, verbal, or implied based on business practices, but they must have commercial substance, meaning both parties will benefit from the transaction. Recognizing revenue depends on the agreement being clear and legally binding, which helps ensure that revenue figures are accurate and meet the 606 standard.

2. Find the performance obligations in the contract

Performance obligations are the distinct promises a business makes within a contract, such as delivering a product or providing a service.

ASC 606 requires businesses to evaluate the contract to identify each distinct obligation to the customer. You need to recognize each performance obligation separately once they are fulfilled.

By clarifying what’s expected, your business can more accurately manage customer expectations and revenue recognition, which is particularly helpful when using financial management software for tracking and reporting.