What are federal withholding tax tables?

Federal withholding tables lay out the amount an employer needs to withhold from employee paychecks. This includes federal income taxes, as well as other taxes, such as Social Security and Medicare taxes.

When running a business, there are many important factors to consider, including payroll. Although setting up payroll can be a bit daunting at first, with a little guidance and preparation, you can easily navigate the process.

You'll need to gather some important paperwork and choose a reliable payroll system. One of the most important factors for running payroll is the IRS withholding tax tables for 2024, which ensures you're properly withholding taxes for your employees. Don't worry, though—with the right resources and support, you can set up payroll smoothly and efficiently.

Federal withholding tax tables and updates to know

Federal tax withholding tables are different from how they used to be. The IRS adjusts the income threshold every year for inflation. That means federal income 2024 withholding tables change every year, in addition to the tax brackets.

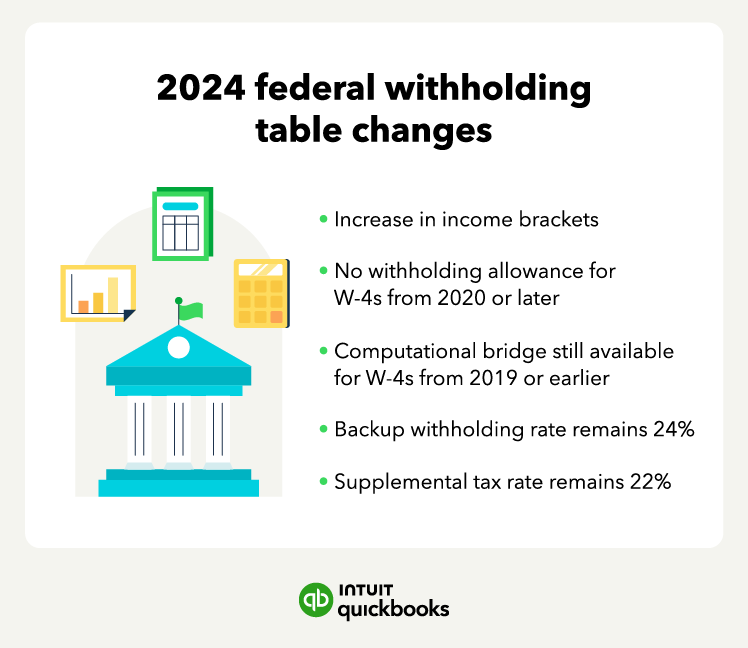

The federal withholding income tax table for 2023 had lower income brackets versus 2024. Here’s what you need to know for the 2024 withholding tables:

- Increase in each income bracket

- No withholding allowances for W-4s from 2020 or later

- Computational bridge available for W-4s from before 2019

- Backup withholding rate remains 24%

- No change in the 22% supplemental tax rate

Here are the IRS withholding tax tables for 2024 for employers that use an automated payroll system.

The first federal tax table from the IRS is if you have a W-4 from before 2019 or if the W-4 is from 2020 or later and the Step 2 box is not checked:

The next federal 2024 withholding table from the IRS is for automated payroll systems if the W-4 is from 2020 or later and the box in Step 2 of the W-4 is checked:

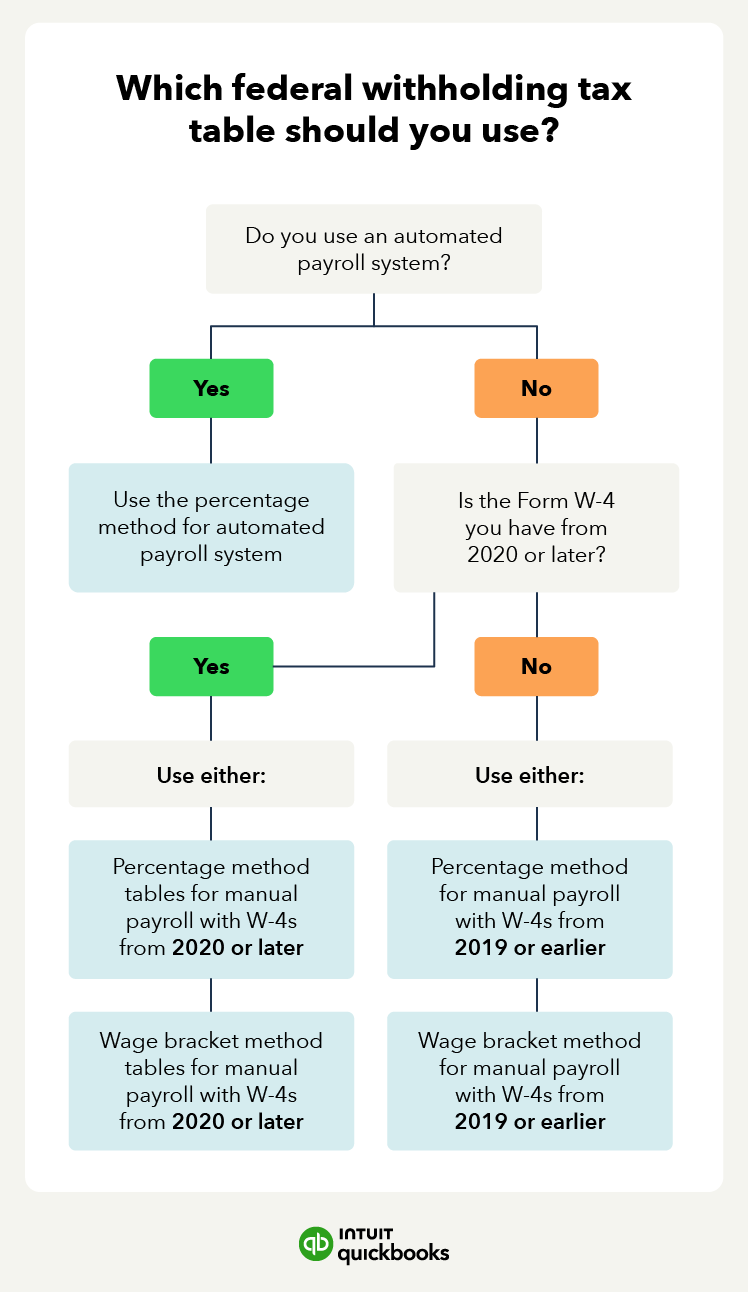

If you run payroll using a manual system, you’ll use different tables than those for businesses that use an automated payroll system built into their accounting software.

If you use a manual payroll system and have a W-4 form for 2020 or later, you can use either of these:

- IRS wage bracket method tables for W-4 from 2020 or later

- IRS percentage method tables for W-4 from 2020 or later

If you use a manual payroll system and have a W-4 from before 2019, you can use either of these:

- IRS wage bracket method tables for W-4 from 2019 or earlier

- IRS percentage method tables for W-4 from 2019 or earlier

Note that withholding allowances are not part of W-4s of 2020 or later. Before the change, employees were able to claim more allowances to decrease their federal tax withholding. But with the newer W-4s, employees can only lower their withholding by using the deduction worksheet or claiming dependents.

How to use a federal withholding tax table

A federal withholding tax table is usually in the form of a table or chart to simplify this process for employers. To determine the withholding amount, you will need an employee’s W-4 form, filing status, and pay frequency. Every new employee at a business needs to fill out a W-4 for this purpose.

Let’s discuss how to calculate the withholding tax. Follow the steps below to calculate the necessary federal withholding income tax rate:

1. Collect necessary documents

Gathering all relevant documents from your employees is the first step in correctly calculating withholding tax. To calculate withholding tax, you’ll need your employee’s W-4 form, gross pay for the pay period, and an income withholding tax table.

2. Get your employee’s W-4

It’s important your employee fills out their W-4 correctly for your withholding tax calculations. Your employee will have to fill out their filing status, number of dependents, and additional income information. You will need to reference this form to calculate withholding tax.

3. Review your payroll records

To calculate employee withholding tax, you will need to review important information from your payroll.

As an employer, you will need to look at these payroll records:

- Payroll period information

- Frequency of the pay periods

- Gross pay amount for the pay period

An employer is also responsible for payroll withholding, which is money taken out of an employee’s gross wages. This money taken is then used to pay the employee’s portion of the payroll taxes to the federal government.

There are also payroll deductions—money taken out of an employee’s paycheck to pay for costs like employee benefits. Payroll deductions can either be mandatory, which employers are required to pay, or voluntary, which employees can pay.

Understanding payroll can be overwhelming, which is why it is useful to use a payroll accounting service to keep track of payroll costs and employee compensation.

4. Calculate withholding tax

The final step is to calculate the withholding tax. However, you’ll need to use one of several tax tables. There are two federal income tax table methods for use in 2024—the wage bracket method and the percentage method.

How to calculate federal tax withholding

There are three key types of withholding tax methods: wage bracket, percentage, and computational bridge:

The method you choose will depend on your payroll system and which W-4 you have from your employees.

Wage bracket method

The wage bracket method is a simpler method, and it tells you the exact amount of money to withhold based on an employee’s taxable wages, number of allowances, marital status, head of household, and payroll period.

QuickBooks Tip:

If you use a manual payroll system, you can use either the wage bracket or percentage method.

Percentage method

The percentage method is a bit more complex as it involves more calculations. It differs in that it has no wage limits. You can use this method if your employee’s wage exceeds the wage bracket limit. If you use an automated payroll system, it will use the percentage method.

Computational bridge

Employers can use a computational bridge to treat 2019 or earlier W-4s as if they were 2020 or later W-4s, specifically for tax withholding purposes. The computational bridge helps reduce complexity by allowing you to use data from older W-4s to calculate the withholding for your employees.

The bridge is optional, but it does mean you don’t have to use separate rules and withholding tables if you have older W-4s.

Follow these four steps to use the computational bridge:

- Step 1: Find the employee’s marital status: Select the filing status in Step 1(c) of a 2020 or later Form W-4 that most accurately matches the employee's marital status on line 3 of a 2019 or earlier Form W-4.

- Step 2: Enter an amount: Fill in an amount in Step 4(a) on a 2020 or later Form W-4 based on the filing status determined in Step 1:

- $8,600 for single or married filing separately

- $12,900 for married filing jointly

- Step 3: Multiply withholding allowances: Multiply the number of allowances claimed on line 5 of the 2019 or earlier Form W-4 by $4,300 and enter the result in Step 4(b) on a 2020 or later Form W-4.

- Step 4: Add additional withholding amounts: Enter any additional withholding amount requested by the employee on line 6 of their 2019 or earlier Form W-4 into Step 4(c) of a 2020 or later Form W-4.

QuickBooks Tip:

If your employees filled out a 2020 or later W-4, note that they can no longer request adjustments to their withholding allowances.

What are the federal taxes withheld?

Federal taxes withheld from employee paychecks generally include federal income tax, Social Security tax, and Medicare tax. The Social Security and Medicare taxes comprise what’s known as FICA taxes (Federal Insurance Contributions Act).

As a business owner, it’s important to understand each of these because you’re responsible for withholding these from your employee’s wages and submitting them to the government.

Federal income tax

This is the tax on an employee’s income that goes to the federal government. The amount you withhold depends on the information your employee provides on their Form W-4, such as their filing status and number of dependents. You’ll use IRS tax tables, like the ones above, to determine the exact amount to withhold based on their earnings. Accuracy is important, as over- or under-withholding can cause issues for both you and your employees.

Social Security tax

The Social Security tax helps fund Social Security benefits, which provide income to retirees, disabled individuals, and their families. Currently, the Social Security tax rate is 6.2% for the employee, and as an employer, you're also required to match this 6.2%, for a total of 12.4%.

The Social Security tax is only applied to earnings up to a certain threshold, which adjusts annually (known as the wage base limit). For 2024, the wage base limit for Social Security tax is $168,600. For earnings above that limit, no further Social Security tax is owed.

Medicare Tax

The Medicare tax funds the federal health insurance program for people age 65 and older, and for certain younger individuals with disabilities. The Medicare tax rate is 1.45% for the employee, and as with Social Security, as an employer, you are required to match this percentage.

Unlike Social Security, however, there’s no wage base limit for Medicare tax—every dollar your employee earns is subject to it..

Additional Medicare Tax

This is an additional 0.9% Medicare tax on wages exceeding a certain threshold ($200,000 for single filers, $250,000 for married couples filing jointly). It's only applicable to employees earning above these limits and is not matched by the employer.

Ways to reduce tax burden in 2024

If you're an employer seeking ways to reduce your tax liability in 2024, consider these strategies:

Take advantage of the Work Opportunity Tax Credit (WOTC)

The WOTC is a tax credit for employers who hire individuals from certain targeted groups by December 31, 2025. Employers can claim 40% of up to $6,000 in wages for employees who work 400+ hours, with a max credit of $2,400. The credit may be higher for certain other hires.

Contribute more to employee health insurance premiums

Employer contributions to health insurance are generally tax-deductible.

Benefit from the Credit for Increasing Research Activities

The Credit for Increasing Research Activities (R&D Tax Credit) is a federal incentive that allows businesses to reduce their tax liability by claiming a portion of qualifying R&D expenses, such as wages, supplies, and patent-related costs. Small businesses, including startups, can apply this credit against both income and payroll taxes, with a maximum of $500,000 per year in payroll tax offsets. This credit encourages innovation by reducing the financial burden of research and development efforts.

Consider hiring independent contractors

Independent contractors manage their own taxes, reducing your payroll tax obligations.

Start an employee retirement plan

You may be able to significantly reduce your tax bill by claiming a tax credit of up to $5,000 per year, for the first three years, when you set up a retirement savings plan such as a SEP, SIMPLE IRA, or a qualified plan like a 401(k). This tax credit directly offsets your tax liability, potentially saving you thousands of dollars.

Claim unemployment insurance tax credit

Unemployment Insurance (UI) is a federal-state program funded by employer payroll taxes. Employers must pay both federal and state unemployment taxes if they meet certain wage or employment thresholds. The Federal Unemployment Tax Act (FUTA) requires employers to pay a 6.0% tax on the first $7,000 of each employee's wages, but employers who pay state unemployment taxes on time can receive a 5.4% credit. See the IRS website for details.

Stay informed and seek guidance

Keep up with changing tax laws that may potentially impact or reduce payroll taxes, and consult tax professionals for tailored business advice.

Find peace of mind come tax time

Correctly calculating withholding taxes is crucial for many reasons. To run a business efficiently and pay your employees accurately, you want to ensure employee W-4 forms are complete.

Using a payroll service like QuickBooks Payroll to handle calculations can simplify your life as a business owner. QuickBooks Payroll offers everything from HR support to a paycheck calculator, so you can spend less time focusing on payroll and more time running your business.

Federal withholding tax table FAQ

What are the federal income tax rates for 2024?

The federal withholding tax rates from the IRS for 2024 are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. This is unchanged from 2023.

Do employers have to withhold taxes?

Yes, employers do have to withhold taxes. Incorrect federal withholding tax calculations can result in many issues for your business. An employer is legally responsible for withholding payroll taxes and paying those taxes to the Internal Revenue Service (IRS).

How do you determine federal withholding?

The federal withholding tax an employee will pay will depend on filing status and the amount of money they make. This will depend on the individual’s filing status, such as single or married filing jointly.

Did federal withholding tax tables change for 2024?

Yes, the federal withholding tax tables are different for 2024. The IRS adjusts income thresholds for the tables each year to account for inflation. Thus, the federal income withholding tables change every year.